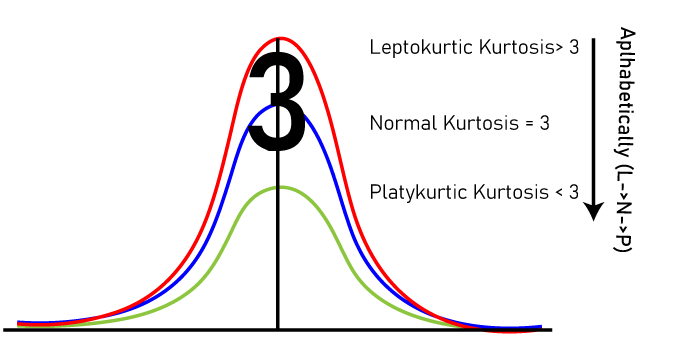

PlatykurticWhat Does Kurtosis Tell Us?Kurtosis is a fraction of whether the information is heavily followed or lightly followed compared to a usual dispersion. That is, informational indices with a high kurtosis will frequently have large tails or exceptions. Informational indices with low Kurtosis will often have light tails or no outliers. What is a Good Kurtosis Value?A typical dispersion with a kurtosis of 3 is seen as mesokurtic. A high kurtosis (>3) is represented by a little "chime" with a high pinnacle, whereas a low kurtosis is represented by a widening of the pinnacle and a "thickening" of the tails. Kurtosis greater than 3 is considered leptokurtic. Types of KurtosesA large amount of data can reveal three types of kurtoses: Mesokurtic, Leptokurtic, and Platykurtic. All kurtosis proportions are compared to a standard conveyance bend. 1. Mesokurtic Kurtosis is classified as having mesokurtic dispersion. This dispersion has a kurtosis similar to that of a typical circulation, implying that the extraordinary value quality of the conveyance is similar to that of a typical dispersion. As a result, a stock with a mesokurtic dispersion often depicts a modest degree of chance. 2. Leptokurtic Leptokurtic circulation is the next classification. Any leptokurtic circulation has more Kurtosis than mesokurtic circulation. This dispersion appears as a curved one with lengthy tails (exceptions.) The "thinness" of a leptokurtic spread is caused by anomalies that extend the even core of the histogram chart, causing the majority of the information to appear in a confined ("thin") vertical reach. Example-A company with a leptokurtic distribution generally represents a higher level of risk, but there is a potential for higher yields because the stock has consistently demonstrated large cost developments. 3. Platykurtic Platykurtic conveyance is the last classification. These circulations have short tails (fewer outliers.). Platykurtic conveyances have demonstrated greater soundness than other bends since exorbitant cost developments were uncommon previously. This translates to a not-so-moderate level of risk.

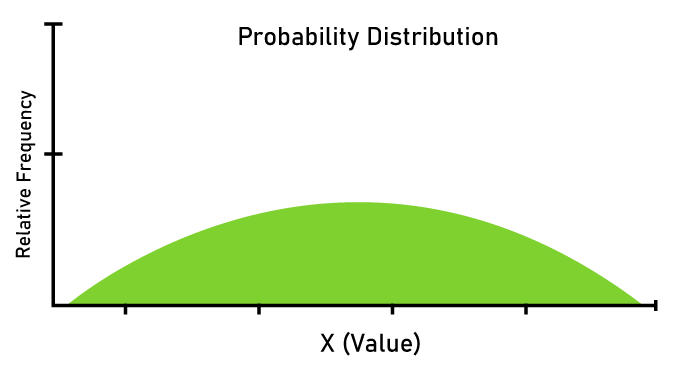

Use of KurtosisKurtosis is used in financial analysis to assess a venture's risk of cost unpredictability. Kurtosis risk differs from other often used estimations, for example, alpha, beta, r-squared, or the Sharpe ratio. Alpha measures excess return compared to a benchmark list, whereas beta measures the volatility of a stock in comparison to the larger market. R-squared quantifies the percentage of development in a portfolio or asset that can be explained by a benchmark, whereas the Sharpe proportion examines return on risk. Kurtosis calculates how much volatility a venture's cost has seen regularly. Consider a stock with a usual price of $25.85 per share. If the stock's price fluctuated widely and frequently enough, the ringer bend would have heavy tails (high Kurtosis). This means there is a lot of variation in the stock price; a financial supporter should anticipate significant price fluctuations regularly. Financial backers may predict that the stock price would fluctuate widely but only seldom if the stock had light tails (low Kurtosis). Why Kurtosis is Important?Kurtosis explains why perceptions in some informational indices typically occur at the tails instead of the focal point of a probability dispersion. Overabundance kurtosis is interpreted in money and financial planning as a type of risk known as "tail risk," or the possibility of a risk occurring due to an exceptional event, as expected by a probability distribution. The tails are designed to be "fat" if such occurrences occur more often than a dispersion would predict. PlatykurticThe term "platykurtic" refers to a measurable distribution in which the excess kurtosis esteem is negative. As a result, a platykurtic conveyance will have more thin tails than a conventional dispersion, resulting in fewer outlandish positive or negative events. In contrast to a platykurtic dispersion, a leptokurtic circulation has positive excess Kurtosis. When deciding where to assist, financial supporters will analyze whether quantifiable distributions are associated with particular types of assumption. More risk-averse investors may choose resources and markets with platykurtic distributions since they are less likely to produce unexpected results.

Key Features

Understanding PlatykurticFactual transmissions can be divided into leptokurtic, mesokurtic, and platykurtic. These distributions differ based on the amount of excess Kurtosis, which correlates with the frequency of ludicrously favorable or unfavorable events. A mesokurtic circulation, the usual dispersion has a kurtosis of three. As a result, dispersion kurtosis of more than three is referred to as "abundant positive kurtosis," while Kurtosis below three is referred to as "negative excess kurtosis." Leptokurtic and platykurtic disseminations have positive and negative excess Kurtosis, respectively, whereas mesokurtic dispersions have three kurtoses. This way, leptokurtic dispersions have a somewhat high possibility of outliers, whereas platykurtic disseminations have the opposite tendency. Special ConsiderationMost financial backers agree that value market returns resemble a leptokurtic conveyance rather than a platykurtic one. That is, while most returns will likely be similar to the market's average return, returns will occasionally deviate significantly from the mean. These emotional and erratic events, sometimes called "black swans," are less likely to occur in platykurtic business sectors. As a result, more cautious financial supporters may avoid investing in leptokurtic markets and instead focus on speculations with platykurtic profits. However, some financial supporters actively seek initiatives with leptokurtic returns, believing that their super-certain returns would more than compensate for their highly unpleasant returns. Real-World Example of PlatykurticMorningstar released an assessment document that featured data on the excessive kurtosis levels of numerous types of resources from February 1994 to June 2011. The rundown included various undertakings, from U.S. and global values to land, items, money, and securities. The abundance of kurtosis degrees was also altered. Money and worldwide securities were at the bottom of the spectrum, with abundant Kurtosis of - 1.43 and 0.58, respectively. On the other end of the spectrum, U.S. high-return securities and speculative stock investments exchange techniques provided abundant Kurtosis of 9.33 and 22.59, respectively. Global land, values from globally emerging economies, and goods were among the resource classes with moderate degrees of abundant Kurtosis. Given their ability to bear possible black swan events, a financial backer looking at this data might quickly determine what kind of resources they want to put into. Risk-averse investors who want to reduce the possibility of extraordinary events should focus on low-kurtosis speculations, while investors who are more comfortable with extraordinary events should focus on high-kurtosis ones. How to say if Data is Leptokurtic or Platykurtic?Examining Kurtosis is one way to determine if your data is leptokurtic or platykurtic. A circulation's Kurtosis is a measure of how peaked it is. A platykurtic conveyance is less crested than an ordinary circulation, while a leptokurtic dispersal is more crested. Kurtosis may be determined using the following recipe: Kurtosis is defined as (n(n+1))/(n-1) (n-2) (n-3)). * ∑ ((x I - μ) ^4)/σ^4 Where the number of pertinent pieces of information is given as n, the mean is, and the standard deviation is. If Kurtosis is more than 3, the conveyance is leptokurtic. If Kurtosis is less than 3, the delivery is termed platykurtic. When Kurtosis equals 3, the dispersion is considered usual. The Benefits of Using Platykurtic Data in your Advertising EffortsInformation from platykurtic sources may be highly beneficial for marketing. Importantly, platykurtic information is less likely than other types of information to be altered by exceptions. This suggests that platykurtic information can help create a more accurate picture of your target market. Additionally, platykurtic information is easier to break down and understand since it is more balanced than other types of information. Finally, platykurtic information is less susceptible to changes in the mean or standard deviation, which means that your marketing efforts will become more dependable with time. The many benefits of Platykurtic data make it perfect for marketing initiatives.

Guidelines to Make Sure Your Data is Authentic PlatykurticYou must initially look for exceptions to ensure that your data is platykurtic. Any information might skew the results focuses that are fundamentally different from the other information focuses. Once all anomalies have been removed, you must calculate the mean and standard deviation. If the data is platykurtic, the mean and standard deviation will be lower than the middle value. Finally, a quantifiable test can confirm the information's platykurtic nature. The Kolmogorov-Smirnov test, which examines the dispersion of an informational collection to a fictitious dissemination, is the most well-known test. If the information is platykurtic, its K.S. measurement will be lower than if it were regularly disseminated. Website SEO and Platykurtic Information: The Perfect CombinationSEO experts highly value platykurtic information since it provides a clear and concise picture of a site's presentation. This data may be used to look into problems, identify fantastic development opportunities, and monitor long-term success. Platykurtic data is often the preferred choice for doing a search engine optimization review since it is so easy to understand. The health of a site's connection profile may also be evaluated using this information. SEOs can identify instances of connection spam by carefully examining platykurtic data and taking necessary steps to clean up the connection profile. Therefore, platykurtic data is a crucial tool for any Website optimization expert.

The Future of PlatykurticThere has recently been a growth in demand for platykurtic data. This phrase refers to data that is extremely dispersed and has little skewness. Platykurtic information is frequently found in online client-created material and virtual entertainment, providing a rich source of information for businesses and associations. However, platykurtic information might be challenging to analyze due to its complex structure. Organizations are increasingly using huge information analysis to pass this criterion. Organizations today can glean insights from vast and intricate informational resources. Nevertheless, massive information analysis is merely one tool that may be used to dissect platykurtic data. In the future, businesses may also use artificial intelligence (A.I.) or artificial awareness to extract insights from this data. Organizations should modify their methods for analyzing platykurtic information as it becomes more prevalent. ConclusionPlatykurtic informational indexes are more useful than leptokurtic informational collections since they don't have tails. Additionally, platykurtic information is more exact since it is less likely to be altered by exceptions. As a result, factual showing and information examination frequently use platykurtic information. Although it is typically not feasible to obtain platykurtic knowledge, it is frequently worthwhile because the benefits might be enormous. Therefore, if you're looking for a more effective and precise way to manage your information, think about using platykurtic informative collections. The distinction it can create is astounding. |

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share