Zero Coupon BondBonds with coupon rates do not cover the interest throughout the time period of their lifetime. Rather, buyers purchase zero-coupon bonds at a discounted price to full price, which represents the sum the buyer will get when the asset "reaches maturity" or becomes due. Zero coupon bonds typically have long maturity periods; most are mature by 10, fifteen, or even more. A trader can prepare for a long-term objective, like financing a child's college education, using this long-term maturity period. An investor can use the big discount to spend a little sum of money that will increase over many years.

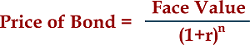

In the private markets, investors can buy several types of zero-coupon bonds that are offered from a range of the cost of a child's higher education. A trader can use a discounted rate to spend a little number of funds that will rise over several years. A number of zero fixed rates, such as those issued by the U.S. Treasury, companies, local governments, and state governments, are available to be bought by traders in the private markets. Bonds with zero coupons don't accrue income till they mature, hence their subsequent market rates are more volatile compared to other bond kinds. Owners can also be responsible for paying federal, regional, and local income taxes on the estimated or "phantom" income that accumulates each year even if zero coupon bonds do not make a payment till the maturity time period. What Is A Bond With No Coupon?An accruing bond usually referred to as a zero-coupon bond, is a financial instrument that doesn't make interest payments but can be sold at a discounted price, and when it matures its face value amount is paid to the buyer. Certain bonds are sold as zero-coupon bonds right away, while others become zero-coupon bonds after being decoupled from their coupons and repackaged as zero-coupon securities by a commercial bank. Zero-coupon bonds are more responsive to market fluctuations than fixed rates since they deliver the entire amount at maturity. A business or public entity can raise capital by issuing bonds. Investors who bought securities when they are created, thus operate as creditors. By acquiring local zero-coupon securities (if customers reside in the area in which the paper was created) or one of the rare corporation zero-coupon debt securities with tax-exempt classification, some buyers can avoid paying taxes on the computed return. The creditor receives payment according to the bond's full price when the terms are met. A business bond's par price, also known as face value, is normally specified as $1,000. Business debt can be purchased for less than its full price if it is offered at a discount. For instance, a trader will get $1,000 if they purchase bonds at a reduction of $920. The lender's profits or gain for owning the asset is the $80 return + coupon installments. Not all securities, however, get dividend payments. Bonds with a zero coupon are the ones that do not. These bonds have been issued at a discounted price and, when they mature, pay back the principal amount. The investment's profit is determined by the distinction between both the sales price and common shares. The investor will be paid the amount of their initial investment interest payments that have been accrued at a specified yield and increased semi-annually. A zero-coupon price's income is imputation interest, which means it is an assumed rate of interest for the asset rather than a fixed rate of interest. For instance, one may pay about $6,855 for a debt having a face value of $20,000, a 20-year maturity, and a 5.5% return. Based on the Internal Revenue, the cash's estimated interest is taxable. Consequently, even though zero-coupon bonds have no cash flows until retirement, investors might still be required to pay national and local taxable income on the annual accrued imputed income. You can prevent owing taxes on these assets by buying zero-coupon bond funds, zero-coupon bond funds with tax-exempt status, or zero-coupon bonds in income accounts. Bonds with no coupon are priced where:

List price, r, and n are the bond's required return rate or income and the bond's potential value (terminal price), respectively. Striped bandsZero coupon bonds are affected by changes in interest costs since their lifespan is equivalent to the period until maturity. Bonds with coupons may have their discounts separated from the reserve, or principal so that various buyers might obtain both the owner along with each of the annual installments. As a result, there are more zero-coupon bonds available. Investors can purchase the residual and discounts individually. Then, every client generates a single one-time payment. Stripping is the process used to create securities with no interest, and the resulting agreements are referred to as strip bonds. Simultaneous Trading of Registration Interests and Primary Securities is referred to as "STRIPS." Typically, dealers buy a block of non-callable, rising securities, Bond longevity, which measures the effect of changes in interest rates is longer for strip securities than it is for debt securities. A rated bond is always of shorter length than a zero debt security, which always comes with a term equivalent to its maturation. Stock dealers typically offer strip bonds with maturities of up to thirty years. Certain Canadian securities may have maturities of more than 90 years. Investors can buy bundles of strip bonds in Canada to ensure that the earnings are customized to their requirements in a specific product. These packages could include a variety of things Public securities are frequently used to make strip bonds. A stripped coupon seems to have no threat of renewal since the owner only receives money at maturity initial slices and/or income (coupon). Securities are initially split into their principal and payments. The vouchers can be exchanged individually or as a whole, depending on the account receivables. In the majority of nations, a reserve bank or national securities repository is largely responsible for managing strip bonds. Utilizing a custodial bank or trust business to store the underlying assets and a transaction advisor to manage the scheme and track possession of the strip bonds is a solution. The creation of physically manufactured strip bonds, in which the payments are manually clipped and afterward exchanged individually, however, because of the tremendous risks and expenses involved, they have all but vanished. UseDue to their extended tenure, zero-coupon bonds are popular among retirement funds and insurance providers. As a result, the rate risk associated with the company's long-term commitments is mitigated or immunized by the securities' pricing, which is especially sensitive to interest rate changes rates. TaxesA zero-coupon debt does have an original issue discount (OID) regarding tax reasons in the United States. Despite the fact that bonds don't pay monthly income, they appeared in a variety with OID typically assuming the payment of interest, also known as illusory income. In order to prevent paying taxes now on potential earnings, zero coupon bonds that are susceptible to US tax should typically be kept in income retirement funds. Conversely, the assumed income is free of U.S. federal income taxes and, in most situations, state and local taxation whenever a zero coupon bond produced by a US state or county organization is acquired. Coupon-rate bonds were first offered in the 1960s, but it wasn't until the 1980s that they took off. A flaw in the US tax code that permitted the deductions of the markdown on securities compared to their principal amount encouraged the adoption of such securities. When the income is considerable or the asset has a lengthy maturity, the rule, which disregards interest accumulating, results in sizable tax savings. The tax avoidance schemes were quickly rectified, but the securities themselves have held their appeal due to their ease of use. Big discount bond income is deductible in India either as income or as investment income. According to CBDT Circular No. 2 of 2002, issued 15 February 2002, it is additionally required by law that income be disclosed on an income statement for heavy discount debt securities from February 2002. What Distinguishes a Bond with a Zero Coupon From a Normal Bond?The main distinction between a zero-coupon and normal debt is the rate of interest or discounts, that must be paid. Monthly bonds, also known as debt securities, charge interest throughout the bond's life and then return the capital at maturity. A zero-coupon bond does not make interest payments; rather, it is sold at a significant discount, which results in a gain for the owner when the bond is redeemed for its face-covering price at maturity. How Does a Shareholder Value a Bond with No Coupon?The estimated interest rate that a shareholder might anticipate earning at maturity is one of the numerous factors that they consider when deciding which zero-coupon debt to buy. The following formula can be used to determine the cost of a zero-coupon bond: The price of a zero-coupon bond = Maturity value ÷ (1 + required interest rate)^ number of years to maturity How Are Zero-Coupon Bonds Taxed by the IRS?Assumed interest is an anticipated interest rate, also known as "phantom interest." The tax rate is owed on the bond's estimated interest. The IRS calculates the assumed interest on Treasury securities using an investable approach, and some federal requirements levels establish a minimum rate of return in regard to respect to its original purchase discounting rules and generated interest of these bonds. |

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share