Financial Statements: List of Types and How to Read ThemIntroduction to Financial StatementsFinancial accounts or statements refer to the written documents that describe the operations and financial success of any company. Governmental organizations, accounting companies, etc., frequently review these financial records to ensure the correctness of data and for tax, financing, or investing purposes. The balance sheet, revenue statement, statement of cash flow, and statement of changes in equity are the four main financial statements accounts used most by for-profit businesses. In contrast, a comparable but distinct collection of financial records is used by non-profit organizations.

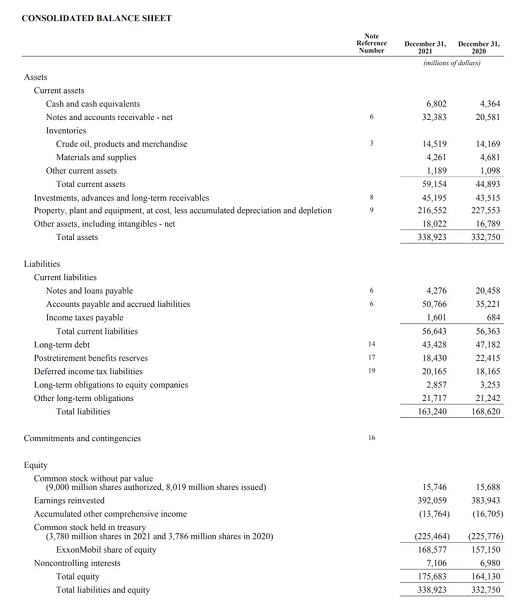

To assess a company's success and forecast future stock price movements, investors and financial experts often use financial statistics. The company's yearly report, which includes its financial records, is one of the most crucial sources of trustworthy and confirmed financial information. The financial records of a business are used to evaluate its financial situation and future chances for profit by creditors, market analysts, and investors. The three primary reports of a financial statement are the balance sheet, the income statement, and the cash-flow statements. Balance SheetThe balance statement is a snapshot of a company's assets, liabilities, and equity held by shareholders. The date, which is usually the end of the reporting period, can be found at the top of the balance sheet to determine when the report was documented. Below is a summary of the elements that make up a balance statement: Assets

Liabilities

Investors' Equity

An Illustration of a Balance SheetAn excerpt from the balance statement for ExxonMobil Corporation (XOM) as of December 31, 2021, is shown below.

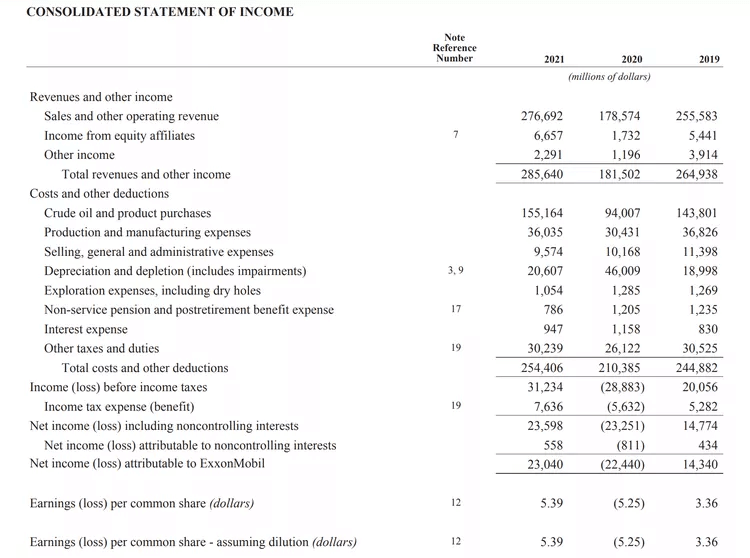

Income StatementUnlike the balance sheet, the income statement is a time-based document that usually covers a year for annual financial statements and a quarter for quarterly financial statements. The financial statement typically provides a summary of revenue, expenses, total income, and earnings per share (EPS). RevenueSelling goods or services generates operating income or revenue for any business. The manufacturing and selling of automobiles would generate operating income for a car manufacturer. Operating income is produced by a company's main lines of business. The income derived from non-core company operations is known as non-operating revenue. These earnings are unrelated to the company's main purpose. Examples of non-operating income include:

Revenue derived from unrelated sources is known as other money. Gains from the selling of long-term assets like property, vehicles, or a subsidiary may also count as other revenue. ExpensesWhen a company engages in its main activity, it incurs major expenses in order to generate revenue from that activity. Cost of goods sold (COGS), marketing, selling, general and administrative expenses (SG&A), depreciation or amortization, and research and development (R&D) are examples of expenditures. Employee salaries, sales fees, utilities like energy, and travel costs are all examples of typical costs/ expenses. Interest paid on debts or loans is a cost associated with secondary pursuits. Expenses are also noted for losses on asset sales. The income statement's primary function is to communicate information about profitability and the financial outcomes of company operations, but it can also be a very useful tool for demonstrating whether sales or revenue are rising when contrasted across multiple time periods. In order to assess whether a company's attempts to lower its cost of sales will ultimately increase profits, investors can also look at how well a company's management is controlling expenditures. Example of an Income StatementAn excerpt from ExxonMobil Corporation's income summary for the fiscal year 2021, as of December 31, is provided below:

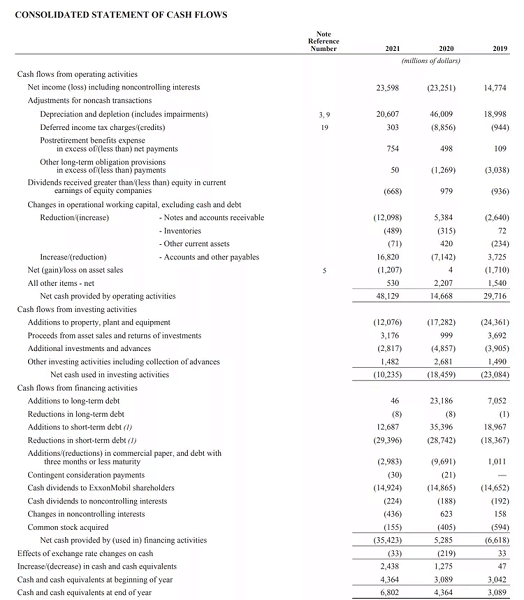

Cash Flow StatementThe cash flow statement (CFS) gauges how effectively a business produces cash to cover debt payments, running costs, and investments. The cash flow statement is like a supplement to the balance sheet and income statement. The CFS provides information to investors about a company's operations, sources of financing, and financial practices. The financial strength of the company is also measured by CFS. A financial cash flow statement cannot be calculated using any specific method or mathematical formula. Instead, it has three parts that detail cash flow information for the various purposes for which a business uses its funds. The following is the explanation of those three CFS components: Operating ActivitiesAny sources and expenditures of money resulting from managing the company and making sales of its goods or services are considered working operations activities of the CFS. Cash from operations includes any adjustments of accounts payable, depreciation, inventory, and financial accounts owing. This collection of interactions also includes wages, tax on income, interest, rent, and cash proceeds from the sale of products or services. Investing ActivitiesAny sources and uses of money from a business's investments, in the long run, are considered investing activities. This group includes any payments connected to a merger or acquisition as well as the purchasing or selling of an asset, loans given to or received from suppliers, and client debts. Additionally, this part includes acquisitions of fixed assets like property, plant, and equipment (PPE). In other words, adjustments to investments, equipment, or assets are related to income from investments. Financing ActivitiesIn addition to the uses of cash given to shareholders, cash from financing activities also includes cash obtained from banks or investors. One can finance a business by issuing debt, issuing shares, buying back stock, taking out loans, paying profits, and repaying debt. These are three main company operations, and with that, the cash flow statement reconciles the income statement with the balance sheet. Example of a Cash Flow StatementThe cash flow summary for ExxonMobil Corporation's fiscal year 2021, as of December 31, is shown in part below:

The three components of the cash flow summary are visible, as are their outcomes.

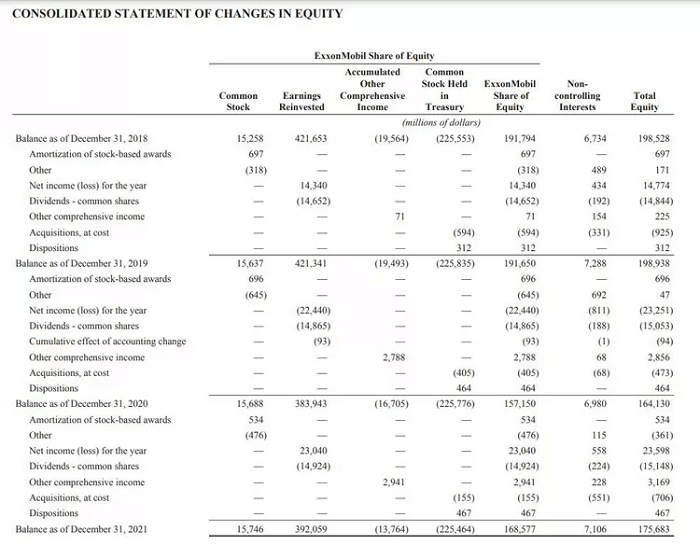

Statement of Changes in Shareholder EquityThe summary of variations in equity depicts the evolution of total equity. The ending balance on the change in equity statement is identical to the total equity stated on the balance sheet, which shows how this information relates to a balance sheet for the same time period. The method for stockholder equity ownership adjustments will differ from one business to another, but generally speaking, there are the following components involved:

ExxonMobil also includes actions for purchases, sales, amortization of stock-based rewards, and other financial activity in its summary of changes in equity. This data can be used to evaluate how much money is being kept by the business for expansion rather than distributed to third parties. Look at the following consolidated statement of changes in equity of ExxonMobil, produced in 2021:

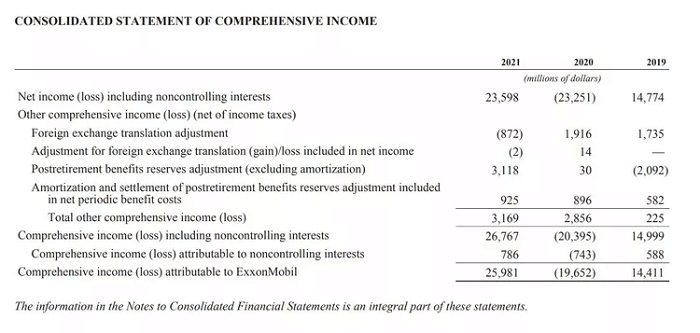

Statement of Comprehensive IncomeA statement of comprehensive income, a frequently underutilized financial statement, outlines standard net income while also taking changes in other comprehensive income (OCI) into account. All unrealized profits and losses that are not shown on the income summary are included in other comprehensive income. This financial summary includes profits and losses that have not yet been documented in line with bookkeeping regulations. It also displays a company's total change revenue. The following are some instances of transactions that may appear on the statement of comprehensive income:

ExxonMobil has a total unrecognized income of more than $2 billion in the case below:

When comprehensive income is taken into account, ExxonMobil reports nearly $26 billion in total income as opposed to just $23.5 billion in net income. Non-profit Financial StatementsFinancial activities are recorded in a comparable collection of financial statements by non-profit groups. The financial accounts used vary depending on whether the organization is for-profit or solely charitable due to certain variations. The typical collection of financial documents used by a non-profit organization consists of the following:

Limitations of Financial StatementsDespite the fact that financial records offer a wealth of data about a business, they do have some restrictions. Investors frequently come to very different inferences about a company's financial success as a result of the statements' interpretive openness. For instance, some investors might favor equity repurchases, whereas others might desire to see that money put toward long-term investments. One investor may find a company's debt level to be acceptable, while another may find the amount of debt for the business to be concerning. The outcomes of the business should be compared to those of its competitors in the same sector when analyzing financial statements to look for patterns. Multiple periods should also be compared. Last but not least, the accuracy of financial records depends on the data used to generate them. It has been recorded too many times that erroneous financial activity or poor control monitoring results in financial statements that are meant to deceive users. There is a degree of confidence that users must put in the veracity of the report and the numbers being shown, even when examining certified financial records. What types of financial statements are most popular?The three main types of financial accounts are the balance sheet, income statement, and cash flow statement. Together, these three financial statements show the assets, liabilities, income, outgoings, and cash flows of a business. Cash flow often comes from operations, investments, and financial events. What are the important items appearing in the financial statements?Depending on the company, individual items will vary in the annual financial statements. However, the most common items are revenue, cost of goods sold, taxes, cash, securities, inventory, current liabilities, long-term liabilities, accounts receivable, accounts payable, and cash flows from investing, operating, and financing activities. What are the benefits available from financial statements?A company's activities are shown in financial papers. It provides details about a company's assets, liabilities, running costs, cash flow management efficacy, and the volume and mode of a company's revenue generation. The financial records of an organization fully disclose the management approach employed. This overall helps measure the company's overall strength and stability. Financial Statements: How do you read them?A variety of techniques are used to analyze financial records. In order to better comprehend changes over time, financial records can first be compared to earlier times. Comparative revenue statements, for instance, detail a company's money from the previous and current years. Users of financial statements are informed of a company's well-being by noting the difference from year to year. Financial accounts are also analyzed by contrasting the outcomes with those of rivals or other market players. Analysts can gain a better understanding of which businesses are performing best and which are trailing the rest of the industry by comparing financial statements to those of other similar firms. GAAP: What is it?The collection of guidelines known as Generally Accepted Accounting Principles (GAAP) dictates how American businesses must prepare their financial records. The rules specify how transactions are to be recorded, when revenue must be acknowledged, and when expenditures must be recognized. International Financial Reporting Standards (IFRS) is a comparable but distinct collection of guidelines that foreign businesses may employ. The Bottom LineThe key to an outside assessment of a company's financial success is its financial statements or records. While the revenue statement provides information on a company's profitability, the balance sheet provides information on the liquidity and viability of the business. By keeping account of the origins and uses of money, a statement of cash flow links these two together. Various financial records, taken or measured in aggregate, show how a business is performing over time and in comparison to its competitors. |

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share