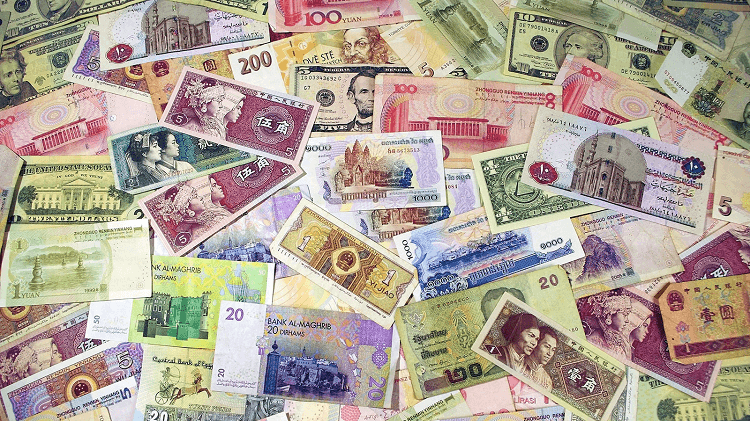

Currency: What It Is, How It Works, and How It Relates to MoneyWhat exactly is Currency?Currency is a system of money in common use for making payments for goods and services. It is often accepted as a method of payment at face value. In the modern world, currency has long surpassed bartering as the principal medium of exchange for the transmission of goods and services. Currencies in physical form are often created in the form of banknotes and coins.

In the twenty-first century, a new currency has entered the world of transactions, which is known as virtual currency. For example, cryptocurrency. Virtual currencies such as Bitcoin and Ethereum have no physical form or governmental backing in the United States. They are exchanged and stored digitally. HistoryEarly CurrencyCurrency was initially a ticket, reflecting grain deposited in Sumerian, ancient Mesopotamian, and Egyptian temple granaries. Metals were utilised as symbols to signify value stored in commodities during the early stages of money. For around 1500 years, this constituted the backbone of the Fertile Crescent trade. The collapse of the Near Eastern trade system, on the other hand, highlighted a flaw. In that era, there was no safe place to put wealth. Therefore, the value of a circulating medium could only be as strong as the forces guarding that safe store/place. A deal could only go as far as the legitimacy of the military. By the late Bronze Age, however, treaties had ensured safe passage for traders from Minoan Crete and Mycenae in the northwest to Elam and Bahrain in the southeast. It is still unknown what was used as payment for these deals. However, oxhide-shaped copper ingots, which were manufactured in Cyprus, are thought to have been used as the currency at that time. The Peoples of the Sea are said to have ended the trading system of oxhide ingots due to an increase in piracy and raiding associated with the Bronze Age collapse. Only the revival of Phoenician commerce in the 10th and 9th centuries BC resulted in a return to prosperity and the introduction of actual currency, most likely beginning with Croesus of Lydia in Anatolia and spreading to Greece and Persia. Throughout Africa, things like beads, ingots, ivory, weapons, animals, manilla currency, ochre, and earth oxides have all been used as a value storage. West African manilla rings were one of the currencies used to sell slaves beginning in the 15th century. African money is still known for its variety, and numerous forms of barter persist in many areas. CoinageSince metal coinage was widely used, the metal itself, originally copper, silver, and gold, and, at some point, bronze, have served as a store of currency. Other non-precious metals are increasingly being used in the production of coins. Mined metals were weighed and hammered into coins. This was done to ensure that whoever accepted the coin received the specified amount of precious metal. Even though coins might be counterfeited, the availability of standard coins produced a new unit of account, which aided in the formation of banking. Archimedes' proposal provided the final link: coins could now be easily tested for their fine metal weight, allowing the value of a coin to be determined even if it had been shaved, debased, or otherwise manipulated. The most critical economies that used coinage had numerous tiers of varied-value coins made of copper, silver, and gold. Gold coins were the most precious and were used for significant purchases, military payments, and state support. The value of a specific type of gold coin was frequently used to determine units of account. At times, silver coins were employed for medium-sized transactions and as a unit of account. In fact, copper or silver coins, or a combination of the two, were widely used for everyday transactions. This technique had been in use in ancient India since the Mahajanapadas. The exact ratios of the three metals' values fluctuated widely between ages and locations; for example, the emergence of silver mines in central Europe's Harz mountains rendered silver substantially less valuable, as did the influx of New World silver after the Spanish conquests. Over time, gold's scarcity made it more valuable than silver, while silver's scarcity made it more valuable than copper. Paper MoneyIn premodern China, the discovery of paper money led to the invention of a new currency type. They were introduced into the Song dynasty (960-1279) from the late Tang era (618-907). It arose for merchants to exchange extensive coinage for deposit receipts issued by wholesalers' businesses. These promissory notes were only valid for a limited time in a particular geographic area. In the 12th century, the Song government took over nearby shops to generate state-issued cash. Nonetheless, the banknotes were only valid locally and for a limited time. However, by the mid-13th century, a common and uniform government issue of paper money had become a recognised statewide currency. Existing pervasive woodblock printing methods, followed by Bi Sheng's moveable type printing by the 11th century, gave the impetus for premodern China's prominent creation of paper money. During the 7th through 12th centuries in the mediaeval Islamic world, a stable monetary economy was established based on increasing circulation levels of a stable high-value currency (the dinar). Credit, cheques, promissory notes, savings accounts, transaction accounts, loaning, trusts, exchange rates, the transfer of credit and debt, and banking institutions for loans and deposits were all established by Muslim economists, dealers, and merchants. Sweden was the first European country to use paper money regularly in 1661. Because Sweden was rich in copper, there were many copper coins in circulation. Despite their low value, giant coins weighing several kilogrammes were required. Silver and gold were considered legal tender during the period, and governments accepted them as payment for taxes. However, the volatility of the two exchange rates increased over the nineteenth century, as did the availability of these metals, particularly silver, and trade. Bimetallism is the usage of both metals at the same time. Inflationists were focused on establishing a bimetallic standard in which gold and silver-backed currencies could coexist. At the same time, governments could also use currency as a policy weapon, issuing paper currency such as the US dollar to fund military spending. They may also stipulate the terms under which they will redeem notes for specie, such as limiting the purchase price or the minimum amount that could be stored. By 1900, most industrialising countries had adopted a gold standard, with paper notes and silver coins serving as the circulating currency. Gresham's law was obeyed by private banks and governments worldwide, which enabled the gold and silver exchange in return for notes. Beginning in the early twentieth century and continuing until the late twentieth century, when the floating fiat currencies came into force, this approach was followed irregularly worldwide, mainly during war or financial crises. The United States was one of the last countries to abandon the gold standard in 1971, known as the Nixon shock. Nowadays, the gold or silver standard currency system is not applicable in any country. Banknote EraA banknote or bill is a modern currency that is widely accepted as legal tender in many countries. Banknotes and coins make up the cash form of a currency. Banknotes were previously made of paper, but in the 1980s, Australia's Commonwealth Scientific and Industrial Research Organisation developed a polymer currency, which went into circulation in 1988 to commemorate the country's bicentennial. In 1983, the Isle of Man released its first polymer banknotes. As of 2016, polymer currency was utilised in over 20 nations, extending the life of banknotes and reducing counterfeiting. What are the different Currency Types?The United States Mint defines currency as money in the form of paper and coins utilised as a medium of exchange. Individual governments generate and distribute currencies all around the world. The Bureau of Engraving and Printing typically issues paper money in the denominations of $1, $2, $5, $10, $20, $50, and $100 notes. The $500, $1,000, $5,000, and $10,000 banknotes are no longer in circulation, although those that remain are redeemable at face value. Currency issued before 1861 is no longer legitimate and cannot be redeemed at face value. The United States Mint typically produces coins of one, five, ten, twenty-five, fifty, and one dollar. There are now approximately 200 national currencies in circulation. About 42 countries, including the United States, use the US dollar or have their currencies directly pegged to it. According to the International Monetary Fund (IMF), the dollar accounts for approximately 58.8% of foreign exchange reserves. Most countries print their own money. Switzerland's official currency, for example, is the Swiss franc, whereas Japan's is the yen. In India, the legal currency is the rupee. The euro, which has been embraced by most European Union members, is an exception. Some nations, such as the Bahamas, Zimbabwe, and Panama, accept the US dollar as legal money in addition to their own currencies. Following the founding of the United States Mint in 1792, Americans continued to use Spanish coins for a time because they were heavier and thus appeared to be more valuable. Branded currencies include airline, credit card points, and Disney Dollars. These are issued by businesses and can only be used to pay for the things and services related to them. Currency versus MoneyMoney and currency are terms that are commonly used interchangeably. While they are related, they have unique meanings. Money is a more well-known phrase that refers to an intangible value system that allows for exchanging commodities and services today and in the future. Currency is simply a tangible representation of money. Money is utilised in many ways, all of which are tied to its eventual usage in some transactions. Money, for example, is a store of value, which indicates that it has and retains a specific worth that allows for continuing transactions. People comprehend that the money they received today will have the exact monetary value when they need to purchase or pay next week. Money is sometimes referred to as a unit of account. In other words, it can account for changes in item value over time. Businesses use money as a unit of account when developing a budget or giving weight to assets. Profits and losses are established and relied on using money as a unit of understanding. What is the use of Currency Exchange?The exchange rate represents the current value of one currency concerning another. As a result, rates for currency pairings such as the EUR/USD (euro to US dollar) are offered. Exchange rates are continually fluctuating in reaction to economic and political developments. Currency trading markets are created as a result of these movements. The foreign currency market where these deals take place is one of the world's largest in volume. Everything is done in massive volumes, with a usual minimum lot size of 100,000. The majority of currency traders are professionals who invest for themselves or for institutional customers such as banks and huge businesses. The foreign currency market is not physically located. Trading is entirely electronic and occurs 24 hours a day, seven days a week, to accommodate traders from all time zones. For the rest, currency conversion is generally done before or during a journey at an airport kiosk or a bank. According to consumer advocates, converting currencies at a bank or an in-network ATM provides the best value. Other options may be more expensive or have unfavourable exchange rates. What is an instance of Currency?Any US paper dollars you have on hand is an example of currency. It can be any of the coins issued by the United States, such as the penny, nickel, and quarter. Currency may also refer to paper notes and coins produced by governments across the world. The Bottom LineUnderstanding what money is will help one understand the concept of currency. Currency is money that people all around the world utilise daily. During WWII, soldiers used cigarettes as currency. So, the currency is obviously used as a medium of exchange for goods and services and for savings and debt payments. Currency, which usually includes paper notes and coins today, is the most common type of money. Money is an intangible value system that permits the continuous exchange of commodities and services within a community. Currency is one of the many shapes that money has taken since it replaced the trading system. |

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share