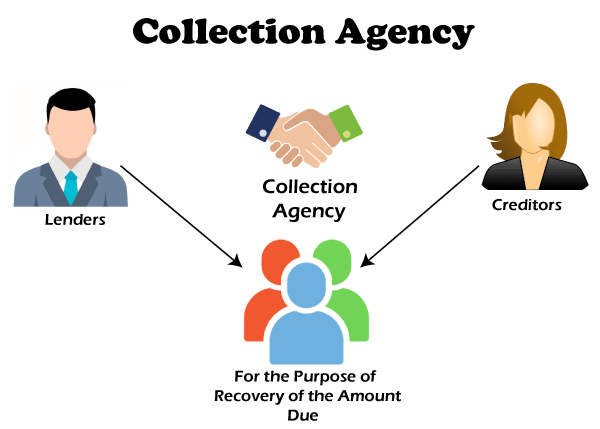

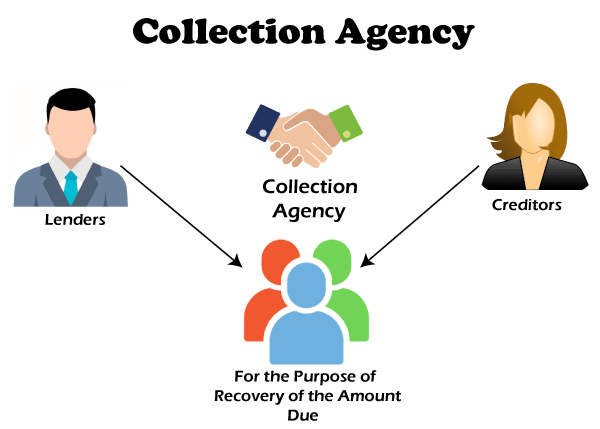

Debt Collection AgencyDebt collection agencies (or debt collectors) frequently work for debt-collection firms; however, others are self-employed. Some also practise law. These companies occasionally serve as intermediaries, collecting past-due bills from clients within 60 days (can be less or more, depending on the proposal) and sending them back to the original lender.

How do debt collection agencies work?The categories of debt that collection agencies often collect are their areas of expertise. For instance, a company could only recover past-due bills under two years old and at least $200 in size. Additionally, a respectable company will restrict its activities to debt recovery within each state's unique statute of limitations. The loan that isn't too old can still be lawfully pursued if it is within the specified period. A portion of the money collected, usually between 25% and 50%, is paid to the collector by the creditor. Credit cards, medical bills, vehicle loans, personal loans, business loans, school loans, and even overdue utility and cell phone bills are among the delinquent obligations that debt collection companies may collect on behalf of the lender. Some collection companies also work out settlement agreements with customers for less than the amount due for hard-to-collect debts. Debt collectors can also suggest cases to attorneys who sue clients who are unable to pay the collection firm. What do debt collectors do?

Delinquent debtors are contacted by debt collectors via phone calls and letters in an effort to persuade them to make settlements on their debt. Debt collectors use software applications and private investigators to conduct additional research when they cannot contact the debtor using the information supplied by the initial creditor. In order to assess a debtor's capacity to pay back, they can also conduct searches for their assets, including bank and brokerage accounts. Collectors may notify credit bureaus about unpaid debts to persuade customers to make payments, as outstanding debts can significantly lower a customer's credit score. Even though the routing and accounts information are known, a debt collector must rely on the borrower to pay their obligation and cannot access a bank account or a pay cheque without first obtaining a judgement. In other words, the court directs the debtor to pay a certain creditor a set sum of money. To do this, a debt collector must file a lawsuit against the debtor before the limitation period expires and obtain a ruling against them. This ruling permits a debtor's bank and employer to withhold money from the debtor's bank accounts and pay cheques, but the debtor must still be notified. Debt collectors also get in touch with defaulting borrowers who are already the subject of judgements. Even after receiving a review, getting the money back may not be easy. Debt collectors may also attempt to place property liens on real estate or compel the sale of an item in addition to imposing custom duties on bank account holders or automobiles. Agencies that buy DebtThe original creditor will reduce its losses by trading the debt to a debt buyer when it decides that it is not likely to be able to collect. Creditors bundle many accounts with comparable attributes and offer them as a single unit. Debt purchasers have a variety of recovery options, including:

Debt buyers frequently bid on the acquisition of these bundles, paying an average of $4 for every $1 of loan face value. In other words, a debt buyer may spend $40 to purchase an overdue account with a $1,000 total owing. The cost of debt decreases with age because it is less likely to be recovered. The type of debt also impacts the price. For instance, housing debt has a higher value, whereas utility debt has a much lower value. Debt purchasers keep all of the money they have amassed. They assume the risk of buying the loan from the original lender (and make the upfront payment to the credit company); therefore, any sums recovered are theirs entirely. When they retrieve past-due debt, debt collectors are also sometimes compensated. They make more money the more they recover. Old debt that has passed its limitation period or is otherwise considered uncollectable is purchased for fractions of the dollar, giving collectors the opportunity to make significant profits. How do reputable collectors work?Consumer harassment is a negative reputation held by debt collectors. More complaints regarding debt collectors and purchasers are submitted to the Federal Trade Commission (FTC) than any other industry.

Some debt collectors take care not to transgress consumer protection rules, and the Fair Debt Collection Procedures Act restricts how debt collectors can collect a debt to prevent them from being aggressive, unfair, and dishonest. An ethical collector will always act by the law and be fair, courteous, and honest. The debt collector shall cease all collection efforts and provide a formal notification stating the amount due, the business you owe the debt to, and instructions for payment when you exercise your legal right to obtain written confirmation of the loan you've been approached about. The corporation will stop attempting to collect the debt from you if the debt collector cannot verify it. Additionally, it will alert the credit reporting agencies to the dispute or ask that the item be taken off your credit report. It will inform the creditor that it ceased collection efforts since it couldn't verify the debt if the collector serves as a broker for a lender and doesn't own your debt. Additionally, there are deadlines that collectors must adhere to, such as not reporting debts older than seven years old and delivering a debt collection letter no later than five days after making contact with the debtor. To avoid pursuing those who don't owe money, respectable debt collectors will work to get accurate and complete data. If you inform them that identity theft is to blame for the debt, they will make a reasonable attempt to confirm your assertion. Additionally, they won't attempt to file a lawsuit against you for debts that have passed the deadline. They won't mistreat you based on your ethnicity, sex, age, and other qualities by harassing you, threatening you, or otherwise. They won't be known any other debt you owe, try to trick you into paying it back, pose as police enforcement, or threaten to have you arrested. Additionally, they won't call you without your consent earlier than 8:00 a.m. or after 9:00 p.m. Special ConsiderationsIn response to the COVID-19 epidemic, federal, state, and municipal regulations were implemented to safeguard customers with financial issues. For those with federally backed mortgages, section 4022 of the CARES Act initially offered foreclosure protection up until May 17, 2020. These homeowners were permitted to ask for a 180-day forbearance with an additional 180-day extension. Since forbearance is a type of loss mitigation that avoids foreclosure as long as you abide by the agreement, this essentially halts the foreclosure process. Initially, the CARES Act also provided renters with eviction protection and forbearance protection for owners of government-backed residential buildings. Until July 25, 2020, everyone residing in federally supported housing had further eviction protection. President Joe Biden first extended those clauses when he issued an executive order on his first day in office. The Biden administration extended the foreclosure and eviction moratorium until March 31, 2021. President Joe Biden prolonged this restriction until June 30, 2021, and for another month until July 31, 2021, to continue assisting homeowners during the epidemic. Anyone having a mortgage secured by a government agency, such as the Federal Housing Authority (FHA) or the U.S. Ministry of Agriculture (USDA), was considered under this category. The countrywide eviction moratorium was extended for a strictly limited period of 60 days on August 3, 2021, under an order from the Centers for Disease Control and Prevention (CDC). However, the Supreme Court overturned the CDC ruling on August 26, 2021, removing the eviction moratorium. Administrative deferral for federal education loan borrowers, protection for beneficiaries of stimulus payments, Chapter 13 bankruptcy processes, credit reporting constraints, and improved unemployment insurance benefits were among other debt relief measures. Other ProgramsConsumers could also locate initiatives that provide coronavirus debt protection, notably at the state and city levels. One example is the letter from New York City requesting that debt collection communications cease. Finding these programmes and the valuable information they provide is not always straightforward. Luckily, the National Consumer Protection law Center provides a paper describing COVID-19 safeguards in many areas at the federal and state levels, including:

Collection of debts is a respectable industry. When a debt collector gets in touch with you, it may not signify the start of an unhealthy relationship. Many debt collectors are sincere people who only attempt to do their jobs. They will engage with you to develop solutions to support you pay your loan, whether that involves a single large payment, several smaller ones spaced out over time, or even smaller settlement alternatives.

Next TopicLevel 2

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share