The 2007-2008 Financial Crisis in ReviewThe Great Recession of 2008 was not a single-day event; it took years to build up. The US economy was showing signs of economic turbulence way before 2008. The crisis resulted from the banks' complete failure of due diligence in sanctioning loans which gave rise to subprime lending. This crisis saw the fall of the USA's giant institutions, which were too big to fail for the US economy like Bear Sterns. The shockwaves of the recession were felt throughout the world, but the epicentre of the whole scenario was the United States of America.

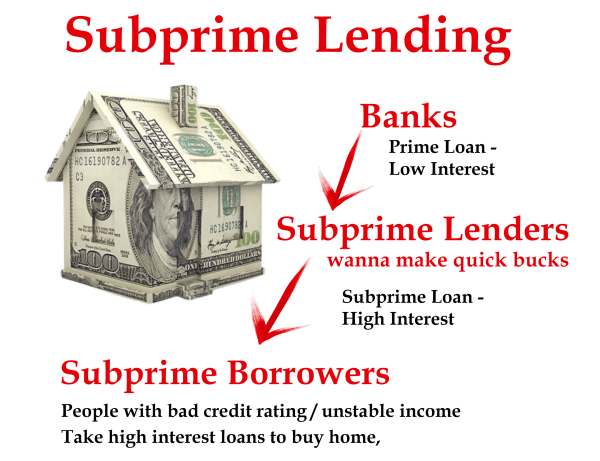

The Great Recession was the immense devastation of the financial and economic structure of the US economy that resulted in the loss of homes, jobs, and lifetime savings of the ordinary people of America. Cause of the Financial Crisis of 2007-2008A large number of subprime lending caused the financial crisis of 2008 due to the Federal Reserve's decline in interest rates in June 2004. Banks sanctioned a massive number of home loans to low-creditworthy borrowers without proper checks on the creditworthiness of the borrowers by the banks. Banks' negligence led to a surge in subprime lending. The borrowers purchased real estate properties with mortgage loans, mainly houses. Due to a large number of sanctioned loans and the inflow of money in the market for buying homes, the demand in the real estate sector accelerated, increasing the prices of homes. This boom in the real estate sector created the Housing bubble. The mortgaged loans sanctioned by the banks were purchased by the investment banks as mortgage-backed securities and collateralized debt obligations because, according to them, this was the most secure form of financial instrument. The securities market also boomed due to many mortgage-backed securities. It was the moment of goodness before any devastation. When the housing bubble reached its saturation level, the borrowers also started to default. By the end of 2004, homeownership in the US surged to 69.2%. Consequently, the housing bubble busted, and the prices of houses in the US started to decline. By 2007, subprime borrowers also started to default, and the borrowers filed many bankruptcy applications. They could not even sell their houses to pay back the loan amount because of the fall in housing prices; even the banks could not sell those houses to recover their money. Thus, the real estate sector got collapsed entirely.

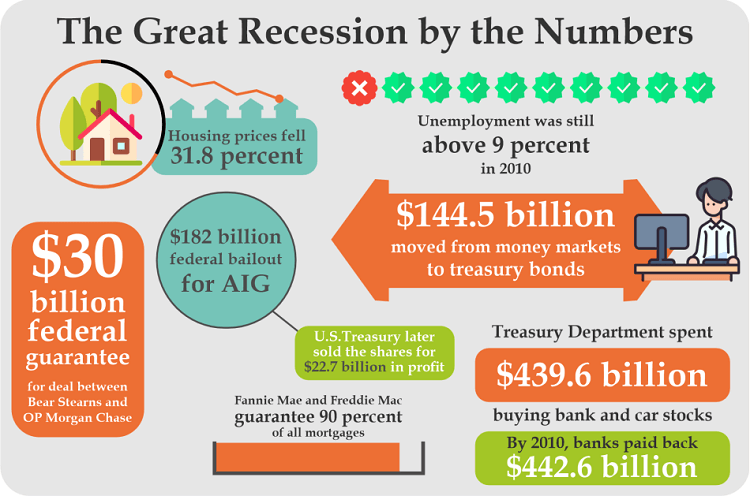

The effect of this fall was seen on jobs when in April 2007, New Century Financial, a leading firm in subprime lending, laid off half of its employees. It was the start of job losses in the crisis. In June, the redemption of two hedge funds was halted by Bear Sterns, which prompted the seizure of $800 million of assets from the funds by Merrill Lynch. Major Economic Giants DownfallsThe Fall in August 2007By April 2007, the experts realized that this was the start of massive economic desolation that would have drawn impacts beyond borders. Due to the crisis, the interbank market that keeps many flowing worldwide's liquidities froze its operation altogether. In October 2007, UBS bank (originally from Switzerland) became the first banking giant to announce losses of $3.4 billion because of subprime lending-related investments. On the other side, Northern Rock- a British bank, approached the Bank of England to seek emergency funds due to the prevailing liquidity crisis. The situation of other investment banks was the same; they were struggling to assess the fair value of their trillion-dollar mortgaged-backed securities, whose value was continuously declining. The Great Fall of Bear Stearns in March 2008In 2008, the recession peaked, and financial institutions and businesses were combating a liquidity crunch. To slow the downside movement of the economic curve of the US economy, the Federal Reserve cut the benchmark rate by three-quarters of one percentage point- regarded as the most significant cut in the quarter century. In February 2008, Northern Rock's financial situation worsened, forcing the British government to nationalize the bank to save it from the crisis. By March of the same year, the financial condition and its working fell drastically; JPMorgan Chase acquired it at a low price in a move to give some relief from the collapse. The Collapse of Lehman BrothersThe summer of 2008 witnessed numerous economic downturns in the US. During that period, one of the banking giants, IndyMac Bank, failed and stopped its operation. After that, the two major home lenders of the US, Fannie Mae and Freddie Mac, collapsed utterly; these were a few of those too big-to-fail companies of the United States. Consequently, both home lending companies were seized by the US administration. The biggest bankruptcy of the US was yet to come. By September 2008, an investment bank giant, Lehman Brothers, declared itself bankrupt; the news led to the fall of the indices of Wall Street very rapidly. The failure of Lehman Brothers was the most significant blow to the US economy, and it instigated the people in the administration to make some effective economic decisions.

The Saving Efforts by the US GovernmentThe Federal Reserve, the Treasury Department, Congress, and the White House were all struggling to get some practical solution for the devastation. Consequently, The Wall Street Bailout package was announced in October 2008 to revive the struggling financial securities market of the US. The package was worth $1488 billion to restore the recession-struck companies. With this package, the US government purchased the stressed assets of banks to recover them from the losses. The move of the government to launch the package also helped the stock market to recover from the crisis. Even after the economic stimulus by the government, some other sectors suffered immensely, like jobs and the housing crisis. The unemployment level reached its peak of about 10%, and about 3.8 million people in America lost their homes due to foreclosures. Passing of Dodd-Frank ReformDuring damage control and to safeguard the US economy from such devastating financial negligence, in 2010, the government passed the Dodd-Frank Wall Street Reform and Consumer Protection Act. The act had features like-

All these rules and regulations under Dodd-Frank Reform were imposed as a measure to avoid any similar economic downturn in the future. Who was responsible for the financial crisis of 2007-2008?The severe economic blow is mainly blamed for subprime lending, but different entities are also responsible for such financial havoc. It was not the fault of any single entity; it was the complete failure of other stakeholders, like-

Banks that suffered from the crisis of 2007-2008It is an interesting fact that no American depositor lost their money deposited in the banks. More than 500 banks failed due to the crisis; mostly among them were the small regional banks, but all of them were acquired by the big banks. This strategy saved the depositors money during the crisis. The banks which failed ultimately were not the commercial banks that lent loans to the borrowers but the investment banks that bought those bad mortgages and resold them to institutional investors. Investment banks like Lehman Brothers and Bear Stearns were among those which burnt badly in the fire of the 2007-2008 crisis. Lehman Brothers completely shut its doors after rejecting the bailout stimulus of the government, and Bear Stearns was bought by JPMorgan Chase very cheaply with all its stressed assets. The other big investment banks like Goldman Sachs, Bank of America, JPMorgan Chase, and Morgan Stanley accepted the government's bailout package, which helped them survive the crisis. These banks were crucial for the government because they were too big to fail, whose failure could severely affect the US economy.

Next TopicMutually Exclusive

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share