AED (United Arab Emirates Dirham)The United Arab Emirates Dirham (AED), also called Emirati Dirham, is the official currency of the United Arab Emirates (UAE). It is divided into 100 fils and is denoted by the symbol "AED" or "DH". The Central Bank of UAE is the authority that controls and issues the currency.

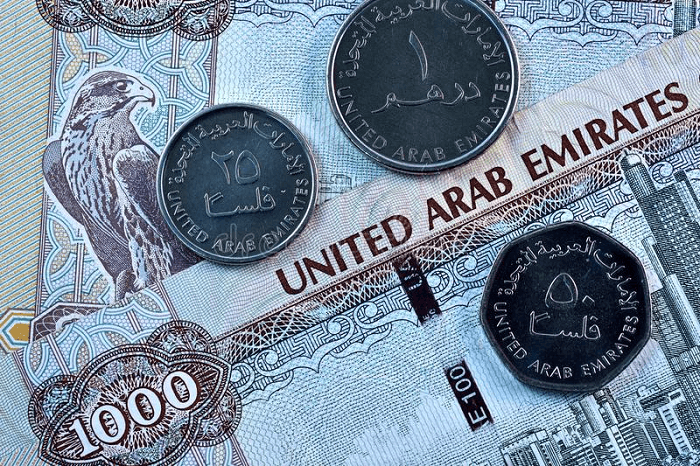

The AED is pegged to the US dollar at a fixed exchange rate of 1 US dollar = 3.6725 AED. This currency is used in the UAE and other countries in the Gulf Cooperation Council (GCC). The banknotes are available in 5, 10, 20, 50, 100, 200, 500, and 1000 AED denominations. In addition, coins are available in the denomination of 1, 5, 10, 25, and 50 fils and 1 dirham. Importance of AED for Individuals and Businesses operating in the UAEBusinesses and individuals operating in UAE must understand what AED is and how it should be used. Firstly, businesses operating in UAE must know the exchange rate of AED and its relation to other currencies because understanding these things helps businesses manage the currency risk effectively and make informed decisions. Secondly, individuals and businesses must also know the monetary policies that the Central Bank of the UAE makes. They should also have an idea about how these policies may affect the economy of the UAE. This knowledge is helpful when the business or an individual needs to make decisions about investment or financial planning. Thirdly, individuals and businesses operating in UAE must also know the local laws and the laws relating to finances. Understanding the local market is also important for them, along with understanding how to use AED in transactions and investments. If there is any regulation or law relating to the use of AED, then it becomes important to comply with those regulations while doing any transactions in AED. Lastly, individuals living in UAE must understand AED properly as it can be used while making their personal budgets or managing personal finances. It is important for making informed decisions about investments and savings too. History of the AEDThe United Arab Emirates Dirham (AED) was first introduced in 1973 and replaced the Qatar and Dubai Riyal as the official currency of the UAE. At the time of its introduction, the AED was pegged to the British Pound Sterling (also called GBP or Great Britain Pound) at a fixed exchange rate of 1 AED = 0.1 GBP. In 1978, the peg to the British Pound was abandoned, and the AED was re-pegged to the US dollar at a fixed exchange rate of 1 US dollar = 3.6725 AED. This exchange rate has remained unchanged to this day. Throughout history, the AED has undergone several changes in banknotes and coin denominations. In earlier times, the banknotes for UAE used to be printed by the British American Bank Note Company, and the coins were used to be minted by Royal Mint in the United Kingdom. Later, the production of banknotes and coinage was taken over by the Central Bank of the UAE in 1980. In the 2000s, the Central Bank of the UAE introduced a new series of banknotes. These new notes were enhanced with security features and design to increase the durability of the notes as well as to reduce the chances of counterfeiting. The banknotes of AED 5, 10, 20, 50, 100, 200, 500, and 1000 were introduced and are currently in circulation. Explanation of the AED's Exchange Rate and its Relationship to Other CurrenciesThe value at which one currency is exchanged for another is known as the exchange rate of a currency. In the case of AED, the value at which AED is exchanged with other currencies like the US Dollar, British Pound, or Euro is the exchange rate of the AED. The AED is pegged to the US dollar at a fixed exchange rate of 1 US dollar = 3.6725 AED. This means that the value of the AED is directly tied to the value of the US dollar. In simple terms, it means that if the value of the US Dollar is increased, then the value of the AED will also increase, and if the value of the US Dollar is decreased, then the value of the AED will also decrease. The fixed exchange rate of AED to the US dollar is maintained by the Central Bank of the UAE using a process which is known as currency intervention. To keep the exchange rate at the desired level, the Central Bank of UAE buys or sells AED in foreign exchange. The AED's fixed exchange rate to the US dollar has both advantages and disadvantages. The main advantage is that it provides stability and predictability for businesses and individuals operating in the UAE, as they can plan and budget based on a fixed exchange rate. The main disadvantage of the AED's fixed exchange rate to the US dollar is that the AED cannot fluctuate in response to changes in the global economy, which can make the UAE economy more vulnerable to external shocks. Factors that Influence the AED's Exchange RateThe factors that can influence the exchange rate of the United Arab Emirates Dirham (AED) are given below:

Historical Trend of Inflation in the UAE and its Impact on the AEDThe historical trend of inflation in the UAE has been relatively stable over the years. According to data from the Central Bank of the UAE, the average inflation rate in the country between 1990 and 2020 was around 2.5%. However, there have been some periods where inflation has increased above this average. For example, during the global financial crisis of 2008-2009, the inflation rate in the UAE increased to around 6%. This was due to the rising food and fuel prices and also caused by the depreciation of the AED against the US dollar. In recent years, the inflation rate in the UAE has been relatively low. According to data from the Central Bank of the UAE, the average inflation rate between 2015 and 2020 was around 1.5%. This is due to the relatively low oil prices, which have kept the cost of living in the UAE low. The Central Bank of the UAE has mostly maintained low inflation rates by using various monetary policy tools, such as adjusting interest rates and controlling the money supply. The impact of inflation on the AED exchange rate is generally minimal, as the currency is pegged to the US dollar at a fixed exchange rate. The Central Bank of the UAE can use its foreign exchange reserves to stabilize the exchange rate if necessary. However, if inflation becomes too high, it can erode the purchasing power of the AED and can make imports more expensive, leading to increased costs for businesses and individuals operating in the UAE. Monetary Policy and Central Bank of the UAEThe Central Bank of the United Arab Emirates (UAE) plays a crucial role in managing the AED, the UAE's official currency. The Central Bank is responsible for issuing and controlling the currency, maintaining its value and stability, and overseeing the country's monetary policy.

One of the main responsibilities of the Central Bank is to maintain the fixed exchange rate of the AED to the US dollar. The Central Bank uses currency intervention to buy or sell AED in the foreign exchange market to keep the exchange rate at the desired level. The Central Bank also sets monetary policy to control inflation and stabilize the economy. This primarily includes setting interest rates and regulating the money supply. The Central Bank can raise interest rates to curb inflation and reduce the money supply or lower interest rates to stimulate economic growth and increase the money supply. The Central Bank also plays a role in supervising and regulating the country's financial institutions, including banks and other financial intermediaries. This helps to ensure the stability and integrity of the financial system. In addition, the Central Bank also acts as the government's financial agent, issuing government bonds and managing the government's foreign exchange reserves. Tools and Policies Used to Control Inflation and Stabilize the AEDThe Central Bank of the United Arab Emirates (UAE) uses several tools and policies to control inflation and stabilize the AED: Interest Rates: The Central Bank sets interest rates, the rate at which banks borrow money from the Central Bank. Increasing interest rates makes borrowing more expensive, which can help to curb inflation by reducing the money supply. Lowering interest rates can stimulate economic growth by increasing the money supply. Open Market Operations: The Central Bank can buy or sell government bonds in the open market. When the Central Bank buys bonds, it injects money into the economy, which can lower interest rates and increase the money supply, stimulating the economy and reducing unemployment. When the Central Bank sells bonds, it withdraws money from the economy, which can increase interest rates and decrease the money supply, therefore curbing inflation. Currency Intervention: The Central Bank can buy or sell the AED in the foreign exchange market to maintain its fixed exchange rate to the US dollar. When the Central Bank buys AED, it increases the demand for the currency, which can appreciate the AED and decrease inflation. When the Central Bank sells AED, it decreases the demand for the currency, which can depreciate the AED and increase inflation. Reserve Requirements: The Central Bank can set reserve requirements for commercial banks, which are the percentage of deposits that banks must hold in reserve. Increasing reserve requirements withdraw money from the economy and can curb inflation. Lower reserve requirements can stimulate economic growth and inject money into the economy. Credit Control Policies: The Central Bank can also implement credit control policies, such as setting limits on the amount of credit banks can extend or provide to borrowers to control the money supply and curb inflation. Impact of the Central Bank's Actions on the Economy and the AEDIn addition to having a significant impact on the economy, the Central Bank's actions also affect the value of the AED. The Central Bank controls borrowing, investment, and spending costs through monetary policies such as interest rates and money supply. These changes affect AED's exchange rate when demand increases or decreases for AED. Additionally, the Central Bank can use its foreign reserves to purchase AED to increase its value and intervene in the currency market to reduce volatility. AED's value is ultimately affected by the central bank's actions. How to manage the currency risk when dealing with the AED?Managing currency risk when dealing with the AED (UAE Dirham) involves assessing the risk factors of currency, for example, political stability, inflation, and economic performance. Diversifying your investments and using hedging strategies to protect against potential losses due to currency fluctuations is also important. You can also use financial instruments such as forward contracts, currency swaps, and options to reduce risk exposure. Forward contracts allow you to lock in an exchange rate for a certain period. At the same time, currency options allow you to purchase or sell a currency at a predetermined exchange rate. Additionally, it is important to monitor the exchange rate and consider any macroeconomic factors that could impact the currency's value. Furthermore, it is wise to monitor currency markets and news to stay informed of changes in the AED's value. Recommendations for Individuals and Businesses operating in the UAE on Managing the AEDFor businesses and individuals operating in the UAE, it is important to consider the following strategies for managing the AED:

By following these strategies, individuals and businesses operating in the UAE can effectively manage the AED and protect their financial future. The Future Outlook for the AED and its Role in the UAE EconomyThe future outlook for the United Arab Emirates Dirham (AED) is strong and will remain an important part of the UAE economy. The AED is pegged to the US Dollar, and the currency has remained relatively stable since its introduction in 1973. This is due to the government's strong commitment to maintaining a competitive exchange rate. The UAE is a major trading partner with many countries, and its economy is highly diversified. This includes oil exports, real estate, construction, banking, and tourism. The UAE economy is expected to grow over the upcoming years, and the AED will remain an important part of this. The government has recently implemented several measures to strengthen the AED, such as introducing new regulations to increase the transparency of the currency market. Additionally, the government is actively promoting the use of the AED as a global currency, which will increase its usage and help to further strengthen its position in the international markets. Best Practices for Conducting Transactions in the AEDWhile doing transactions in the United Arab Emirates Dirham (AED), it is important to familiarize yourself with the exchange rates of the currency ahead of time. Also, one must be aware of the transaction limit the Central Bank of the UAE sets. It is also suggested to use a certified financial institution to exchange foreign currency into AED and to make all payments in AED. To avoid unforeseen fees, paying with local currency rather than a credit or debit card whenever possible is often advised. Finally, while traveling or shopping in the UAE, it is recommended to be aware of the customs regulations to ensure that all transactions are done per local laws. |

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share