2008 Recession: What the Great Recession Was and What Caused ItThe Great Recession of 2008 was a global economic crisis that shook the global financial market, especially the banking and the real estate sector. The downfall resulted in the surge of home mortgage foreclosures and the loss of individuals' jobs, homes, and lifetime savings. It was regarded as the most prolonged economic downfall after the Great Depression of the 1930s. The effects of this economic slowdown were seen globally; all the world's economies felt their shockwaves, but primarily it was centred in the United States.

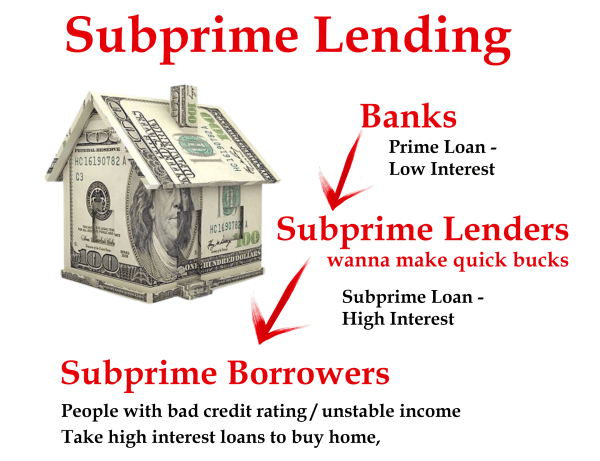

What is the meaning of a Recession?Recession is a macroeconomic phenomenon that shows a significant reduction in global economic activities and is considered part of the regular business cycle. Though the economic tamper caused by the recession is for some time, its after-effects are seen on the economies for a longer duration. It results in job losses, production downfall, economic and political instability, etc. The Base for the RecessionIn the 2000s, a large chunk of investment was done in tech industries that created the tech bubble, and after some time, this tech bubble busted; during that time, the US also faced terrorist attacks. These two events weakened the US economy; as a result, in September 2001, the Federal Reserve lowered the interest rate deeply to stabilize the US economy. Consequently, due to the low-interest rate, cash flow increased in the market, and the US economy rose. This led to a surge in demand for homes, which created the need for home loans and subsequently resulted in an increase in the mortgage. This whole action constructed a housing boom in the US due to the easy availability of loans. The banks sanctioned these loans without assessing the strict creditworthiness of the borrowers, which increased the probability of defaults. This entire operation created a pool of a large number of low-creditworthiness buyers. Role of Subprime Lending

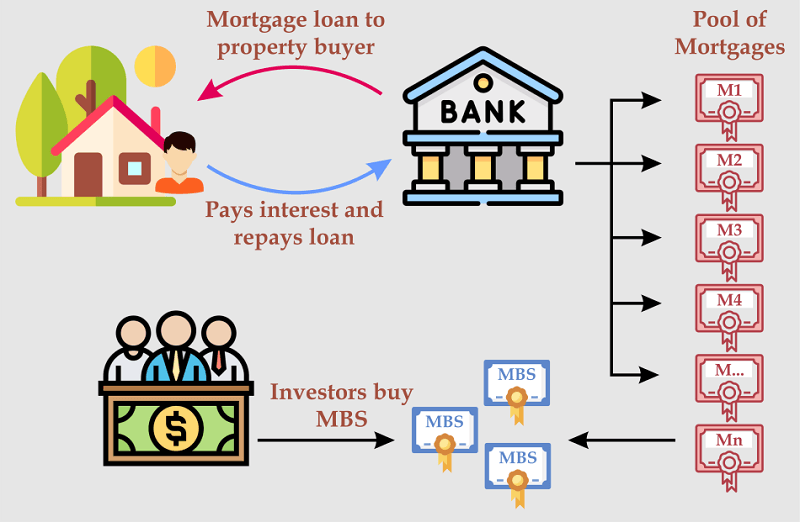

The banks were in a hurry to lend loan-sanctioned loans to uncreditworthy home buyers without considering their repayment capabilities; these loans were regarded as subprime lending. As a result of subprime lending, the number of defaults increased. Why were the banks lending recklessly?Due to the lowered interest rates, the demand for loans increased, and the banks sanctioned loans quickly without much compliance, but banks also had hidden benefits behind approving these loans. Banks passed those loans to acquire mortgaged backer securities (MBS). Mortgage-backed securities are investment instruments made up of a group of home loans bought from the banks by large investment banks. The banks sold the home loans to investment banks, which paid the amount to such lending banks. Investment banks purchased all the loans to form MBS.

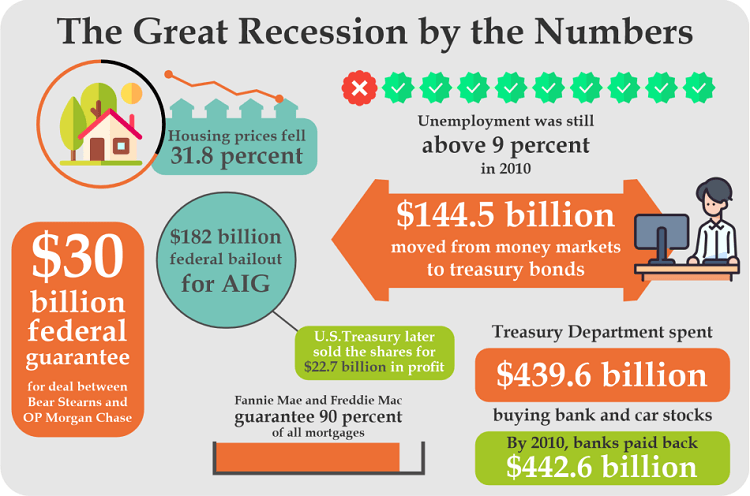

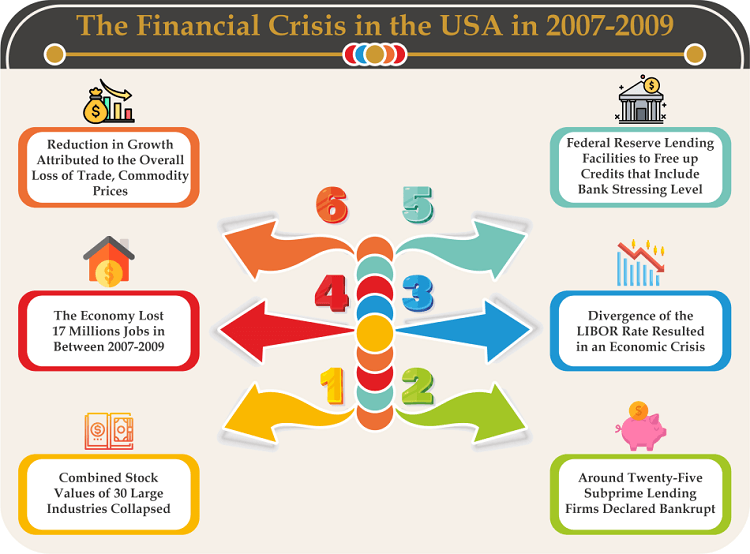

MBS are a safe instrument as investment banks buy them in the hope that the borrower will repay the loan on time and there will be less room for defaults. It is wholly based on the faith that the corresponding banks have done the due diligence before lending to the borrowers. The investment banks sell these MBS to the retail investors who purchase them due to their low-risk factor. In this case, lending banks were not at much risk because they sold their loans to investment banks; the overall risk of defaults was shifted to investment banks that purchased those loans and the investors who invested in these MBS. Role of Credit Default SwapsCredit Default Swaps is a derivative instrument or contract that guarantees an investor to offset his risk in case of credit risk. At that time, some big institutional buyers had observed the early stage of the defaults by the borrowers. The investment banks also quickly issued them Credit Default Swaps as they thought that CDOs are a safe instrument that would not have defaults, so they would never have to reimburse the insured amount; another thing is that these investment banks received good money as a premium for Credit Default Swaps. The spillover happened when the home loan borrowers started to default; they surrendered their houses to recover loans. Suddenly due to a large number of home sales, the homes' prices were reduced and resulting in the decline of the real estate market. The fall of the real estate market led to the problem of recovery of defaulted loans as banks could not recover the amount due to the low prices of the homes. This created a default of Collateralized debt Obligation held by institutional and large investors, but these large investors had hedged their risk of default through Credit Default Swaps (CDS). When these CDOs defaulted, those who hedged their CDOs went to the investment banks and asked for their insured invested money; as many CDOs defaulted, the investment banks received requests for repayment of the insured sum. Consequently, investment banks were burdened by the massive repayment orders under Credit Default Swaps. It was the same case as if an insurance company gets a request for repayment of the insured sum from all of its insurance holders, creating a tremendous cash outflow from the insurance company. This incident devastated the banking industry due to such high cash outflow, which damaged their financial position. Effects of the Downturn

Damage Control Measures by the Authorities

Key Terms

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share