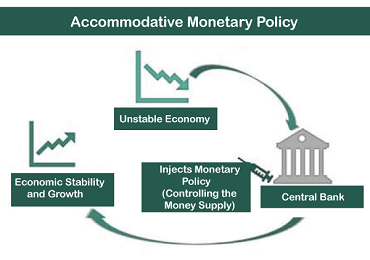

Accommodative Monetary PolicyWhat exactly is an Accommodative Monetary Policy?The accommodative monetary policy is when a central bank attempts to expand the general money supply to stimulate the economy when growth is slowed (based on GDP). It is also sometimes referred to as loose credit or easy monetary policy.

The policy is intended to increase the money supply in response to national income and monetary demand. In-Depth Understanding of Accommodative Monetary PolicyAccommodative monetary policies are frequently implemented to avoid a weak aggregate demand, which can lead to an economic recession. Citizens would rather save money than invest at such a hard time. As part of this policy, bankers seek to encourage people with a broad monetary measure. The goal is to move toward economic growth and company expansion. Banks employ a variety of stimuli to deliver a healing tonic to the country, including the production of commodities and services. The tonic usually has the motive of unintended consequences for increasing citizens' income. In addition, it also pushes lending companies to give greater loans to both consumers and enterprises. Monetary policy should be eased when GDP growth is below potential and has been negative for two quarters. Other factors, which must be considered, include a low level of capital investment, a steady rise in the unemployment rate, and weak inflationary pressures. Considering inflation and interest rates is critical when developing accommodating monetary policies. Policymakers want to improve the national financial supply by managing inflation and interest rates. These policies and factors are reflected in national bank mandates. Whenever a country's money supply is low, the government typically employs broad-based accommodative monetary policies to improve the quantity of available money in various areas. In other cases, however, different methods can be used in a restrictive monetary policy. How does an Accommodative Monetary Policy work?

The Federal Reserve may stimulate the economy via accommodating monetary policy whenever the economy weakens. It accomplishes this by lowering the Federal funds rate in a series of steps, lowering the cost of borrowing. Through quantitative easing (QE), the Federal Reserve can also stimulate or increase the money supply. The intention of accommodative monetary policy is to promote higher expenditure by making money less expensive to borrow through lowering short-term interest rates. The economy's money supply grows when money is widely available through banks, and spending rises as a result. When firms can readily borrow money, they have more capital to expand operations and hire more people, resulting in a lower unemployment rate. People and businesses, on the other hand, tend to save less when the economy improves because banks provide low savings interest rates. Any extra funds are instead invested in the stock market, leading stock prices to skyrocket. What are the advantages of an Accommodative Monetary Policy?

What are the disadvantages of an Accommodative Monetary Policy?

What is the impact of monetary policy on people's lives?Monetary policy must be more effective in narrowing racial wealth and income gaps. While accommodative monetary policy lowered income disparities, it raised wealth disparities and racial inequality, according to the Federal Reserve Bank of New York. While it can keep interest rates low to stimulate economic growth and keep or reduce unemployment, it may benefit certain individuals more than others. Assume that White households have more money invested in stocks and bonds than Black families. In that case, an accommodative monetary policy may help them more if the prices of stocks and investments rise. Moreover, White households, typically wealthier than Black households, will have more money in their portfolio, widening the wealth difference even further. What is some criticism of the Accommodative Monetary Policy?While accommodative monetary policy boosts economic growth in the short term, it may have detrimental long-term consequences. Suppose the money supply is loosened for an inordinately long period. In such cases, too much money would be chasing too few goods and services, leading to inflation. This raises the price of various things, such as housing. Most central banks use accommodative and restrictive monetary policies to support growth while keeping inflation under control. To reduce economic growth, a restrictive monetary policy may be imposed. In contrast to accommodative monetary policy, a restrictive monetary policy entails raising interest rates to limit borrowing and boost savings. Moreover, a surge in money might cause the currency (or exchange rate) to depreciate. What are some examples of Accommodative Monetary Policy?Example 1 Throughout the late phases of the bear market that began in late 2000, the Federal Reserve adopted an easy monetary policy. When the economy started to improve, the Fed relaxed its accommodating measures, eventually transitioning to a restrictive monetary policy in 2003. In addition, to overcome the recession caused by the 2008 financial crisis, an accommodative monetary policy was again introduced, with interest rates reduced to 0.5%. The Fed can also acquire Treasuries on the open market to inject capital into a faltering economy and raise the amount of money in circulation. Example 2 In May 2022, China cut borrowing rates for five-year loans to 4.45%, a 15 basis point reduction. The People's Bank of China implemented this move to stimulate the housing market. It was an attempt to rein in the post-Covid economic downturn. However, some investors voiced concern that rate cuts alone would not be enough to restart the real estate market. Example 3 The Federal Reserve launched different emergency accommodative monetary measures in March 2020 to alleviate the Covid-19 economic collapse. The Fed cut interest rates by 1.5 percentage points, bringing them close to zero. It was an attempt to reduce the cost of borrowing for businesses and individuals. Furthermore, the Fed purchased various debt assets, including treasuries and mortgage-backed securities. Example 4 During the Great Recession, property values in the United States fell, and the economy slowed dramatically. The Federal Reserve reduced interest rates from 5.25% in June 2007 to 0% in 2008. However, the economy remained sluggish. In response, the Fed began acquiring government assets worth $3.7 trillion in January 2009. The Bottom LineThe Federal Reserve reduces Fed fund rates and short-term lending interest rates when the economy suffers a downturn. Furthermore, the Fed extends open market operations or buys government assets. Borrowings rise as a result of lending restrictions. Eventually, money circulation grows, and consumers have more discretionary income. Purchasing power determines product demand, which influences goods supply and production. To mitigate economic downturns, the central bank employs large accommodating measures. The central bank encourages greater currency circulation in the market to raise customers' purchasing power through different expansionary policies. The market responds by increasing product demand, which causes an increase in production. Ultimately, more jobs are created.

Next TopicAccount Analysis Definition

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share