Negotiable Instruments: Definition, Types, and ExamplesA negotiable instrument is a piece of paper that guarantees the payment of a certain sum of money, either immediately upon demand or at a predetermined period, and of which the payer is often identified. It is a document made of or envisaged by a contract which unconditionally guarantees money and can be redeemed as money now or later as specified. The phrase has several meanings or forms based on how it is employed, following various laws and depending on the nation and environment in which it is used.

A signed paper that promises to pay a certain amount to a specific person or the assignee is a negotiable instrument. To put it another way, it is a codified IOU (I owe you): a tradable signed document that guarantees the payment of a certain amount to the bearer at a particular time or upon demand. The instrument must contain a name or other indication of the payee, the individual receiving the money. Some negotiable instruments may exchange on a secondary market because they are tradable and assignable. Key Takeaways

Understanding Negotiable InstrumentsBecause they are transferrable, negotiating instruments provide the specific holder with the option of taking the money as cash, using it as they see fit for the deal, or in any way they like. The particular amount pledged and required to be paid entirely, either immediately or at a certain period, is noted as the fund amount indicated in the agreement. It is possible to transfer a negotiable instrument from one individual to another. After the transfer, the holder has complete legal title to this instrument. The entity providing the negotiable instrument makes no further promises in these papers. Furthermore, the bearer cannot be given additional instructions or requirements to obtain the money specified on the negotiable instrument. An Instrument must be marked or signed by the maker-the person providing the draft-for it to be deemed navigable. JurisdictionsNearly every country in the Commonwealth of Nations has codified the law governing the negotiable instruments in a Bills of Exchange Act, such as the UK's Bills of Exchange Act 1882, Canada's Bills of Exchange Act 1890, New Zealand's Bills of Exchange Act 1908, Australia's Bills of Exchange Act 1909, India's Negotiable Instruments Act, 1881, and Mauritius' Bills of Exchange Act 1914. Additionally, most Commonwealth jurisdictions have their own Cheques Acts that offer some additional safeguards for bankers accumulating unendorsed or abnormally endorsed cheques, stipulating that crossed cheques marked are "not negotiable" or similarly are not transferable and define that cheques may be presented electronically in interbank cheque clearing systems. History

An instrument known as adesha, equivalent to the modern meaning of a bill of exchange, was used in India during the Mauryan period in the third century BCE. It was an order to a banker directing him to pay the specified money on the note to a third party. In the first century BCE, the Romans are said to have utilized an early cheque called praescriptiones, as 2,000-year-old Roman promissory notes have been discovered. Typical bills of exchange and promissory notes have their roots in China. During the Tang Dynasty in the eighth century, a specialized instrument called the fey tsien was used to transmit money across large distances safely. In exchange for depositing valuable items at a local Templar preceptory in a European nation, the Knights Templar began issuing early versions of bank notes to departing pilgrims around 1150. The pilgrim could redeem the letters upon arrival in the Holy Land by showing the message to a Templar preceptory there. The "cha" or "chap", which was printed by the Ilkhanid emperors of Persia in the middle of the 13th century and very briefly utilized for dealings between the court and merchants for approximately three years before it fell into disuse, was a form of paper money. The court only accepted the "cha" at escalating discounts, which led to the collapse of this approach. Middle Eastern traders, who had utilized the first forms of bills of exchange ("suftadja" or "softa") from the eighth century until the present, later employed similar documents for money transfers. The 12th century saw the employment of its prototypes by Iberian and Italian traders. The essential characteristics of bills of exchange and promissory notes were developed in Italy in the 13th and 15th centuries. At the same time, later stages of their development were attributed to France (16th and 18th centuries, when the endorsement first appeared) and Germany (19th century, formalization of Exchange Law). The earliest mention of bills of exchange in English law goes back to Richard II's reign in 1381; the legislation required their usage in England and forbade the future export of gold and silver bullion, in any form, to settle international business transactions. Due to various legal systems, English exchange law differed from continental European law; the English approach was eventually adopted in the United States. Two of the primary factors for the rise in popularity of the usage of negotiable instruments in England were:

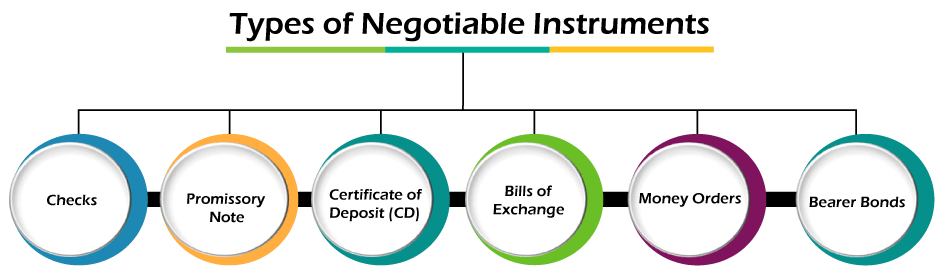

Lord Mansfield is also responsible for the emphasis on negotiability that exists today. Documents from the Germanic Lombards may also include some negotiable components. Distinguished from other Types of ContractsIn terms inherent in and emerging from the necessary offer, acceptance, and conveyance of consideration, a negotiable instrument can help to communicate value representing at least part of the performance of the contract, even if it may not be apparent at the time of the contract formation. The underlying agreement envisages the holder's right to retain the instrument and negotiate with the holder in due course that payment for the instrument is at least a part of the fulfilment of the agreement to which the linked negotiable instrument is subject. In the case of a "bearer instrument", when the document of ownership itself specifies and conveys the right to pay, the instrument memorizing the ability to demand payment and the right to pay may be transferred. There are exceptions, such as when the instrument is lost or stolen, in which case the person in possession of the note may be an owner but may not always be a holder in good faith. A legitimate authorization of the negotiable instrument is necessary for negotiation. No further consideration is necessary to establish an accompanying contract assignment since the value is given up to obtain a negotiable instrument (benefit). The weight afterwards lost (detriment) to the former holder is considered. The document is believed to memorialize the right to payment and the authority to demand compensation. The negotiable document may, in some cases, serve as the written record of a contract, fulfilling any relevant statute of fraud concerning that deal. Negotiation frequently allows the transferee to join the contract as a party through an assignment of the contract (whether expressly authorized or by operation of law) and to carry out the transferee-assigned party's rights under the agreement. However, the order instruments (endorsement and delivery) or delivery alone can affect negotiation (bearer instruments). Negotiable instruments can take many forms; however, the following are the authorized and accepted negotiable instrument forms:

Among these, promissory notes and bills of exchange are the two primary types of negotiable instruments: Promissory Note

A promissory note, though potentially non-negotiable, may be a commercial document if it is an unquestioning promise in written form made by one individual to another, approved by the maker, interacting to pay a specific amount of money, to order or to bearer, immediately upon demand to the payee or at an exact future time. Whether an instrument is negotiable or not depends on the legislation that applies to that particular piece of paper. When a bank issues a promissory note payable to the bearer immediately, it is known as a banknote. A Promissory Note is writing (not a bank note or currency note) that contains an unconditional undertaking signed by the maker to pay a specific amount of money only to or on the order of a particular person or the bearer of the instrument, as stated in Section 4 of India's Negotiable Instruments Act, 1881. Bill of ExchangeA bill of exchange, sometimes known as a "draft", is a written request for payment from the drawer to the drawee. The cheque (check in American English), for instance, is a bill of exchange. A typical sort of bill of sale is drawn on a banker and payable on demand. Bills of exchange are written instructions from one individual to his bank to pay the bearer a certain amount on a specific date. They are most commonly employed in international commerce. Bills of trade were a typical exchange form before printed money was invented. Today, they are not as often utilized. An order for money to be paid to a third party is essentially a bill of exchange. In this negotiable instrument, three persons must create account change: the drawer, the endorsee, and the payee. The drawer is the one who draws the money. He directs the third party to make a payment. The drawee is the party against whom the bill is drawn. The statement is addressed to him, and he is the one who must pay it. When he expresses a desire to pay the invoice, he becomes an acceptor. The payee is the individual or a party for whom the check is drawn or due. The parties can be all different people. A payee may endorse a bill of exchange on behalf of a third-party provider, who may then endorse it to a fourth party, and so on forever. Regardless of any counterclaims that could have prevented the previous payee or guarantor from doing so, the "holder in due process" may assert the whole amount of the bill against the drawee and any prior endorsers. There may be instances when the account bill said to be negotiable may occasionally be marked as "non-negotiable", e.g., the crossing of checks. In such situations, it may still be transferred to a different party, but the recipient may not be granted special rights. Modern RelevanceAlthough negotiability is frequently seen as fundamental in commercial law, its current applicability has been questioned. Negotiation became common when money and liquidity were relatively rare in the 1700s and with Lord Mansfield. Several pieces of legislation have restricted the owner in due course rule. Additionally, it has been questioned whether the holder in due course provision effectively balances the motivations of mortgage originators and assignees. Examples of Negotiable InstrumentsThe personal check is one of the more often used forms of negotiable currency these days. It functions like a draught (draft), payable in the precise amount stated upon receipt by the payer's banking institution. Similarly, a cashier's check serves the same purpose but calls for the money to be allocated or put aside in the respective account by the payer for the payee before it is written. Similar to checks, the payer's banking institution can grant money orders. The payer must frequently provide or submit cash before the money order may be issued. The money order may be converted into cash once the payee has received it by the regulations of the issuing company. Traveller's checks operate differently since a transaction needs to be signed by two people. The payer must sign the document at the time of issuance to offer a sample signature. A countersignature is required as a precondition of payment after the payer decides who will receive the money. Traveller's checks are typically used when the payer is going abroad and wants to employ a payment method that offers an extra layer of protection against fraud or theft while travelling. Bills of exchange, promissory notes, draughts, and certificates of deposit (CDs) are distinct categories of negotiable documents. |

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share