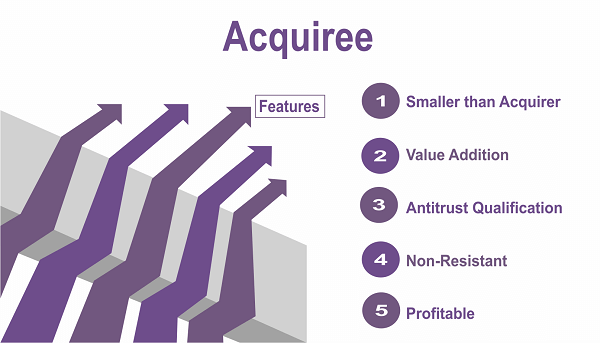

Acquiree Definition: What is it?The word "acquiree" is crucial in the realm of mergers and acquisitions (M&A). It refers to the business that is being acquired by or is being sought after for acquisition by the acquirer. The acquiree that typically represents the business entity and may experience changes in ownership, management, or organizational structure due to the transaction, is essential to the M&A process. It is often referred to as the 'target company'. In order to understand the dynamics of M&A negotiations, it is crucial to comprehend the significance and meaning of the acquiree. During the due diligence process, the acquirer's top priorities include assessing the acquiree's financial performance, market position, strategic fit, synergy possibilities, and legal compliance.

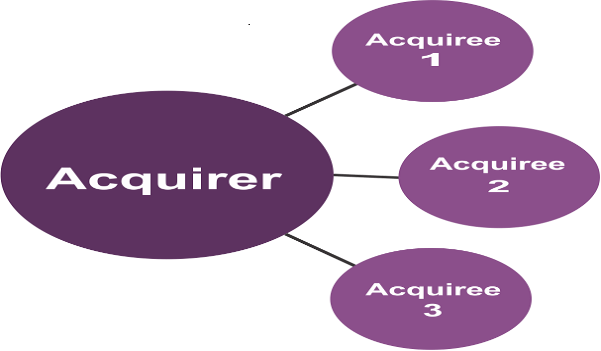

Planning, target discovery, due diligence, negotiation, paperwork, and closure are some of the steps of the acquisition process when the acquirer and stakeholders work closely to determine the terms and circumstances of the deal. Stakeholders may comprehend the complexities of M&A transactions and how they affect the companies involved by comprehending the idea of the acquiree. Both the acquirer and the acquiree have important things to gain from the idea of an acquisition. Being mentioned as a potential target in an M&A deal might provide opportunities as well as difficulties for the acquiree. On the one hand, it can imply that the buyer recognizes the worth and potential of the business, which could result in financial rewards for its stakeholders and shareholders. In contrast, the acquiree can experience future uncertainty due to adjustments in management, company operations, or organizational structure. The purchase of an acquiree is frequently motivated by strategic goals. The acquirer may look to increase its market share, broaden its product offering, obtain access to new intellectual property or technology, or create synergies that improve overall profitability and competitiveness. Unique assets, capacities, clientele, or market position of the acquiree may strategically line up with the acquirer's long-term objectives, making it a desirable target. Steps Involved in Acquiring a CompanyA number of procedures and factors must be taken into account during the acquisition process to achieve a successful transaction. Each stage is essential to the process overall, from target selection and strategy planning to post-acquisition evaluation. Strategic planning includes defining the acquirer's goals and locating potential target businesses that fit those objectives. Initial contact and confidentiality are established to start conversations and safeguard sensitive information. The target's financial, legal, and operational components are carefully examined as part of the due diligence process. The purchase price and the parameters of the transaction are decided through valuation and negotiation. The agreement between the acquirer and the target is formalized via the definitive agreement. Regulatory and shareholder authorization may be required depending on the country and the sector. Integration planning and execution focus on merging operations, systems, and cultures. Finally, post-acquisition evaluation assesses the acquisition's success and identifies improvement areas. These steps, with the involvement of professional advisors, ensure a well-structured and strategic acquisition process. The following are the generalized steps involved in acquiring a company: 1. Strategic Planning and Target IdentificationIn this first step, the acquirer defines its strategic goals and seeks out possible targets that complement those objectives and are believed to work in synergy with the parent company in some way or another. To filter out prospective targets, the acquirer often takes into account variables like market position, financial performance, industry dynamics, synergy possibilities, and many other trivial factors. 2. Initial Contact and ConfidentialityAfter identifying potential targets, the acquirer contacts the chosen target business to finalize the deal. To secure sensitive data, this is typically done through a non-disclosure agreement (NDA); this also ensures the privacy of the parties involved and decreases the risk of a data breach. It may be necessary to have preliminary negotiations to gauge the target's interest in an acquisition. 3. Valuation and NegotiationThe acquirer establishes the value of the target company in accordance with the current market scenarios and trends. A fair purchase price is determined by taking into account market conditions, financial research, and valuation techniques. The parameters of the acquisition, such as the purchase price, payment structure, and any contingencies, are then negotiated between the acquirer and the target company in order to reach a deal that is satisfactory to both parties. 4. Due DiligenceThe crucial due diligence phase entails a thorough analysis of the target organization's financial, legal, operational, and commercial aspects. The acquirer examines financial statements, contracts, legal agreements, intellectual property, customer relationships, and other pertinent data to evaluate the target's assets, liabilities, opportunities, and risks. 5. Definitive AgreementA formal agreement is developed and signed once talks have been effectively concluded. The terms and circumstances of the acquisition are outlined in this agreement, which may be a purchase agreement or a merger agreement. It contains clauses pertaining to the purchase price, closing requirements, representations and warranties, and both parties' obligations following the closure. 6. Regulatory and Shareholder ApprovalsRegulatory permissions from government bodies may be necessary, depending on the jurisdictions and industries involved. Shareholder approvals may also be necessary. These authorizations guarantee adherence to applicable laws on antitrust, foreign investment, and other regulations. In addition, shareholder approval may also be required, in which case the target firm's shareholders vote to approve the acquisition. 7. Integration PlanningFollowing the deal, the acquirer creates a thorough integration strategy. This strategy defines the merger of the acquirer's operations, systems, personnel, and cultural elements with those of the acquiree. It covers the entire post-acquisition plan and identifies synergies, chances for cost savings, and growth objectives. 8. Closing and IntegrationThe transaction is formally concluded after receiving all required approvals. As part of the closing process, the acquirer receives ownership of the target firm, and all outstanding financial and legal obligations are satisfied. After that, integration efforts like operations consolidation, system implementation, process harmonization, and employee integration start. 9. Post-Acquisition EvaluationExamining the success of the acquisition after integration is complete is known as post-acquisition evaluation. This entails keeping tabs on and evaluating the acquired company's financial and operational performance. Any essential alterations and improvements are implemented to maximize the worth and advantages of the acquisition. This assessment enables the acquirer to determine the degree to which the initial strategy goals have been met and to pinpoint any areas that still need work. The particular procedures and phases may differ based on the nature of the transaction, industry regulations, and other considerations. It is vital to keep in mind that every purchase is different. Professional advisors are frequently hired to offer knowledge and direction during the acquisition process and to understand the overall market sentiment and trends. Examples include investment bankers, attorneys, and accountants. It is important to note that an acquirer can acquire any number of acquirees depending on the available resources and requirements.

Factors to Consider While Getting Acquired by a CompanyThere are several things to consider when thinking about being acquired by another company in order to achieve a profitable and effective transaction. Each factor plays a critical role in the overall process, from figuring out your company's value to negotiating the deal structure and resolving post-sale problems. A successful and profitable sale depends on several key factors: valuation, timing, preparation, and hiring experienced consultants. In addition, it's important to be aware of the needs and objectives of possible buyers, maintain confidentiality, and deal with any tax repercussions. When getting acquired by a company, there are several key considerations that can greatly impact the success and outcome of the transaction. Exploring these factors in detail can help you navigate the process effectively. Here are some important considerations when selling your company: ValuationCalculating your company's fair market value is the process of valuation. It considers several variables, including market conditions, financial performance, and potential for growth in the business. You can create a reasonable asking price and negotiate successfully with potential buyers by conducting a thorough valuation. TimingWhen selling your business, timing is essential. Take into account your company's financial performance, industry developments, and the general state of the economy. Selling when your business is expanding and the market is favourable will draw in more possible purchasers and raise your company's value. PreparationEffective selling requires careful preparation. Organizing financial statements, tax records, legal agreements, and other significant documents falls under this category. It also entails performing due diligence on your own business to find any problems or difficulties that might appear throughout the sale process. Professional AdvisorsConsulting with seasoned experts like investment bankers, attorneys, and accountants is strongly advised. They may offer knowledgeable direction throughout the selling process, including deal structuring, negotiation, valuation, and legal and tax issues. Target ClientsIt's critical to find clients who share the objectives and principles of your business. Think about strategic, financial, or sector-specific buyers. You may find the correct fit and increase value by being aware of their motives and evaluating the connections between your business and possible purchasers. ConfidentialityTo safeguard your company's sensitive information and avoid disruptions, secrecy must be upheld throughout the selling process. Enforcing confidentiality agreements and restricting access to information make sure that only those with permission can access sensitive information. Deal StructureTake into account the deal's structure, such as a merger, asset sale, or stock sale. Each structure has unique financial, tax, and legal ramifications. Determine the most effective structure for your circumstance by considering the potential influence on your stakeholders and consulting a professional. Negotiation ApproachIt's crucial to create a clear negotiation approach. Establish your desired outcome taking into account the purchase price, payment terms and other important factors. Figure out your bargaining position and keep your expectations in check as you get ready to participate in transactional negotiations. Tax ImplicationsRecognize how the transaction will affect your taxes and think about ways to pay as little as possible in taxes. This includes all applicable tax advantages or exemptions, capital gains tax, and transfer tax. The tax effects of the transaction can be improved by consulting with tax experts. Transition PlanningYou need to plan in advance for a smooth transition after the sale. Think about the effects on stakeholders such as employees, clients, suppliers, and customers. To maintain business continuity and reduce potential risks, create a thorough transition plan that details the procedures and timetables for transferring duties, information, and connections. Legal and Regulatory ComplianceEnsure adherence to all applicable laws, rules, and standards unique to your sector. Before the sale process, take care of any legal or regulatory difficulties to reduce potential stumbling blocks. This can entail requesting the requisite licenses, permissions, or approvals from regulatory bodies. Post-Sale ConsiderationsThink about your plans for the future after the sale of your business. Think about your individual objectives, such as retiring, launching a new business, or changing roles within the organization. Plan your financial goals and take into account how the sale's revenues will be distributed and handled. With careful analysis, strategic preparation, and expert advice, you can considerably raise the likelihood of a successful sale that satisfies your goals and optimizes the value of your business. The Bottom LineIn conclusion, a firm or business entity that is being bought out or taken over by another company is referred to as an acquiree. The objective of the acquisition process, when ownership and control are changed, is the acquiree. The objective of the acquiring company is to take over the acquiree's activities, assets, and market position. There are several ways for this transaction to take place, including mergers, acquisitions, and buyouts. The acquiree is an essential component of the overall acquisition process and the acquiring company's strategic plans and growth goals. |

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share