How Are Accumulated Depreciation and Depreciation Expense Related?OverviewDepreciation is the process of spreading out an asset's cost over the period of its useful life. Assets must be allocated since they depreciate over time because of deterioration or obsolescence. Accumulated depreciation and depreciation expenditure are two essential depreciation concepts. We will examine the relationship between these two ideas in order to understand the concepts and utility of both in finance. Accumulated depreciation refers to all of a company's depreciated assets amounts, while Depreciation Expense refers to the amount that has been depreciated for a single period. A sort of accounting item known as depreciation illustrates how much investment costs have decreased throughout its useful life. Depreciation, in other words, spreads out the cost of an asset over time while allocating how much of an investment has been used up in a year till the item is outdated or no longer in use. Without depreciation, a company would be forced to pay an asset's full cost in the year it was purchased, which could hurt profitability. Simply put, accumulated depreciation is the entire asset cost that has been recorded as a depreciation expense ever since the item was first put to use. Understanding Accumulated DepreciationA fundamental idea in accounting and finance is accumulated depreciation. It represents the entire depreciation expense recorded for an asset since its purchase. Depreciation is a technique for spreading an asset's cost throughout its useful life. It is essential because assets depreciate over time due to damage or obsolescence.

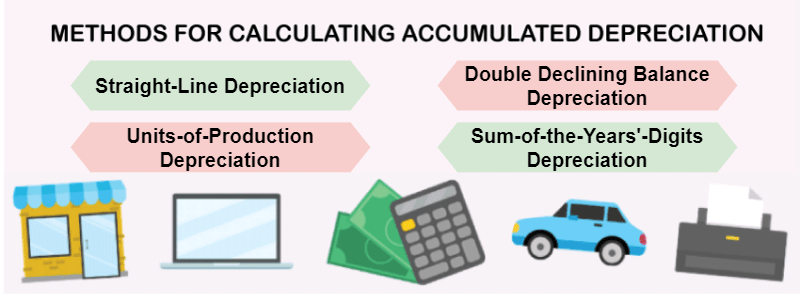

It is simple to calculate accumulated depreciation. It simply refers to the total depreciation expense recorded during the asset's lifetime. Several approaches, such as straight-line, double-declining balance, and units-of-production, are used to compute depreciation expense. The asset's useful life and salvage value are used to determine how much depreciation should be charged.

An asset's book value is the original cost less the total amount of depreciation. As a result, the asset's book value declines as accumulated depreciation rises. As a result, an asset's book value decreases over time as it ages, representing the value loss brought on by usage, damage from use, and obsolescence.

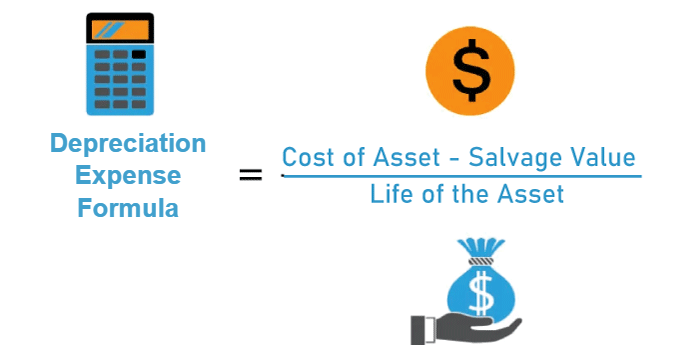

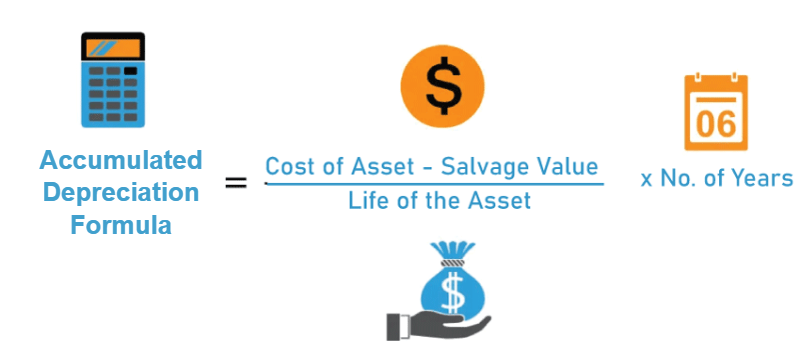

On the balance sheet, accumulated depreciation is shown as a negative asset. To get the asset's net book value, it is deducted from the asset's cost. Although the accumulated depreciation account is not shown on the income statement, it does have an impact on how net income is determined. This is so that net income may be calculated by deducting depreciation expense from revenue on the income statement. As a result, the net income decreases as accumulated depreciation increases, reflecting that the asset loses value over time. Depreciation ExpenseThe loss in value of a fixed asset over the course of its useful life is referred to as depreciation expense. To support long-term revenue generation, businesses invest in fixed assets, like machinery, structures, and equipment. Unfortunately, these assets don't last indefinitely due to deterioration, obsolescence, and other causes and typically lose value over time. Because it enables businesses to appropriately record the depreciating worth of their assets over time on their financial statements, depreciation expense is a crucial accounting term. This charge is recorded on the income statement and lowers the firm's net income, which has an impact on the profitability and tax liabilities of the organization. Depreciation expense is calculated using a variety of techniques, such as straight-line, accelerated, and units of production depreciation. The simplest technique of depreciation includes dividing the asset's cost evenly across its useful life. This is known as straight-line depreciation. The units of production depreciation consider the quantity of use of the asset in relation to its useful life, while accelerated depreciation methods, such as double-declining balance, allow for bigger deductions in the early years of the asset's life. An asset's useful life is a projection of how long it will be in use before being replaced or retired. To ensure that the depreciation expense is properly recorded, businesses must accurately estimate the useful life of an item. Underestimating an asset's usable life can lead to increased depreciation costs later in its lifespan, while overestimating it can lead to an overestimation of the asset's worth. Examples of Depreciation Expense and Accumulated DepreciationKeeping track of depreciation costs is essential for reporting since depreciation spreads an asset's cost across its lifetime. The simplest way to calculate this expense is using a straight-line approach. One can simply compute the depreciation expense after dividing the "asset's cost minus its salvage value" by the asset's useful life. Let's say a company spent $50,000 on some long-lasting equipment for its operations. The item will have a salvage value of $2,000 and a functional life of 15 years. Thus, according to the projection, the depreciation would cost $3,200 each year. ($50,000 - $2,000)/15 = $3,200

Now, we calculate the accumulated depreciation, which is equal to the total depreciation expense that has accrued since the asset has been in use. Therefore, a total of $16,000 in accumulated depreciation would accrue after five years. $3,200 x 5 = $16,000

Accumulated Depreciation and Book ValueTwo key accounting concepts associated with the depreciation of fixed assets are accumulated depreciation and book value. The total amount of depreciation expense that has been recorded on a fixed asset over the course of its useful life is known as accumulated depreciation. Depreciation expense is recorded annually on the income statement and is accumulated in a separate item on the balance sheet called accumulated depreciation. As a contra-asset account, accumulated depreciation is deducted from the asset's cost on the balance sheet to determine the asset's book value. The worth of an asset as it appears on a company's balance sheet is referred to as book value, also known as carrying value or net book value. An asset's book value is determined by deducting its cost from its total depreciation. The asset's book value reflects how much value the asset still carries on the company's balance sheet after depreciation has been applied. Using the straight-line depreciation technique, a corporation would, for instance, record an annual depreciation charge of $10,000 for a piece of equipment that costs $100,000 and has an estimated useful life of 10 years. After five years, the equipment's accumulated depreciation would be $50,000 ($10,000 annually multiplied by five years), and its book value would be $50,000 ($100,000 cost less $50,000 accumulated depreciation). For a variety of reasons, accumulated depreciation and book value are significant. First and foremost, they make it possible to accurately document the decline in fixed asset value over time, which is crucial for a company's financial reporting. Second, they give information on a company's asset worth, which is vital for creditors, investors, and other stakeholders concerned with its financial situation. Third, they are crucial for tax purposes since a company's tax burden can be decreased by deducting depreciation expense from taxable revenue. Also, we might state that book value and accumulated depreciation are significant accounting ideas connected to the depreciation of fixed assets. While book value refers to the asset's reported value on a company's balance sheet, accumulated depreciation indicates the total amount of depreciation expense recorded on an asset during its useful life. For proper financial reporting, determining a company's financial status, and for tax purposes, it's crucial to comprehend these ideas. Different Depreciation Methods with ExamplesDepreciation is an accounting term that describes dividing a fixed asset's cost throughout its useful life. The amount of depreciation expense to be recognized annually can be determined using a variety of depreciation methodologies. The kind of asset, how long it will last, and the organization's accounting principles will all influence the chosen method. These are a few typical depreciation techniques and some instances of their application:

What is the fundamental calculation method for Accumulated Depreciation?Accumulated depreciation refers to the cumulative amount of depreciation expense shown for an asset on a company's balance sheet. It is figured by summing the sums of the annual depreciation costs for a given period. Is accumulated depreciation a liability or an asset?Accumulated depreciation is documented in a counter-asset account, which has a credit balance and reduces the fixed asset's gross value. As a result, neither an asset nor a liability is recorded for it. Is depreciation expense a liability or an asset?The income statement lists depreciation expenditure as an expense to reflect how much of an asset's worth has been depleted for the year. As a result, it is neither an asset nor a liability. The Bottom LineDepreciation expense and accumulated depreciation are two concepts that are crucial to accounting and finance. These two ideas are connected by the fact that the updated cumulative depreciation balance is calculated by adding the depreciation expense recognized in each period to the previous accumulated depreciation balance. The relationship between these two ideas is crucial for correctly reporting an asset's value on the balance sheet and calculating a company's net income and worth. Any accountant, financial analyst, or business owner who wants to make wise financial decisions must understand the relationship between accumulated depreciation and depreciation expense. |

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share