ACH Transfers: What Are They and How Do They Work?A sort of electronic funds transfer (EFT) technology used to transmit money between bank accounts in the United States is called an ACH (Automated Clearing House) transfer. ACH transfers are frequently used for online bill payments, person-to-person transfers, business-to-business transactions, as well as direct deposit of paychecks, government benefits, and tax refunds.

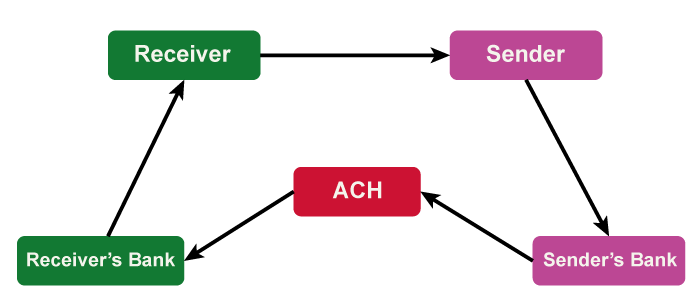

ACH transactions operate electronically by debiting money from one bank account and depositing it in another. The sender starts the procedure by giving the required details regarding the recipient's bank account, including the routing number and account number. The money transfer between the two accounts is subsequently made possible by the ACH network, usually requiring a few business days. How does ACH transfer work?The Automated Clearing House (ACH) network is used to electronically move money between bank accounts. Every day, millions of transactions are processed through the ACH network, which is a trustworthy and secure platform. The sender must supply the recipient's bank routing number and account number in order to start an ACH transfer. The account number identifies the specific account, but the routing number specifies the bank where the receiver's account is housed. The sender's bank creates an ACH transaction file after receiving the required information to start the transfer. This file includes details about the sender, the recipient, and the transfer amount. The ACH network transfers the target money to the recipient's bank if the transaction is accepted. The money is subsequently posted to the recipient's account by the recipient's bank. ACH transfers can include both credit and debit transfers. Credit transfers are commonly used for payroll direct deposit, tax refunds, and vendor payments. Debit transfers are commonly used for bill payments, charitable donations, and loan payments. ACH transfers are a low-cost alternative to other payment methods, such as wire transfers or paper cheques. The cost of processing an ACH transaction is typically much lower than the cost of processing a wire transfer, which can be several times more expensive.

Types of ACH TransferThere are two main types of ACH transfers: credit transfers and debit transfers. Credit TransfersWhen money is sent to a recipient's account, credit transfers are used. Credit transfer illustrations include the following:

Debit TransfersWhen money is transferred from a sender's account, debit transfers are used. Debit transfer instances include:

Both credit and debit transfers are carried out in batches, i.e., a single file of transactions is gathered and processed at predefined intervals throughout the day. The cost of processing transactions is decreased and efficiency is increased thanks to this batch processing. ACH transactions normally take one to two working days to process. However, depending on the institutions involved in the transfer, it may take up to three business days. Benefits of ACH TransferCost-effective and EfficientA more affordable option to conventional payment methods like cheques and wire transfers is ACH transfers. Businesses may drastically save the costs of printing, postage, and other labour-intensive paper-based procedures by using ACH. ACH transfers are an appealing option for both organisations and people since they often have cheaper transaction costs or even no fees at all when compared to wire transfers, which frequently have large fees. Enhanced SecurityConcern for security is of the utmost importance when doing financial transactions. A safe and dependable way to send money is through ACH transfers. Sensitive financial data is protected by the ACH network's stringent adherence to rules and regulations established by the National Automated Clearing House Association (NACHA). Streamlined Recurring PaymentsFor businesses that deal with recurring payments, such as subscription-based services or monthly billings, ACH transfers offer an efficient solution. With ACH, businesses can set up recurring payments, eliminating the need for manual intervention and reducing administrative overhead. The ability to automate recurring payments not only saves time but also minimizes the risk of errors associated with manual input. By ensuring that payments are made promptly and consistently, businesses can maintain positive relationships with their customers and streamline their revenue collection processes. Faster Settlement TimesTraditionally, businesses had to wait for several days for funds to clear through the banking system. ACH transfers have significantly improved settlement times, allowing businesses to access their funds more quickly. Although ACH transfers are not instantaneous like wire transfers, they typically settle within 1-2 business days, making them faster than traditional paper-based methods. Faster settlement times provide businesses with improved cash flow management and better liquidity. The ability to access funds promptly allows businesses to reinvest or allocate resources more efficiently, supporting their growth and operational needs. Improved Cash Flow ManagementCash flow is the lifeblood of any business, and efficient management of funds is crucial for success. ACH transfers enable businesses to have greater control over their cash flow by offering predictability and consistency in payment processing. With ACH transfers, businesses can schedule payments in advance, ensuring that funds are debited or credited on specific dates. This predictability helps businesses in planning their financial commitments, optimizing their cash flow, and avoiding late payment penalties or missed opportunities. ACH Transfer Challenges and Future DevelopmentsACH transfers play a crucial role in various financial transactions, such as direct deposit of salaries, bill payments, and business-to-business transactions. However, despite their widespread adoption, ACH transfers face certain challenges that hinder their full potential. This section explores the challenges associated with ACH transfers and highlights future developments that aim to address these issues, thus paving the way for a more streamlined and effective electronic payment system. I. ACH Transfer Challenges

II. Future Developments

Comparison between ACH Transfer and other Payment MethodsACH transfers and other payment methods each have their own advantages and considerations. Understanding the differences between these options is crucial for businesses and individuals looking to optimize their payment processes. In this section, we will compare ACH transfers with other popular payment methods, examining factors such as cost, security, accessibility, and transaction speed. ACH TransfersACH transfers, or Automated Clearing House transfers, are electronic funds transfers that enable the movement of funds between bank accounts. They are widely used for various types of payments, including direct deposits, bill payments, and person-to-person transactions. ACH transfers are processed in batches and typically take one to three business days for funds to be cleared and settled. They offer several benefits, such as cost-effectiveness, security, and convenience. Wire TransfersMoney can be moved directly and quickly between accounts with the help of wire transfers. Wire transfers allow real-time or nearly real-time transactions in contrast to ACH transfers, which are executed in batches. But with wire transfers, this ease and speed come at a high cost. Wire transfers are less cost-effective for frequent transactions because they frequently carry large fees. For urgent or high-value transfers, such as significant corporate transactions or overseas payments, wire transfers are frequently used. Credit Card PaymentsCredit cards are a widely accepted payment method, allowing individuals and businesses to make purchases and payments on credit. Credit card transactions are processed through card networks, such as Visa or Mastercard, and typically offer instant authorization. From the customer's perspective, credit cards provide ease of use, reward programs, and protection against fraudulent transactions. However, businesses accepting credit card payments must pay interchange fees and comply with card network regulations. Debit Card PaymentsDebit cards allow for quick and convenient payments, just like credit cards. However, debit card transactions withdraw money directly from the cardholder's bank account, giving him real-time information on the available balance. Debit card payments are more cost-effective for businesses since they are subject to lower fees than credit card transactions. Debit card holders' banks may set transaction limits, which could reduce the convenience of using a debit card. Mobile Payment AppsDue to their convenience and adaptability, mobile payment programmes like Apple Pay, Google Pay, and PayPal have grown in popularity. Users of these apps can use their mobile devices to conduct safe transactions by connecting their bank accounts, credit cards, or other payment methods. Peer-to-peer transfers and loyalty programmes are frequent extras in mobile payment apps. However, because not all businesses or people may support them, the availability and acceptance of mobile payment apps may vary from region to region. Things to Consider While Choosing Payment MethodsChoosing the right payment method is essential for efficient and cost-effective financial transactions. ACH transfers, wire transfers, credit card payments, debit card payments, and mobile payment apps each offer distinct advantages and considerations. However, when choosing a payment method, we must consider the following factors:

The Bottom LineThe effectiveness, security, and cost-effectiveness of payment mechanisms are vital for completing transactions successfully in today's fast-paced digital environment. ACH transfers have been a common solution for both enterprises and people due to their unique advantages and considerations. In this article, we discussed a lot about the advantages and disadvantages of ACH transfers and how they work and compete with other payment options, which usually help us make a wise decision in choosing the right payment method. |

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share