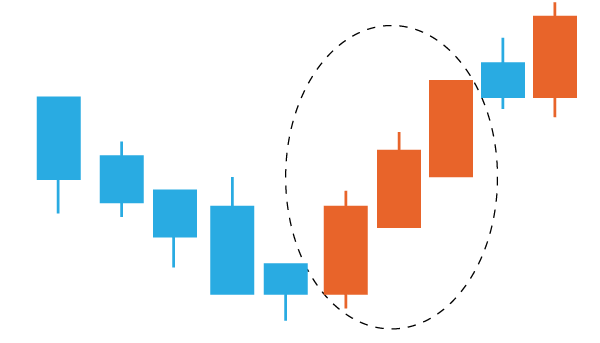

Three White Soldiers DefinitionYou must have heard about the 'Three White Soldiers' candlestick pattern in stock marketing at least once. It is called white soldiers because we generally represent bullish candles with white or green colour, whereas we represent bearish candles with red or black colour.

In layperson's terms, Three White Soldiers can also be called Three Green Soldiers. But the actual term for these kinds of candlesticks is Three White Soldiers only, as it is a Japanese term, and in Japan, candlesticks are usually represented by white and black colour only. Here, White candlestick is bullish candlesticks, and black is for bearish candlesticks. This article will discuss 'Three White Soldiers' and how it helps an investor in stock marketing. Understanding the Three White Soldiers through the DefinitionAccording to the Japanese, Three White Soldiers represents three soldiers who stand with each other in such a way as to face any situation and defeat anyone. In the stock market, this shows that if any three consecutive candlesticks are present after a long downfall of the market prices, then it can change the overall market trend. In terms of the stock market, the Three White Soldiers is a significant signal for a bullish reversal. But it is imperative to see that when it appears. These three white soldiers' patterns show that the bearish reversal has ended and the bullish reversal has started, which will totally change the market trend and turn into a bullish trend. For example, if the market is falling for an extended period and after that, the market sees a rise in the form of three white soldiers, then it is considered beneficial and effective. Characteristics of Three White Soldiers

Understanding the Closing and Opening of the Three White SoldiersFor the three white soldiers chart, the candles should act like the below:

All swing traders monitor charts regularly and often view or analyze charts after the market closes. Also, on the day when they find three white soldier patterns, they make the swing trade and make profits out of it. Also, to determine whether the three white soldiers are strong or not or if they are real or fake, it becomes essential to watch the volumes of the sold shares accordingly. The volume of the third candle on the third day must always be more than the volume of the first candle. At the same time, the volume of the second candle could be less or more than the volume of the first candle. If the value of all three candles increases, then the three white soldiers are powerful and say that a bullish reversal is happening. Confirmation to Enter the Market and Marking Stop LossWhen the closing price of the subsequent candles is higher than the high price of the third candle, it can be seen as a confirmation to enter the market and mark stop loss. The subsequent candle is formed after the third candle. The opening price of that subsequent candle can be above the closing price of the third candle or may be below the closing price of the third candle. If the opening price of the subsequent candle is above the closing price of the third candle (i.e., third soldier), then, in that case, the stop loss should be put at the low price of the third candle. If the opening price of the confirmation candle (i.e., subsequent candle after the third soldier) is below the closing price of the third soldier, then in such a situation, the stop loss that should be taken is the low price of the first soldier or candle of the three soldiers. When the opening price of the confirmation candle is gap up or higher than the closing price of the third candle, then it shows that there is a strong rise in the market, and then the stop loss can be shifted upwards, but there are chances of falling off the market if gap up opening is seen. And therefore, it is important to keep the stop loss near the opening price of the third soldier. One has to carefully analyze the graph before trading. When there is a gap-down opening of the confirmation candle, it is assumed that the market is about to go up and the bulls dominate the bear. Profit booking using the Three White Soldiers patternProfit booking in such kind of situation is very simple. Once you have entered the market, the investors need to sit down and watch for any bearish reversal. If the investors see any bearish reversal candle in the graph, then the investors should leave the market and book the profit. Also, if Gravestone Doji is seen after a long-rising trend, it is seen as the indicator of a bearish reversal, and the increasing trend of the market is about to end or the market is about to fall. A Gravestone Doji is defined as a bearish pattern indicating a reversal followed by a downtrend in the price action. Key Takeaways

The Bottom LineThe three-white soldier pattern is one of the excellent tools adopted by the technical analyst to understand the market's psychology and predict action. If you are new to the stock market, then the "three white soldiers" pattern can help you learn the market quickly, as it is straightforward to spot the data in the chart. It makes trading simple, and investors can rely upon this pattern, especially for beginners who do not have any idea about other candlesticks' patterns. But it should always keep in mind before depending on the pattern that there are some other indicators that need to be checked before entering the market. Also, it is essential to know that there is an opposite trend of "three white soldiers" named "Three Black Crows", which shows the trend's bearish reversal. The drawbacks of the three-white soldier pattern are that it is infrequent and does not occur frequently. The three White Soldiers pattern should be used by traders when they are looking to stay in the market for a longer time so that the trader can buy the assets or stock at a low price and sell it when the prices are high. Despite all the facts, one must remember that the "Three White Soldiers" and other such graphs are purely conceptual, not a completely proven strategy of trading.

Next TopicLoan-to-Value (LTV) Ratio

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share