Yield Spread: Definition, How It Works, and Types of SpreadsA yield spread refers to the disparity in yields across debt securities with different maturities, credit scores, issuers, or risk levels, measured by subtracting the value of one item from the yield of the second. This distinction is commonly stated in basis points (bps) or percent growth. Yield spreads are often expressed in terms of one yield against that of US Bonds, where the rating difference is referred to. For instance, if the yield on the five-year Government bond is 5% and the return on the 30-year Government bond is 6%, the yield difference here between the two debt securities is 1%. If the 30-year note is selling at 6%, the five-year note must be buying at roughly 1% based on previous yield spreads. At its present yield of 5%, it is highly appealing.

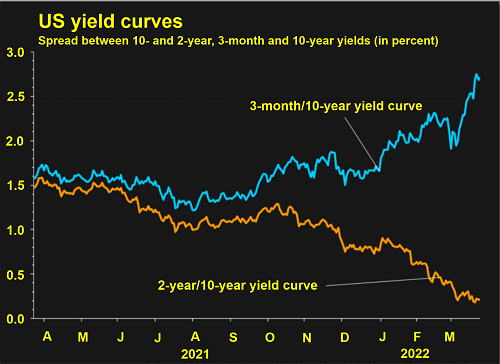

The yield spread refers to the disparity in the rates of profit of 2 distinct investments that are stated, usually of different credit quality. Bondholders use it to determine how costly or inexpensive a particular bond or set of securities can be. The yield spread, often referred to as the credit spread, is merely the disparity between the rates on two bonds. The yield spread is a way to compare the yields of two economic items. Simply put, it is a measure of the credit risk associated with investing in one financial product more than another. Knowing The TermsWhen spreads among bonds with different performance ratings widen, it suggests that the market is pricing in a higher chance of failure on lower-grade securities. For instance, if one bond yields 7% as well as another yields 8%, the "gap" is 1% point. If that margin rises to 4%, the industry is anticipated to have a higher risk of default, indicating a deteriorating economy. Spreads are normally given in "percentage points", which implies a 1% points difference is commonly said to be "100 percentage points". Non-treasury securities are also valued based on the variance in yields. Bond investors are using the yield spread to determine the degree of cost for a debt or set of securities. How Does Yield Spread Function?Yield spreads aren't set. Spreads are continuously in flux as bond rates are. The yield spread's orientation might change, or "broaden," indicating that the yield gap between two securities or industries is growing. When spreads shorten, the yield gap narrows. When you consider that interest rates increase as bond prices are falling, an increasing spread suggests that one area is playing better than all the others. Assume the return on a higher binding index rises between 8% to 8.5%, whereas the US 10-year Treasury yield remains constant at 2%. The margin narrows from 6 to 6.5 percent on average (600 to 650 percent growth) suggesting that high-yield securities outperformed Treasury bonds throughout this time. Yield Spread - Compensation for Danger to ShareholdersGenerally, the higher the risk of a property or investment class, the wider the yield spread. The rationale for this disparity is that investors must be compensated for taking risks. If an expenditure or commitment is deemed reduced, investors often do not want a high dividend to tie up their capital. However, market contestants will seek appropriate compensation, i.e. a bigger yield spread, in order to incur the risk that their principal would drop, which is only achievable if an asset is perceived to be a greater risk. As an example: A bond produced by a large, well-established, and economically responsible corporation will often easily change spread in comparison to State Bonds. A bond produced by a smaller company with poor financial health, on the contrary hand, will market at a larger gap than treasury bonds. This demonstrates that non-investment grade securities have a higher yield than high-rated asset bonds. This event demonstrates the disparity between higher-risk advanced markets and the typically lower-risk securities of established markets. The yield gap is employed to determine the yield advantage between two or more comparable assets with differing durations. The spread between two and ten-year maturities is widely used to illustrate how much higher income an owner can earn by assuming the increased risk involved in investing in lengthy bonds. When Is The Yield Spread Used?A financial adviser will generally use yield spread to determine which assets are among the most appealing. For example, if past yield spreads among a specific bond as well as the hazard-free rate are significantly distinct from current values, a buying/selling chance may exist. Yield spread also can emphasize worth, or even which securities are "cheap" or "premium". On average, higher yield range assets are hazardous, as investors believe a bigger return on riskier goods. Yield Spread Movements ExplainedYield spreads aren't set or inflexible because bond yields & gaps are continually in flux. If the yield differential between two connections or industries grows or decreases, The yield spread can widen or narrow or boost or fall in direction. Understanding that bond yields increase as prices are falling and decrease as prices go up, a growing or increasing spread indicates that one industry is performing much better than another. Suppose, for example, that the return on a higher binding index rises from 6.0% to 6.5% whereas the return on a public treasury remains constant at 3.0%. As a result, the gap has widened from 3.0 percent on average, or 300 percent growth, to 3.5 percent on average, or 350 percent increase, indicating that high-yield bonds outperformed public bonds throughout this period. As a result, if a bond or bond fund pays an exceptionally high yield, anybody who keeps that asset gets rewarded. Yield Spread AnalysisYield spread analysis is created by comparing the duration, availability, and creditworthiness of two devices or one asset to a benchmark. The "yield spread of Is an over B" refers to the percentage return on investments through one financial instrument labeled as A that is smaller than the percentage return on investment from another security categorized as B. Essentially stated, the yield spread is a method for relating or comparing any two financial instruments in order for a buyer to regulate his choices by assessing the risk and return on investments. When it is time to make investments in different assets, yield spread analysis assists buyers and relevant individuals in understanding market behavior. The investor has the power to assess If the disparity among securities of different quality grades is large, the industry is releasing a higher likelihood of default on lower-grade securities. This demonstrates that the economy is starting to slow, and thus the market anticipates a higher risk of default. However, if the sector is assessed to have forecast a somewhat lower default risk, the disparity between different bonds of varying risk levels narrows, indicating that the economy is increasing. For example, if the differential between treasury securities and junk bonds is four percent traditionally, the industry is deemed to be releasing lower default risk. In addition, if you are a loan, the yield spread research might assist you to control. For instance, if a customer is qualified to receive a loan at 4% but prefers a loan at 5%, the difference of 1% is indeed the yield spread, which is the additional income that contributes to the bank's revenue. Many lenders give rewards to loan agents who suggest loans featuring yield spreads as a method to encourage brokers to look for clients able to pay for the interest rates. As per yield spread research, the yields on securities in substitution sectors have a typical connection. Spreads are shown to be expanding throughout periods of low mood and growth. Spreads will be impacted in three ways:

Types of Yield Spread1. Zero-Volatility Spread A zero-volatility spread (Z-spread) gauges the investment's spread over the full Treasury spot-rate slope, provided the bond is kept to expiration. This technique can be a time taking moment because it necessitates a large number of trial-and-error computations. To begin, try one dispersion figure & perform the computations to check if the current value of the future cash flows matches the bond's cost. If not, you must restart and attempt again until the 2 value is closer. 2. The Strong Yield Spread The strong ionic Yield spread is indeed the percent change in present yields of numerous high asset classes when contrasted to investment-grade (e.g., Rating) corporate debt, Treasury securities, or perhaps another reference bond measurement. Higher binding spreads that are bigger than the historical trend indicate that junk bonds are more vulnerable to credit and failure, Junk bonds pose a danger. 3. Option-Adjusted Spread (OAS) An option-adjusted spread (OAS) turns the gap between both the fair price and the average price, stated in dollars, into a yield metric. The OAS methodology relies heavily on interest rate volatility. The choice incorporated in the asset can affect free cash flow, which must be addressed when assessing the agency's value. Premium on Yield Spread"Yield-spread premiums" are what lenders refer to. Customers refer to them as permitted kickbacks. Yield spread premiums are payments made to housing brokers or borrowers in exchange for guiding a borrower to a mortgage with a greater interest rate. The yield spread premium is the charge given to the seller by the mortgage company in exchange for the yield spread. in exchange for a greater rate of interest or a mortgage payment above the market. The yield spread premium is represented as 'YSP' in the market. Even though the borrower is eligible to obtain a mortgage with a set interest rate, the dealership or lending agent can make this amount and cost the debtor a little higher rate to earn more commission. Previously, this activity was presented as a technique to avoid paying the borrower significantly reducing the number of expenses, as traders could get their fee while shielding ultimate pricing with a yield spread premium. It is often referred to as undesirable points. Lenders may yield spread premiums to loan brokers or borrowers. The yield-spread premium is determined as a proportion of the principle. Loan creditors, for instance, frequently opt to pay 2% as a yield spread premium to loan dealers, thus creditors should demand the yield spread premium well in advance of the total price. How Does YSP Work?Suppose Mathew requires $200,000 to buy a property. He receives an estimation for a yield-spread premium refund with a 6% rate of interest and -2.136 points, resulting in a $2,136 return that he can use for the loan's actual prices. A 4.5% credit with one notch signifies that the loan has a low-interest rate but the borrower must spend $2,000 on closing costs. It is important to keep in mind that financial advisers are not always informed and do not always inform their customers about available yield-spread premium payments. A mortgage broker, for example, might acquire a quote from a complete financier for financing with a 6% interest rate and -2.136 points. These yield-spread premiums translate to a $2,136 bonus on a $200,000 credit, which can be applied to the cost of the project. To earn money that way, the mortgage lender marks up the loan to the client and calculates a fee of, perhaps, 6% and 0 points, recouping the $2,136 as compensation for trying to broker the transaction. Why Is YSP Important?Yield-spread premium loans typically feature greater interest rates. As a result, debtors who intend to stay in their homes for a limited time are the ideal candidates for these loans. The extra annual interest, more than a relatively short period of time, is likely to be less than the actual prices the borrower would have had to pay. Yield spread can also be used to determine a lender's efficiency when making a credit to an individual borrower. An essential yield spread for personal loans, especially residential mortgages, is the gap between both the rate of interest paid by the customer on a certain mortgage and the (reduced) rate of interest that the lender's reputation would enable that customer to pay. For instance, if a lender's credit is excellent enough even to apply for a 5% loan but takes a 6% loan, the increased 1% yield spread (with much the same default risk) turns into greater profit for the lender. Lenders frequently give yield spread incentives to traders who discover borrowers ready to spend larger yield spreads as a marketing strategy. ConclusionIn the capital markets, there aren't any such items as a free lunch- as an amazingly risk-free return. There is a rationale why a bond as well as a bond fund pays such a high yield. Everyone who maintains that asset is likewise taking on extra risk.

Next TopicAbsentee Landlord

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share