What Is Insurance?Many individuals have insurance for their life, home, or automobile. However, some of us rarely consider what insurance is or how it functions. An agreement to guarantee money from one party to another in case of a specific loss, damage, or accident is known as insurance. Insurance is a strategy for protecting against financial loss. In essence, insurance is a contract represented by insurance companies and provides a customer with financial protection or recompense by an insurance company in the event of specified failures.

An insurer, insurance business, insurance provider, or underwriter is a corporation that offers insurance. The phrases "policyholder" and "insured", though usually used synonymously, are not always the same because there is a chance that additional insureds who did not purchase the insurance may also be protected. The insured accepts a known, restricted, and assured failure in the form of a payment transaction to the insurer in exchange for the insurer's commitment to compensate the insured in the event of a covered loss. The deficit must be quantifiable in money, whether it is or not. Insurance plans are designed to guard against significant and minor financial losses by damage to the insured party or their property or by responsibility for injury or damage caused to a third party. Key Takeaways

HistoryEarly MethodsChinese, Indian, and Babylonian traders used risk-distribution strategies as early as the third and second millennia BC. Chinese merchants would redistribute their goods among several ships when navigating through dangerous river rapids to minimize losses from the sinking of a single ship.

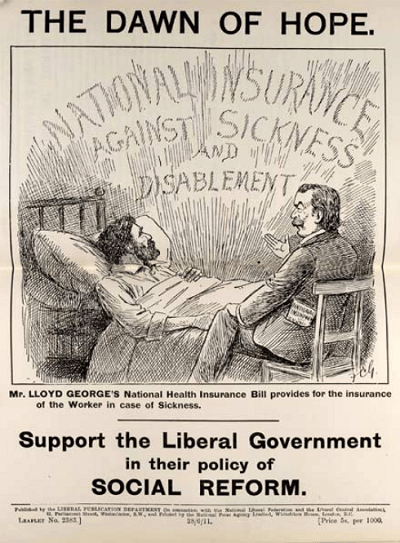

Hindu texts from the third century BC, including Dharmasastra, Arthashastra, and Manusmriti, also contain insurance concepts. The Greeks of antiquity had maritime loans. A ship or cargo received a cash advance that would be returned with high interest if the journey was successful. But if the ship went down, there would be no way to get the money back, so the interest rate had to be high enough to cover both the use of the capital and the danger of abandoning it (fully described by Demosthenes). Since then, these kinds of loans have often been made in coastal regions under the names bottomry and respondentia bonds. Around AD 1300, direct marine-risk insurance began in Belgium for premiums paid in addition to loans. An insurance contract was first recorded in Genoa in 1347. The marine insurance industry grew significantly in that century, and premiums varied according to risks. These insurance contracts made it possible to separate insurance from investing, a division of labour that was first successful in the maritime insurance industry. The first recorded life insurance policy was purchased on William Gibbons' life for £383, 6s. 8d., for a year in the Royal Exchange in London on June 18, 1583. Modern MethodsIn Europe during the Enlightenment, where specialized kinds emerged, insurance grew much more complicated. The Great Fire of London in 1666, which destroyed more than 13,000 homes, is considered the origin of insurance coverage as we know it today. The disastrous impacts of the fire changed how insurance was developed. Sir Christopher Wren's inclusion of a location for "the Insurance Office" in his revised map of London in 1667 demonstrated a shift in thinking about the issue from convenience to urgency. Numerous failed attempts at fire insurance schemes led to the founding of the first fire insurance firm, the "Insurance Office for Houses", by economist Nicholas Barbon and eleven companions in 1681 to cover brick and frame dwellings. Initially, his Insurance Office covered around 5,000 properties. People started buying life insurance in the first half of the eighteenth century. William Talbot, or Sir Thomas Allen, founded the Amicable Society for a Perpetual Guarantee Agency in London in 1706 as the first company to offer life insurance. Edward Rowe Mores founded the Society for Equitable Assurances on Lives and Survivorship in 1762 based on the same idea.

It was the first mutual insurer in the history of the world, and it invented age-based premiums based on mortality rates, establishing "the framework for scientific insurance research and the development" and "the grounds of modern culture assurance on which all life assurance strategies were subsequently based." The term "accident insurance" was first introduced in the late 19th century. The Rail Passengers Assurance Corporation, founded in 1848 in England to provide insurance against the mounting number of casualties on the developing railway system, was the first business to provide accident insurance. The York Antwerp Rules (YAR) for the expense allocation between ship and cargo in the case of general average was the first international insurance regulation. The "Association for the Reform and Codification of the Law of Nations", the forerunner of the International Law Association (ILA), was founded in Brussels in 1873. After publishing the first inaugural York Antwerp Rules in 1890, it adopted the current name of the "International Law Association" in 1895. The Global Federal state of Insurance Organizations (GFIA) was officially founded in 2012 to increase the insurance industry's ef?cacy in offering insight to international regulatory authorities and making a contribution more efficiently to the global discussion on issues of common interest. It took over from the International Network of Insurance Associations (INIA), which had previously been an informal network, and became active in 2008. Its 40 member organizations and one observer association are located in 67 countries, representing approximately 89% of all insurance premiums paid globally. How does Insurance work?Almost any individual or organization can find an insurance company that will insure them (-for a cost, of course), and there are numerous insurance plans available. The most common personal insurance product categories are auto, medical, home, and life insurance. Most Americans have at least one of these insurance plans, and it is required by law to have car insurance. Businesses need customized insurance plans to protect them against the various dangers they encounter. A fast-food restaurant, for instance, needs a policy that can guard against damage or injury from deep-frying food. Even if they are not exposed to this type of danger, auto dealers require insurance to cover any potential damage or injuries that may occur during test drives. Also, insurance plans are offered for highly specialized needs, such as insurance coverage, medical malpractice insurance, and abduction and hostage insurance. Insurance Policy ComponentsWhen choosing coverage, it's essential to understand how insurance works. If you have a firm knowledge of these concepts, you may select the range that most closely matches your needs. Full insurance coverage may or may not be your best option. Three components are at least required for every insurance type/plan: the premium, the policy limit, and the deductible. PremiumDepending on the risk profiles of you or your business, which may include creditworthiness, the insurer determines the compensation. For instance, if you own several expensive automobiles, you will likely pay more for auto coverage than someone who owns one mid-range vehicle with an immaculate driving record. Prices for equivalent products, however, may also differ between insurers. Policy LimitThe insurance limit is the maximum amount an insurer will pay for a covered loss by the policy terms. More excellent rates frequently accompany higher restrictions. A general life insurance policy's face value is the maximum amount the insurer will pay; following the insured's death under certain circumstances, this amount is handed to a nominee or family. DeductibleThe insured must pay a specific amount in cash before the insurance provider settles a claim. Deductibles serve as a deterrent for many minor, insignificant claims. Deductibles may be charged per policy or per claim, depending on the provider and the kind of coverage. Due to significant out-of-pocket expenses, plans with higher deductibles are often less expensive because fewer minor claims are filed. Social EffectsThrough the way it alters who is responsible for paying for damages and losses, insurance may have a variety of repercussions on society. On the one hand, it can lead to an increase in fraud; on the other hand, it can aid in disaster preparedness and reduce the consequences of disasters on both people and society. Moral hazards, financial crimes, and proactive measures taken by the insurance provider are some ways that insurance might affect the likelihood of losses. Moral hazard is a term used by insurance researchers to describe the more significant loss brought on by inadvertent carelessness. Insurance fraud is a term that describes the higher risk brought on by purposeful carelessness or indifference. Inspections, insurance clauses demanding particular forms of maintenance, and potential discounts for lost mitigation initiatives are among the ways that insurers try to combat negligence. Although, in theory, insurers could promote investment in loss minimization, some commentators have asserted that in practice, insurers historically had not actively pursued loss control steps to prevent disaster losses like hurricanes-due to worries about rate depletion and legal battles. Types of InsuranceThere are several types of insurance. Let's focus on the most crucial types: Health InsurancePeople who regularly need medical treatment or have chronic health issues should seek health insurance plans with smaller deductibles. The yearly premium is more expensive than a comparable policy with a higher deductible, but it is cost savings year-round, making healthcare more affordable access to people. Home Insurance

Homeowners insurance, sometimes known as home insurance, protects your residence and possessions from damage or theft. Most mortgage lenders require borrowers to carry insurance for a property's full or fair market rate (often the purchase price). With proof of this insurance, they will authorize a loan or provide funding for a residential real estate transaction. Auto Insurance

When you buy or rent a car, protecting your investment is critical. If you are in an accident, your vehicle is stolen, vandalized, or damaged by a natural disaster; auto insurance can provide you peace of mind. The company pays the entire or most of the associated expenses after the accident or vehicle damage. Life InsuranceThe insured and the insurer enter into a life insurance contract. A life insurance policy guarantees that the insurer will pay a certain sum to chosen beneficiaries when the insured passes away in exchange for the premiums the policyholder pays over his lifetime. Travel Insurance

The costs and dangers associated with travel are covered by a type of insurance called travel insurance. This type of protection is helpful for both domestic and foreign travellers. Over half of Americans who travelled without travel insurance had to pay fines or shoulder the cost of damages, according to a survey done in 2021 by the insurance firm Battleface. Is Insurance an asset?Due to its ability to gain value over time or be transformed into cash, based on the kind of coverage and how it is utilized, long-term life coverage may be seen as a financial asset. As said, most permanent life insurance policies provide the progressive accumulation of funds. ControversiesIt does not reduce the risk.

Insurance is merely a risk-transfer mechanism in which a larger entity (i.e., an insurance company) is given the financial burden that may result from a chance event in exchange for a fee. This doesn't change the likelihood of an event; it only lessens the cost load. Insurance is a danger for both the insurance business and the insured. The insurance firm will carry out a risk assessment while creating the policy since it is aware of the potential danger. Therefore, it is stipulated that where there is a higher probability of a claim being made by the insured, the premiums will be high accordingly. However, rates may decrease if the policyholder follows the insurer's advice and adopts a risk management program. Because a robust risk management strategy reduces the likelihood of a sizable claim for the insurer while stabilizing or lowering rates for the policyholder, insurers must regard risk management as a shared venture between the policyholder and them. Moral HazardMoral hazard is the idea that an insurance firm can unintentionally discover that its insureds are not necessarily as risk-averse as they might be (because, by definition, the insured has shifted the risk to the insurer). This "insulates" people from the total costs of risk-taking, undermining risk-reduction or risk-adaptation strategies and prompting some to label insurance programs as possibly maladaptive. The Complexity of Insurance Policy Contracts

Insurance contracts may be intricate, and some policyholders may not need to know all the costs and coverages they are covered for. People could purchase policies with unfavourable conditions as a result. Many nations have passed comprehensive statutory and regulatory frameworks covering every part of the insurance industry in response to these problems, including policy requirements and the methods by which they may be promoted and marketed. The Insurance business discovered the hard way that many courts would not enforce policies against policyholders when the judges themselves cannot comprehend what the policies are saying. Hence, most insurance plans in the current English language have been carefully designed in plain English. Usually, courts interpret ambiguity in insurance plans in favour of coverage under the policy and against the insurance company. An Independent insurance consultant delivers entirely unbiased advice, free of the financial conflicts of interest of broker-dealers or agents, by advising policyholders on a service charge retainer, similar to an attorney. However, to obtain proper customer coverage, such a consultant must still interact with authorized brokers or agents. Limited Consumer BenefitsFor low-probability, catastrophic losses, insurance is typically seen as beneficial by economists and consumer advocates in the United States, but not for high-probability, minor losses. Customers are urged to avoid ensuring failures that would not significantly interrupt their lives and to choose large deductibles. But customers have demonstrated a propensity to select modest deductibles and to insure relatively minor, high-probability losses over low-probability ones, possibly because they are unaware of or choose to disregard the low-probability risk. This is linked to less health coverage against low-probability losses being purchased, which might lead to increasing inefficiencies due to moral hazard. Redlining

Redlining is the practice of rejecting insurance coverage in particular geographic locations, ostensibly due to a high risk of loss, even when the stated driver is unlawful discrimination. Redlining and racial profiling have a lengthy history in US property insurance. This race has historically impacted and still affects the policies and practices of the insurance business from an examination of company underwriting and advertising material, court papers, and studies by government entities, industry and community organizations, and academics. When setting premiums and premium rate structures, insurance companies consider measurable criteria, including location, credit ratings, gender, employment, marital status, and educational level. Nevertheless, using such variables is sometimes viewed as unfair or illegally discriminatory. The response against this practice has occasionally resulted in political debates over how insurers decide prices and regulatory involvement to limit the factors employed. Religious ConcernsDifferent Muslim scholars have different perspectives on life insurance. Most people believe that life insurance plans that pay interest (or guaranteed bonuses or NAV) are a type of riba (usury), and some people even believe that policies that pay no interest are a form of gharar (speculation). Some claim that the actuarial science used in the underwriting proves gharar is not existent. Although some Jewish Torah scholars have highlighted concerns about insurance as a way to circumvent God's will, most think it is appropriate in moderation. Many members of Anabaptist communities (Mennonites, Amish, Hutterites, and Brethren in Christ) participate in community-based self-insurance programs that disperse risk within their communities, despite the long history of resistance to commercial insurance among some Christians who believe insurance shows a lack of faith. The Bottom LineIn an insurance agreement, one party is protected by the insurer against losses brought on by inevitable tragedies or risks. It aids against financial loss for insured individuals or their families. The most prevalent types of insurance are life, medical, homeowners, and auto.

Next Topic18 Hour City

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share