Rule of 72(t): Definition, Calculation, and ExampleA financial concept known as the Rule of 72(t) offers a straightforward formula for figuring out how much money an individual can remove or use each year from their retirement accounts without paying early withdrawal penalties. It is a helpful tool for people who want to retire early or use their retirement funds before turning 591/2 years.

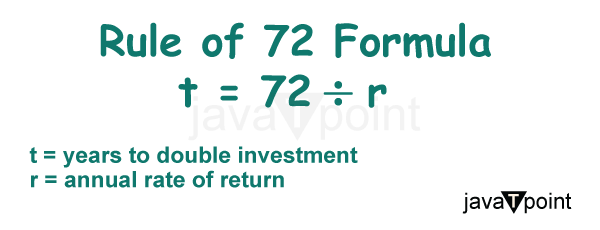

Effective retirement planning requires a thorough understanding of the Rule of 72(t) since it enables people to make wise financial and retirement-related decisions. By understanding how to apply this method, people can estimate their annual withdrawal amounts and ensure a reliable income stream during their retirement years. This article will examine the definition, computation, and practical use of the Rule of 72(t). In this article, we'll go over how to make calculations utilizing Rule 72(t) step-by-step, give a specific example scenario, talk about key aspects to think about, and outline several different strategies. With this guide, Rule 72(t) will be fully understood by the readers, who will be able to better manage retirement planning and make wise financial decisions. Definition and Explanation of the Rule of 72(t)The annual withdrawal limit from retirement accounts like 401(k) and 403(b) that a person can make without paying early withdrawal penalties is determined by the Rule of 72(t), a simplified financial concept. It offers a simple method for calculating a systematic withdrawal strategy for individuals who want to retire early or use their retirement funds before turning 59 and 1/2. The compounding interest theory serves as the foundation for the Rule of 72(t). It is predicated on the idea that investment would increase over time at a fixed rate of return. Using this formula (or Rule), people can calculate the maximum annual withdrawal from their retirement accounts while taking the length of the withdrawal period into account. The formula is based on the number 72, corresponding to the time required for an investment to double in value at a particular interest rate. To determine the approximate years for the investment to be doubled (or dropped by 50%), use the following simple formula: divide the number 72 by the anticipated interest rate. Individuals divide the account balance by the outcome of the Rule of 72 calculation to determine the annual withdrawal amount using the Rule of 72(t). This gives an approximate figure for the amount of annual income that can be withheld without being penalized. Additionally, this Rule is only applicable to investments that typically earn compound interest, not simple interest. It's important to remember that the Rule of 72(t) is only an approximate estimate and not a precise calculation. The precise amount that can be withheld may change based on the rules of the retirement plan, any applicable taxes, and other elements. It is advised to seek professional financial counsel to guarantee correct estimates and sensible planning. Individuals can estimate their annual withdrawal amounts using the Rule of 72(t), giving them a starting point for developing a sustainable retirement income strategy. Although this Rule should only be used as one tool among many retirement planning techniques, it is important to be aware of its restrictions and potential risks. Calculation of the 72(t) RuleCalculating the interest rate and applying the Rule of 72(t) formula are the two crucial steps in computing the Rule of 72(t). Following these procedures, individuals can estimate the annual withdrawal amount from their retirement savings: Step 1: Calculating the Interest RateThe interest rate to be incorporated into the calculation must first be well-known. The interest rate often represents the predicted annual return on the retirement account. This rate may change depending on the investor's investing strategy, level of risk tolerance, and market conditions. It's crucial to remember that the interest rate chosen should be a reasonable estimate based on previous experience and predictions for the future. Step 2: Using the 72(t) Rule FormulaThe Rule of 72(t) formula is used after establishing the interest rate. The equation is as follows: Withdrawal Period = 72 / Interest Rate

The withdrawal time is the number of years during which annual withdrawals from a retirement account are anticipated to decrease its balance. The formula gives a rough estimate of the years it would take for the account balance to be depleted by dividing 72 by the interest rate. Calculation for PaymentThe sums that an account holder receives as part of the periodic payments permitted by rule 72(t) are based on life expectancy, which can be determined using one of three IRS-approved techniques:

It's crucial to remember that these IRS-approved techniques have particular guidelines and specifications. It is recommended to seek advice from a skilled tax expert or financial counsellor to fully grasp the complexities of each strategy and choose the one that best fits each person's unique needs and circumstances. ExampleConsider a 53-year-old lady with a $250,000 IRA yielding 1.5% yearly who wants to withdraw early as per rule 72(t). The woman would get about $10,042 a year in payments using the amortization approach. She would get about $7,962 annually for five years, according to the minimal distribution approach. Her annual payout would be around $9,976 if she chose the annuitization approach. Alternatives to the Rule of 72(t)Several mathematical formulas can be applied as alternatives to the Rule of 72(t) for calculating early retirement withdrawals. The Rules of 69, 70, and 68 are a few examples. They can also provide some insights into retirement planning despite being less well-known. According to the Rule of 69, an investment that grows at a fixed rate will double in value every 69 divided by the interest rate. This Rule offers a rapid calculation of the period it will take for an investment to double, much like the Rule of 72. Another approximation used to determine when an investment would double in value is the Rule of 70. According to this, an investment will double in value roughly every time the number is divided by the variable's growth rate. It makes the same constant rate of return assumption as the Rule of 72. In addition to the investment, the Rule of 70 is also used in predicting population or GDP (Gross Domestic Product) growth. The statistical idea of standard deviation is connected to the Rule of 68. It claims that roughly 68% of the data falls within one standard deviation of the mean under a normal distribution. Although not directly related to retirement withdrawals, knowing this Rule can help you manage risk and estimate the range of possible investment outcomes. These rules can offer rough estimates, but they should only be used thriftily and not replace careful retirement planning. To create a more precise retirement strategy, factors like taxes, inflation, and market circumstances should all be considered in addition to these guidelines of different rules. Speaking with a financial counsellor to receive individualized advice based on unique circumstances and objectives is advised. Benefits of the Rule of 72(t)

Limitations of the 72(t) Rule

The Bottom LineThe Rule of 72(t) is helpful for people who want to retire early or use their retirement funds before turning 59 and 1/2. Calculating the annual withdrawal amounts from retirement accounts offers a streamlined way. Although the Rule of 72(t) provides advantages like penalty-free early withdrawals and flexibility in retirement planning, it also includes drawbacks, including strict withdrawal schedules and significant tax repercussions. Aside from that, the three IRA techniques (RMD, Fixed Amortization, and Fixed Annuitization) provide additional ways to calculate annual withdrawal amounts. Individuals should carefully analyze their financial situations, seek advice from financial experts, and weigh other retirement withdrawal options to build a thorough and sustainable retirement plan.

Next Topic#

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share