Economic Cycle: What It Means and 4 Phases of Business Cycles

The economic cycle refers to the overall condition of the economy as it travels through the four stages in a recurring pattern. The four stages that the economic cycle has been termed- are expansion, contraction, peak, and trough. Different factors affect the current stage of the economic cycle. These factors include GDP, interest rate, and so on. What Is an Economic Cycle?The term economic cycle refers to the instability of the economy between periods of growth (expansion) and recession (contraction). Different factors such as interest rate, GDP (gross domestic product), consumer spending, and total employment can help the people in the market determine the ongoing stage of the economic cycle. When the investors understand how the economic cycle works, it can help them and different businesses understand when it is the right time to make investments and when it is time to put their money out. The reason being it has a straight impact on everything, starting from stocks to bonds and much more, including profits as well as corporate earnings. Key points-

Working of the Economic CycleAn economic cycle, which is also popular by the term business cycle, is a periodic motion of the economy in a circular motion, moving in a certain manner which is, from expansion to contractions and back again. The characterization of the economy is mainly done based on the growth and downfall of the economy. The expansion of the economy means growth, whereas the time of contraction is the time when there is a significant decline in economic activity, which continues for at least a few months.

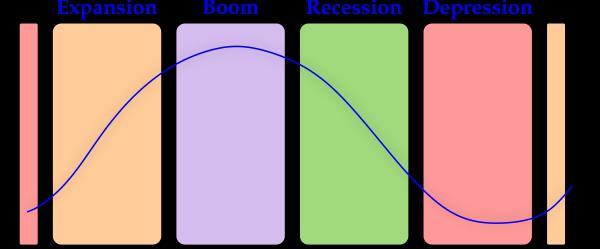

Four stages make up the economic cycle, often known as the business cycle. They are as follows:

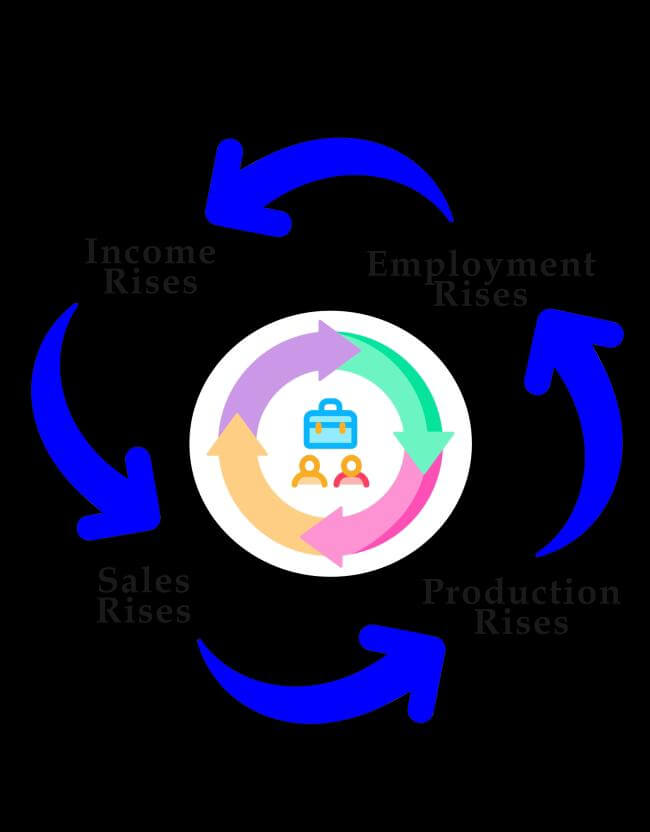

How the economy behaves is determined with the help of several key metrics, which help us to determine where the economy is and where it's headed. For instance, when unemployment begins to drop, and more people are fully employed, the economy is often in the expansion phase. Similarly, at times of contraction of the economy, people tend to resist their spending of money by ignoring some expenses because money and credit are harder to come by as lenders often tighten up their lending requirements. As mentioned earlier, corporations as well as investors need to be thorough with how these cycles work and the amount of risk that comes along with it, as they can have a huge impact on the performance of the investment made by a company or an individual. At times the investors may as well see the benefits in reducing their exposure to some specific sectors and vehicles when the economy is starting to contract and vice versa. Not just investors but business leaders can also benefit from these cycles and take cues from them while making big decisions such as when to invest and whether to expand their companies at a particular time. Impact of Economic PhasesThe economic phase has a huge and noticeable impact on the market. At the time when the economy is in expansion, businesses tend to gain profit which, in turn, leads to more employment opportunities for the people as the companies hire more people and there is more disposable income and spending. That leads to the rise in profits of businesses and helps in righteously continuing the cycle. When the economy comes into contraction, the businesses that were gaining profits during the expansion period tend to lose their profits, and that leads to the downsizing of the company and laying off of the employees. In the situation where people are losing their jobs, there is less consumer spending as well as less disposable income, which results in reduced business profits. This goes on in a vicious cycle. Ideally, an economy should maintain a continuous state of expansion. But, at the same time, contractions are necessary for an economy so that inflation is in control and the economy is not overheating. To the ones wondering what it means by an overheated economy, it refers to an economy that is undergoing a very long period of economic growth but, at the same time, is reaching a great level of inflation. When inflation is at its peak, it leads to inefficiency within an economy based on the market. Special ConsiderationFor setting the official dates for the economic cycles in the United States, the National Bureau of Economic Research (abbreviated as NBER) is the ultimate source. Economic cycles are determined by changes in the GDP (gross domestic product); the National Bureau of Economic Research is responsible for the release of the measurements of economic cycles from peak to peak or trough to trough.

Since the 1950s, the average length of an American economic cycle has been roughly five and a half years. The length of cycles is flexible and varies greatly, though, from barely 18 months at the time of the peak-to-peak cycle in 1981 to 1982 to the expansion that was initiated in 2009. The NBER reports that there were two peaks between 2019 and 2020. The first occurred during the fourth quarter of 2019 when quarterly economic activity peaked. The monthly peak occurred in a distinct quarter, which was identified as occurring in February 2020. Such great variation in the lengths of the cycles dismisses the myth that economic cycles can die out of old age or are a kind of activity that happens in regular periodic motion, like that of physical waves or swings of a pendulum. But there are many discussions band debates on the factors that take part in determining the length of an economic cycle and the reason behind their existence in the first place. Taking Care of Economic CyclesGovernments, financial institutions, and investors all control economic cycles in a variety of ways. Fiscal policy is frequently used by governments. The government may employ an expansionary fiscal policy, which includes in itself swift deficit spending, to end a recession. To prevent the economy from overheating during expansions, it can also undertake a contractionary fiscal policy, which involves taxing and running a budget surplus to limit aggregate expenditure. Monetary policy may be used by central banks. A central bank may decrease interest rates or adopt an expansionary monetary policy to encourage consumption and investment when the cycle enters a downturn. It can use contractionary monetary policy during an expansion by increasing interest rates and reducing the amount of credit flowing into the economy, which will lessen inflationary pressures and the need for a market correction. Investors frequently find opportunities in the technology, capital goods, and basic energy sectors during expansionary periods. Investors may buy utilities, financial, and healthcare companies that prosper in downturns when the economy is weak, as it promises profit. Businesses that can track the historical relationship between their performance and business cycles can proactively plan to safeguard against impending downturns and place themselves to benefit as much as possible from economic expansions. For instance, if your company follows the general economy, warning indicators of a coming recession can indicate that you shouldn't grow. It might be better for you to increase your financial reserves. Analyzing Economic CyclesVarious schools of thought break economic cycles in different ways and bring forth their definition of them. MonetarismMonetarism is a type of school that brings forth the idea that the government of any state can have stability in their economy if they collectively focus on their money supply's growth rate. It connects the economic cycle with the credit cycle. Any diversion in the interest rates can either lessen or increase activities in the economy by increasing or decreasing the cost of borrowing for individuals, corporations, and the government. To increase the complexity that arises while interpreting business cycles, a very famous economist and proto-monetarist, Irving Fisher, puts forth the argument that no such thing as an equilibrium exists in the economy. He further says that this kind of cycle exists only because there is a natural shift in the economy across various types of disequilibrium. The reason behind that is the continuously changing demands of the consumer, which leads to overproduction or underproduction and over-investment or investment by the producers in the economy. Keynesian EconomicsThe scholars that follow the Keynesian approach say that the cycles are produced by shifts in aggregate demand, which are sparked by the inherent volatility and unpredictability of investment demand. For whatever cause, a self-fulfilling cycle of economic doldrums can happen when a company's attitude turns pessimistic and investment slows. Because there is less demand due to lower expenditure, businesses are forced to reduce staff and make further cuts. According to Keynesians, there is no obvious remedy to the economy's decline caused by unemployed employees other than government action and economic stimulus. Austrian EconomistsThese researchers contend that the central bank's manipulation of credit and interest rates leads to irreversible distortions in the structure of inter-industry and inter-business linkages that are remedied during a recession. When a central bank cuts interest rates below what the market would otherwise decide, investment and business tend to favor the sectors and production methods that stand to gain the most from the rate reduction. However, at the same time, the artificially low rates discourage genuine saving that is required to fund these projects. In the end, the unsound investments fail in a wave of company failures and falling asset prices, which trigger an economic crisis. Commonly asked questions include-How Do You Define an Economic Cycle? There are four stages of an economic cycle-which is also known as a business cycle-expansion, peak, contraction, and trough. Dating back to the year 1950, the duration of an economic cycle in the United States has generally ranged between five and a half years. Some of the variables that are essential in determining the stages of the economic cycle are gross domestic product, interest rates, and consumer spending as well as interest rates. When someone is trying to determine the duration of a cycle, from peak to peak or trough to trough, the National Bureau of Economic Research is considered to be one of the most reliable sources for such work. What Are the Stages of an Economic Cycle?

There are four stages of an economic cycle, namely expansion, peak, contraction, and trough. When the economy is going through an expansionary phase, it grows for two or more consecutive quarters. Different events take place due to this. Unemployment rates increase, interest rates decline, and consumer confidence grows. The economy steps into the peak phase when the highest level of output is reached, which indicates the end of the growth. After this, a contractionary phase comes as employment rates start to level and housing starts to decline. A trough, which is the lowest point in the business cycle, brings with it more unemployment, less credit availability, and declining prices. What Causes an Economic Cycle? Numerous economic schools of thought have different opinions on the factors that trigger an economic cycle. For instance, monetarists connect the credit cycle to the economic cycle. In this case, interest rates, which directly impact the cost of debt, have an impact on consumer spending and overall economic activity. A Keynesian perspective, however, follows the belief that fluctuations in demand for investments or volatility are the reason for the economic cycle, which in turn impacts spending and employment. The ConclusionEconomic cycles are very helpful for investors and for the people who work in trading. The reason behind the formation, span, or even existence of these cycles is unknown, but if a person follows the cycle truly, then they can surely avoid losses to a certain extent. |

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share