Carbon Credits and How They Can Offset Your Carbon Footprint

Key Lessons

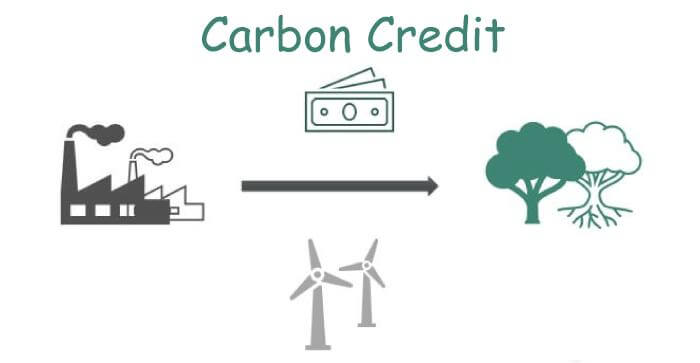

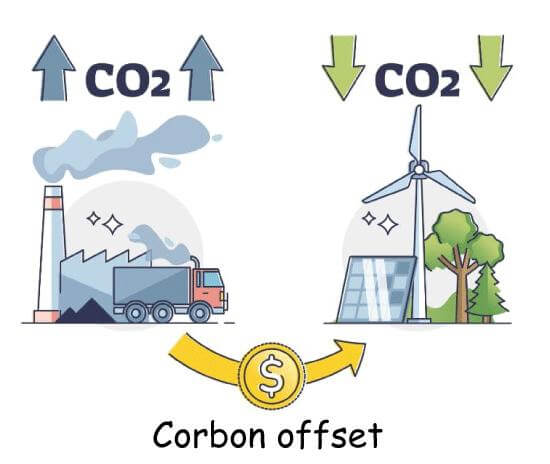

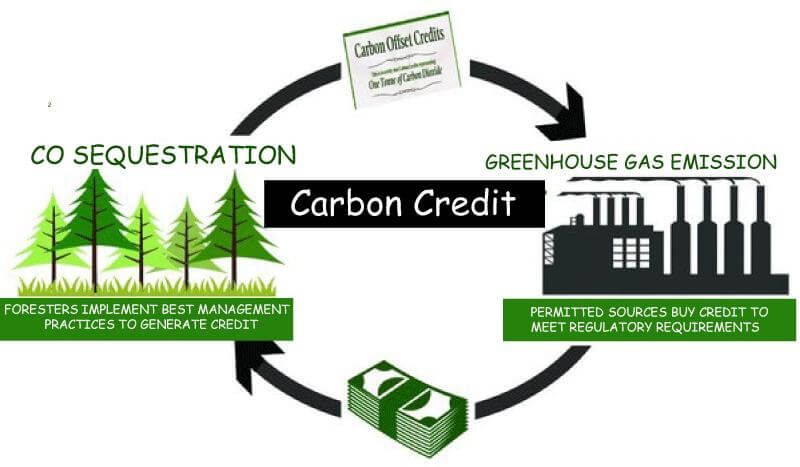

How Do Carbon Credits Work?The final goal of carbon credits is to lessen the emission of greenhouse gases into our environment. To be precise, a carbon credit displays the right to release greenhouse gases equivalent to a ton of carbon dioxide. The Environment Defense Fund says that a ton of carbon dioxide in the form of carbon credits is equivalent to a 2,400 - mile drive in terms of carbon dioxide emissions.

Nations or companies are given a fixed number of carbon credits and are free to trade them to help in balancing worldwide carbon emissions. As it is known that carbon dioxide is the main greenhouse gas, the United Nations says that people across the globe speak simply of trading in carbon. As it is known to everyone that carbon dioxide is the main greenhouse gas of all, it is said by the United Nations that trading in carbon is spoken about very simply by people around the world. The main aim is to decrease the number of credits slowly so that it can encourage businesses to think and develop new strategies which can help in lowering greenhouse gas emissions. Carbon Credits in the U.S. TodayIn the U.S., cap-and-trade regimes are still divisive. Although, the Center for Climate and Energy Solutions has suggested that 11 states have accepted such market-based strategies that are developed by the government for reducing greenhouse gas emissions. Ten of them are Northeastern states that teamed together under the Regional Greenhouse Gas Initiative to collectively combat the issue (RGGI). The Cap-and-Trade Program in California2013 saw the start of California's cap-and-trade scheme. The state's significant electric power plants, industrial facilities, and gasoline distributors are subject to the regulations. After the programs of the European Union, the Chinese province of Guangdong, and South Korea, the state claims that its program is the fourth largest across the globe.

A market system is sometimes used to characterize the cap-and-trade system. In other words, it establishes a market value for emissions. Its supporters contend that a cap-and-trade program provides an incentive for businesses to invest in cleaner technology rather than purchasing permits, the price of which will rise yearly. United States Clean Air ActSince the passage of the U.S. Clean Air Act in 1990, which is recognized as the first cap-and-trade program in the history of the world (despite referring to the caps as "allowances"), the United States has regulated airborne emissions. The Environmental Defense Fund attributes the program's success to a significant decrease in sulfur dioxide emissions from coal-fired power stations, which were a major contributor to the infamous acid rain of the 1980s. The Inflation Reduction Act

Carbon Credit Initiatives across the globe

The Climate Agreement of Paris

Important fact: The Paris Agreement, also known as the Paris Climate Accord, was reached by the heads of state and governments of more than 180 nations to reduce greenhouse gas emissions and keep the rise in global temperature to under 2 degrees Celsius (36 degrees Fahrenheit) by the year 2100. Glasgow's 26th Conference on Climate Change

1. Why should atmospheric carbon and greenhouse gas concentrations be lowered? Scientists working at the United Nations Intergovernmental Panel on Climate Change (IPCC) have successfully proved that the constant increase of greenhouse gases in the atmosphere is increasing the planet's temperature. This causes extreme weather changes across the globe. Currently, the main greenhouse gas in the atmosphere is carbon which is created by burning fossil fuels, that is - coal, oil, and gas. With an attempt to control the amount of carbon that is emitted into the environment, we might be able to avoid further environmental degradation caused by greenhouse gases. 2. How much does a carbon credit cost?

There is no fixed price to carbon credits, and they have different prices which depend upon the market and location where they are traded. In the year 2019, the average price of carbon credits was $4.33 per ton. This figure jumped up to the price of $5.60 per ton in the year 2020 and is now finally settled at the price of $4.73 in the first eight months of the following year. 3. Where can you buy carbon credits? Several private companies offer carbon offsets to individuals as well who are seeking to lessen their net carbon footprint. These offsets are financial investments in or donations to forestry initiatives or other initiatives with low carbon footprints. There are several sources from where people can buy transferable credits on a carbon exchange, like Singapore's AirCarbon Exchange or New York's Expansive CBL. 4. How vast is the carbon credit market? Due to the number of restrictions in each market and other differences based on the region, assumptions about the size of the carbon credit market are very different from one another. According to some estimates, the voluntary carbon market, which is primarily made up of businesses that purchase carbon offsets for corporate social responsibility (CSR) purposes, was worth $1 billion in 2021. Estimates for the market for compliance credits, which are connected to regulated carbon caps, range up to $272 billion for 2020. The ConclusionCarbon credits were invented as a method to reduce the emission of greenhouse gases in our environment and have proven to be an effective method as well. By establishing a market where businesses or people can trade emission permits, this is accomplished. The scheme provides businesses with a predetermined number of carbon credits, which diminishes over time. Any surplus may be sold to any other business or person. For businesses or people, carbon credits provide a financial incentive to work toward lowering their carbon emissions. Companies that are unable to lower their carbon emissions can still run their businesses, although at a higher cost. Research over the years has proved that the carbon credits system has led to measurable as well as verifiable emission reductions over the years.

Next TopicAbility-To-Pay Taxation

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share