Initial Public Offering (IPO): What It Is and How It WorksWhat is an Initial Public Offering (IPO)?IPO refers to a procedure of selling shares of a private firm to the general public for the first time in a new stock issuance. An initial public offering (IPO) allows a company to raise equity capital from the general public.

The transition from a private to a public corporation can be a significant step for private investors to realise the rewards of their investment because it frequently involves a share premium for current private owners. Before an IPO, a corporation is considered private. An IPO is an important stepping stone for a company since it can raise significant capital. This boosts the company's ability to grow and develop. The increased openness and credibility of the share listing may also benefit in securing better terms when seeking borrowed financing. When a company believes it is mature enough to withstand the rigours of SEC regulations and the incentives and obligations of public shareholders, it will begin to market its desire to go public. This level of development is frequently accomplished when a company has a private valuation of around $1 billion, sometimes known as unicorn status. Private enterprises with excellent fundamentals and established profitability potential can qualify for an IPO at various prices, depending on market competitiveness and their ability to meet listing conditions. When a corporation goes public, previously owned private shares become public, and current private shareholders' shares are worth the public selling price. Meanwhile, the public market permits millions of investors to purchase stock in a corporation and contribute funds to the shareholders' ownership. Overall, the equity worth of the new owners is determined by the number of shares sold by the corporation and the price at which those shares are sold. Shareholders' equity remains the same when the company is private or public. HistoryBy offering shares of the Dutch East India Company to the general public, the Dutch established the initial building blocks for the recent terminology we know today as an IPO. Since then, corporations have used IPOs to raise capital from public investors by issuing public share ownership. IPOs have been recognised for both uptrends and downtrends in issuance over the years. Due to innovation and other economic issues, individual industries often experience distribution ups and downs. During the dot-com boom, businesses with little money hurried to list on the stock market. After the financial crisis, IPOs halted, and new listings were scarce for several years. Most IPO interest has recently migrated to so-called unicorn startups with a private value of more than $1 billion. Investors and the media are often divided about whether any company should go public via an IPO or remain private. How does it work?When a firm begins its road to get IPO, the following steps are involved:

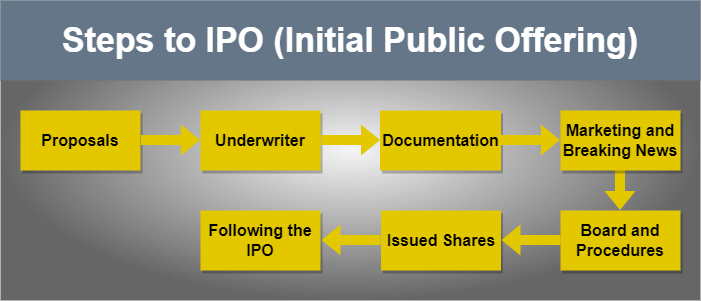

Proposals In this step, valuations are performed to determine the services, the correct type of security to issue, the offering price, the number of shares, and the market offering time. Underwriter During this process, the respective corporation selects its underwriters and legally agrees to underwrite terms via an underwriting agreement. Documentation The information for the company's IPO papers is compiled in this stage. The S-1 Registration Statement, the principal IPO filing document, is used to accomplish this. It is divided into two sections: the prospectus and the privately held filing information. The S-1 provides preliminary information about the anticipated filing date, and it often gets frequently changed during the pre-IPO process. The prospectus is also updated regularly. Marketing and Breaking News Marketing materials are developed to pre-market or advertise the new stock issuance at this stage. Underwriters and executives promote the issuance of shares to forecast demand and set the final offering price. Underwriters may make adjustments to their financial analysis during the marketing process. This includes adjusting the IPO price or date as they see fit. Firms must adhere to exchange listing guidelines and SEC rules for public firms. Board and Procedures In this step, firms establish a board of directors and ensure processes for quarterly reporting of auditable financial and accounting data. Issued Shares Finally, the corporation distributes its shares on the specified day of the IPO. The money from the main issue to shareholders is received in cash. On the balance sheet, it is shown as stockholders' equity. Consequently, the balance sheet share value is exclusively determined by the stockholders' equity per share valuation. Following the IPO Post-IPO provisions could be put in place. Underwriters may be given a time limit after the IPO date to purchase additional shares. Meanwhile, some investors may experience a period of silence. Can anyone invest in an IPO?A new IPO will frequently have more demand than supply. As a result, there is no certainty that all interested investors will be able to purchase shares in an IPO. Those interested in investing in an IPO can do so through their brokerage firm. However, access to an IPO may be limited to a firm's larger clients. Another alternative is to invest in an IPO-focused mutual fund or other investment instruments. Are IPOs a Smart Investment?Much media attention is usually given to initial public offerings, some of which are done on purpose by the firm going public. In general, IPOs are well-liked by investors due to their propensity to induce erratic price changes on the day of the IPO and shortly after. Significant losses, as well as large gains, might occasionally result from this. Investors should ultimately evaluate each IPO in light of their financial situation, risk tolerance, and the prospectus of the company that is going public. What are the advantages of an IPO?

An IPO provides significant financing and can shift a company's growth trajectory. ZTO Express, for example, raised $1.4 billion in its IPO in 2016. Even without considering the additional benefits, the earnings from an IPO are sufficient reasons for many organisations to go public, especially given the new money's multiple investment choices. A company may use an IPO to support R&D, hire new employees, expand facilities, reduce debt, fund capital expenditure, acquire new technology or other firms, or for different objectives.

Every firm has stakeholders that have invested substantial time, money, and resources to build a successful business. These entrepreneurs and investors frequently need to see a significant investment return. An initial public offering is a crucial exit option for stakeholders since it allows them to collect large sums of money or, at the least, liquefy the capital they already have invested in the firm. As indicated in the above paragraph, initial public offerings (IPOs) sometimes generate approximately $100 million (or more), making them highly appealing to founders and investors who frequently believe it is time to earn financial payback for years of "sweat equity". It should be noted, however, that for founders and investors to profit from an IPO, they must sell their shares of the now-public company on a secondary exchange. The proceeds of an IPO do not provide shareholders with immediate liquidity.

The cost of financing is a significant barrier for any firm, but notably for newer private enterprises. Companies must frequently pay higher interest rates or give up ownership to obtain funding from investors before an IPO. An IPO can significantly simplify the process of securing new capital. Before a firm can even begin the official IPO preparation process, it must be audited by PCAOB3 criteria; this audit is often more scrutinising than any previous audits and creates more trust that what a company provides is accurate. This improved confidence will likely result in reduced interest rates on bank loans because the firm is seen as less hazardous. In addition to lower borrowing rates, after a company becomes public, it can also raise additional funds through subsequent stock market offerings, which is usually easier than obtaining capital through a private investment round.

Being a public corporation also permits a firm to accept publicly traded shares as payment. While private business stock can be used as payment, it is only helpful if a reasonable exit opportunity emerges. On the contrary, public stock is a form of cash that may be bought and sold at any moment at a market price and used to reward employees and purchase other firms. To flourish, a firm must hire the proper people. The ability to pay employees in stock or provide stock options enables a firm to compete for top-tier talent even if the basic monetary compensation is lower than what rivals offer. Furthermore, acquisitions are frequently crucial for businesses to expand and remain relevant. However, purchasing other firms is typically prohibitively expensive. When a firm goes public, it might issue shares of stock instead of millions of dollars in cash as payment. What are the disadvantages of an IPO?

Unlike private firms, public enterprises are required by the Securities and Exchange Commission (SEC) to file annual financial statements. These SEC restrictions are both onerous and expensive. Reporting a company's financial position publicly often necessitates the establishment of more stringent financial controls, staffing a financial reporting team and audit committee, the implementation of quarterly and yearly financial close processes, hiring an audit firm, and hundreds of other tasks. These duties cost public firms millions of dollars each year and need thousands of hours of effort.

Sometimes, market forces can be brutal for corporate leaders accustomed to acting in the company's best interests. Founders frequently have a long-term perspective, imagining how their firm will appear in the future and how it will affect the world. On the other hand, the stock market is focused on short-term profits. When a business goes public, investors and analysts worldwide analyse every move it makes. They are primarily concerned with one question: "Will this firm fulfil its quarterly profits target?" If a company achieves its goal, its stock price usually rises; if it does not, its stock price usually falls. Regardless of whether leadership is operating in the organisation's best interests, failure to accomplish the public's short-term goals may cause the company to lose value and change leadership in the long run. Founders who dislike being restricted by short-term public aims should reconsider going public.

The fact that founders may lose ownership of their company is a significant downside of an IPO. Although means for guaranteeing that the business's founders retain the majority of decision-making authority are available, once a firm goes public, the leadership must please the public, even if other shareholders still require voting power. Going public entails obtaining large sums of money from public shareholders. Because shareholders have invested so much money in the firm, they want it to behave in their best interests, even if it means heading in a path that the founders despise. Assume that shareholders believe that the company should be run in a way that benefits them financially. In that event, they will use shareholder votes or public criticism to force the firm to establish a new leadership.

The IPO transaction process is expensive, on top of the ongoing costs of public company regulatory compliance. Furthermore, underwriters typically charge 5% to 7% of gross proceeds, meaning that an underwriter's discount on a typical IPO may cost up to $7 million. Companies that raise a moderate amount of cash (about $100 million) could anticipate paying $1.5 - 2 million in legal expenses, $1 million in auditor fees, and $500,000 in registration and printing fees in addition to underwriter fees. The transaction costs would be considerably higher if a firm employs a financial reporting advisor or other speciality groups. The Bottom LineIPOs are often popular among investors because they create colossal price movements on the day of listing and later days after the launch of the IPO. But, investors should analyse each IPO in light of the company's prospectus, as well as their financial status and risk tolerance. A firm may or may not benefit from an initial public offering. IPOs have several pros and downsides. If an individual is considering an IPO, he must analyse all the benefits and drawbacks, be patient, and explore their options. |

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share