Accounting PracticeUnderstanding Accounting PracticeThe process of recording the ongoing financial activities of a company or business entity on the basis of financial records by following specific rules and guidelines is known as an accounting practice. Various accounting procedures are needed to be followed while creating the yearly financial statements for a corporation; some of them are legally required accounting practices. Companies can pick from a variety of accounting techniques, and there are standards that they must follow. A unified set of accounting guidelines, methods, and standards known as generally accepted accounting principles (GAAP) was released by the Financial Accounting Standards Board (FASB). U.S. public corporations are required to have their accountants prepare their financial statements in accordance with GAAP.

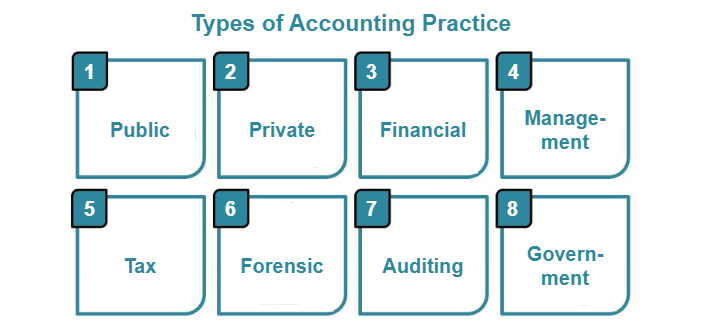

A business needs accounting procedures to prepare the annual financial statements mandated by law, including the income statement, comprehensive income statement, balance sheet, statement of cash flows, and statement of shareholders' equity. A business or individual in charge of keeping accounting records must implement a number of controls. For instance, authorization controls that require only authorized individuals to sign bills, admission restrictions in storekeeping and inventory rooms, or limitations on lower- and middle-level employees' access to data. In addition to recording and access control, accounting practice also necessitates recording in accordance with legal requirements and widely accepted accounting principles, such as IND AS or IFRS. Types of Accounting PracticeAlthough there can be many accounting practices depending on the specific business or company, mentioned below are some of the common practices:

1. Public Accounting PracticeSince some financial documents and other information must be made public, associated services, including recording accounting records, are outsourced to an independent firm in public accounting practice accounts. In public accounting practice accounts, the public accountants, or CPAs (Certified Public Accountants), perform all controls over accounting records. 2. Private Accounting PracticeA company entity chooses an individual expert to record the accounting and other information accurately and systematically in private accounting practice. Since the individual chosen for the position is an expert, he/ she is the only person responsible for implementing all controls for the organization. 3. Financial Accounting PracticeThis is the most common type of accounting practice and involves the preparation of financial statements such as income statements, balance sheets, and cash flow statements. Financial accounting is used to provide information to external stakeholders such as investors, creditors, and regulators. 4. Management Accounting PracticeThis type of accounting practice involves the preparation and analysis of financial information for internal use by managers to make informed business decisions. Management accounting focuses on budgeting, forecasting, cost analysis, and performance evaluation. 5. Tax Accounting PracticeThis type of accounting practice involves the preparation of tax returns and ensuring compliance with tax laws and regulations. Professional and certified tax accountants work with individuals, businesses, and organizations to minimize tax liabilities and maximize tax savings. 6. Forensic Accounting PracticeThis type of accounting practice involves the investigation and analysis of financial records to detect fraud, embezzlement, or other financial crimes. Forensic accountants may work with law enforcement agencies, attorneys, or insurance companies to provide expert testimony in legal proceedings. 7. Auditing PracticeAuditing involves the examination of financial statements and other financial information to ensure accuracy and compliance with accounting standards and regulations. Auditors may work for accounting firms or for companies as internal auditors. 8. Government Accounting PracticeThis type of accounting practice involves the preparation of financial statements and other financial reports for government entities such as federal, state, or local governments. Governmental accountants may work for government agencies or private accounting firms specializing in government accounting. Each of these accounting practices requires different skills and expertise, and accountants may choose to specialize in one or more areas depending on their interests and career goals. Various Other ControlsAccess ControlWith this control, the accounts department's actual accounting records, such as bills, bank statements, check issues, etc., are only accessible to authorized individuals. Authorization ControlData and reports shouldn't be accessible to everyone in the accounting department. Authorization ought to be restricted to an employee's function. Moreover, data entry personnel make entries with senior staff's approval. Process ControlEach organization has a unique method for keeping track of its bills and other documents. For instance, if the first bill is sent, the debtor receives items. If the goods acceptance approval occurs, the sales accounting entry must be completed. Thus, proper process control should be used for accounting records. Methods used for Accounting PracticeSome of the most common methods used for accounting practice are:

These are just a few of the many methods used in accounting practice. Accountants must choose the most appropriate method for each situation based on specific factors such as the size and complexity of the organization, the industry in which it operates, and the specific requirements of regulators and stakeholders. Good Accounting Practice Examples

Accounting Practice - Standards and Principles - GAAP and IFRSAccounting practices are supported by various standards and principles that provide a framework for financial reporting, ensuring consistency and comparability across organizations and jurisdictions. The Generally Accepted Accounting Principles (GAAP) and the International Financial Reporting Standards (IFRS) are two of the most widely used accounting frameworks. GAAP is a set of accounting principles, standards, and procedures used primarily in the United States. GAAP is designed to ensure consistency and comparability in financial reporting and is used by most public companies in the U.S. GAAP covers a broad range of accounting topics, including revenue recognition, inventory valuation, and financial statement presentation. On the other hand, IFRS is a set of accounting standards developed by the International Accounting Standards Board (IASB) for use in many countries around the world. IFRS is designed to provide a global framework for financial reporting, ensuring consistency and comparability in financial statements across different jurisdictions. IFRS covers various topics, including revenue recognition, financial instruments, and business combinations. GAAP and IFRS share many similarities regarding their underlying principles and objectives. Both frameworks aim to provide a consistent and transparent approach to financial reporting, ensuring that financial statements accurately reflect a company's financial performance and position. However, there are also some differences between GAAP and IFRS. One of the key differences is in the treatment of certain accounting issues, such as the recognition and valuation of assets and liabilities. For example, under GAAP, companies are required to use the lower cost or market value to determine the inventory worth, while under IFRS, companies may use the cost or net realizable value. Another difference is in the way the financial statements are presented. Under GAAP, companies are required to present their financial statements in a specific order (balance sheet, income statement, and cash flow statement), while under IFRS, companies may choose to present their financial statements in a different order. Despite these differences, both GAAP and IFRS aim to provide a consistent and transparent approach to financial reporting, ensuring that financial statements accurately reflect a company's financial performance and position. As a result, it is important for businesses to understand and comply with both GAAP and IFRS, depending on their location and industry. Importance of Accounting PracticeAccounting practice is essential for the success and sustainability of any business, regardless of its size, industry, or location. Here are some of the key reasons why accounting practice is so important:

Overall, accounting practice is vital in ensuring the financial health and success of a business. It provides a framework for managing financial resources effectively, complying with legal and regulatory requirements, evaluating performance, making informed decisions, and mitigating financial risks. The Bottom LineAccording to generally accepted accounting standards and contemporary legal doctrine, accounting practice is the daily recording of accounting and financial data. Commercial entities employ a variety of controls to ensure the accuracy of their accounting records. Many reports are based on accounting records, and the management of the organization is responsible for making internal and external choices based on that information. Auditors establish reliance on accounting records by confirming controls in those records. For best practices, organizations should maintain physical and written records of all accounting information. No matter if a company is for profit or not, keeping accounting records by following specific guidelines is still a need. For any organization to last long, efficient accounting procedures and open records are essential.

Next TopicAccounting Ratio

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share