Stock Market prediction using Machine LearningThe term stock exchange suggests to a few trades where in portions of openly held organizations are traded. Such money related exercises are directed through conventional trades and by means of over-the-counter (OTC) commercial centres that work under a characterized set of guidelines. Both "stock exchange" and "stock trade" are frequently utilized conversely. Brokers in the financial exchange trade shares on at least one of the stock trades that are essential for the general stock exchange. The financial exchange permits purchasers and merchants of protections to meet, communicate, and execute. The business sectors take into consideration cost revelation for portions of partnerships and act as an indicator for the general economy. Purchasers and venders are guaranteed of a fair cost, serious level of liquidity, and straightforwardness as market members contend in the open market. The main financial exchange was the London Stock Trade which started in a café, where merchants met to trade shares, in 1773. The principal stock trade in the US started in Philadelphia in 1790. The Buttonwood Understanding, so named in light of the fact that it was endorsed under a buttonwood tree, denoted the start of New York's Money Road in 1792. The understanding was endorsed by 24 merchants and was the principal American association of exchanging stocks kind. The brokers renamed their endeavour the New York Stock and Trade Board in 1817. A stocks exchange is a directed and controlled climate. In the US, the fundamental controllers incorporate the Stocks and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). Libraries used:NumPy:NumPy (Numerical Python) is an open-source Python library that is utilized in pretty much every area of science and designing. It is the widespread norm for working with mathematical information in Python, and it is at the core of the logical Python and PyData ecosystems. Pandas:Pandas is characterized as an open-source library that gives elite performance data control in Python. The name of Pandas is gotten from the word panel data, and that implies an Econometrics from Complex information. It is utilized for information examination in Python and created by Wes McKinney in 2008. Matplotlib:Matplotlib is a thorough library for making static, vivified, and intuitive perceptions in Python. Matplotlib makes simple things simple and hard things conceivable. Make distribution quality plots. Create intelligent figures that can zoom, container, update. Scikit-learn:Scikit-learn is an open-source data analysis library, and the best quality level for Machine learning (ML) in the Python ecosystem. Key ideas and elements include: Algorithmic dynamic strategies, including: Order: recognizing and sorting data based of examples. XG Boost:This contains the Outrageous Gradient Boosting Machine learning algorithms which is one of the algorithms which assists us with accomplishing high precision on expectations. Code: Importing Dataset:Any named gathering of records is known as a Dataset. Datasets can hold data, for example, clinical records or protection records, to be utilized by a program running on the framework. Datasets are additionally used to store data required by applications or the working framework itself, for example, source programs, full scale libraries, or framework factors or boundaries. For informational collections that contain discernible text, you can print them or show them on a control center (numerous Datasets contain load modules or other double information that is not exactly printable). Informational collections can be recorded, which allows the Dataset to be alluded to by name without determining where it is put away. The dataset or CSV file used in this article can be downloaded using this link: Output:

Date Open High Low Close Adj Volume

Opening Highest Lowest Closing Trading

price price price price volume

that day that day

2010-07-07 16.4000 16.629999 14.980000 15.8000 15.8000 6921700

2010-07-08 16.1399 17.520000 15.570000 17.4599 17.4599 7711400

2010-07-09 17.5800 17.900000 16.549999 17.4000 17.4000 4050600

2010-07-12 17.9500 18.070000 17.000000 17.0499 17.0499 2202500

2010-07-13 17.3899 18.639999 16.900000 18.1399 18.1399 2680100

This are the five rows of the CSV file. we can see that data for a portion of the dates is feeling the loss of the reason behind that is on ends of the week and occasions stock market stays closed hence no exchanging occurs on these days. Output: (1705, 7) From the above output we can clearly say that the total no. of columns available are 7 and the total no. of rows available are 1705 in the dataset or CSV file. Output:

Open High Low Close Adj Volume

Opening Highest Lowest Closing Trading

price price price price volume

that day that day

count 1705.0000 1705.0000 1705.0000 1705.000 1705.000 1.7050e+03

mean 130.13992 132.520000 128.57000 130.4599 133.4599 4.2707e+06

std 94.58002 95.900000 92.549999 94.4000 95.4000 4.2707e+06

min 16.9500 16.070000 14.000000 15.04990 15.0499 1.1850e+05

25% 30.3899 30.639999 29.900000 29.13995 29.10399 1.19435e+06

50% 156.5453 162.45450 153.45645 158.48455 159.54548 3.1807e+04

75% 224.5464 220.56545 215.56545 225.54565 222.56445 5.6621e+09

Max 285.54556 290.55455 280.54545 286.56545 286.56545 3.1763e+02

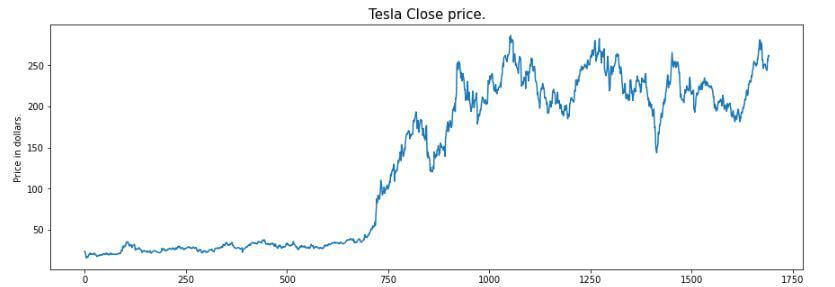

Exploratory Data Analysis:EDA is a way to deal with dissecting the information utilizing visual strategies. It is utilized to find patterns, and examples, or to really look at suspicions with the assistance of factual rundowns and graphical portrayals. While playing out the EDA of the Tesla Stock Cost information we will dissect how costs of the stock have moved over the timeframe and what the finish of the quarters means for the costs of the stock. Example: Output:

From the above graph we can see that the tesla stocks are showing an upward trend as shown in the graph. Output:

Date Open High Low Close Adj Volume

Opening Highest Lowest Closing Trading

price price price price volume

that day that day

2010-07-07 16.4000 16.629999 14.980000 15.8000 15.8000 6921700

2010-07-08 16.1399 17.520000 15.570000 17.4599 17.4599 7711400

2010-07-09 17.5800 17.900000 16.549999 17.4000 17.4000 4050600

2010-07-12 17.9500 18.070000 17.000000 17.0499 17.0499 2202500

2010-07-13 17.3899 18.639999 16.900000 18.1399 18.1399 2680100

In the output of ds.head(), if we notice cautiously we can see that the information in the 'close' column and that accessible in the 'Adj Close' segment is a similar we should check regardless of whether this is the situation with each column. Feature Engineering:Feature engineering helps with getting a few important features from the current ones. These additional features some of the time help in expanding the exhibition of the model altogether and absolutely help to acquire further bits of knowledge into the data. Output:

Date Open High Low Close Adj Volume day month year

Opening Highest Lowest Closing Trading

price price price price volume

that day that day

2010-07-07 16.40 16.62 14.98 15.80 15.80 69217 7 7 2010

2010-07-08 16.13 17.52 15.57 17.45 17.45 77114 8 7 2010

2010-07-09 17.58 17.90 16.54 17.40 17.40 40506 9 7 2010

2010-07-12 17.95 18.07 17.00 17.04 17.04 22025 12 7 2010

2010-07-13 17.38 18.63 16.90 18.13 18.13 26801 13 7 2010

Here, we have splitted the date column into three more columns has day, month, and the year this are already initialized in the date columns previously. Output:

Date Open High Low Close Adj Volume Day month year Quarter

Opening Highest Lowest Closing Trading

price price price price volume

that day that day

2010-07-07 16.40 16.62 14.98 15.80 15.80 69217 7 7 2010 0

2010-07-08 16.13 17.52 15.57 17.45 17.45 77114 8 7 2010 0

2010-07-09 17.58 17.90 16.54 17.40 17.40 40506 9 7 2010 0

2010-07-12 17.95 18.07 17.00 17.04 17.04 22025 12 7 2010 0

2010-07-13 17.38 18.63 16.90 18.13 18.13 26801 13 7 2010 0

A group of three months is called as a quarter. Each organization prepares its quarterly results and distributes them publicly so, that individuals can analyse the organization's performance. These quarterly outcomes influence the stock costs vigorously which is the reason we have added this element since this can be a useful feature for the learning model. Output:

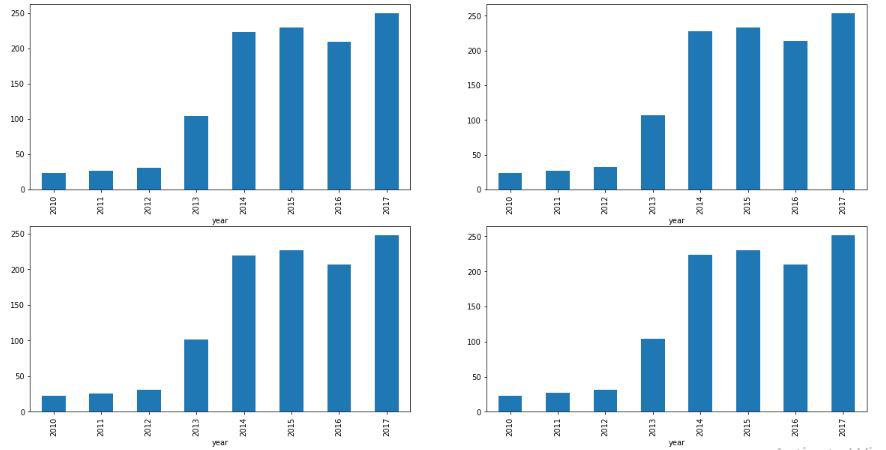

By analysing the above bar graph, we can say that the stocks of the tesla have increased twice in the span of year 2013 to the year 2014. Here are a portion of the important observations of the above-grouped data:

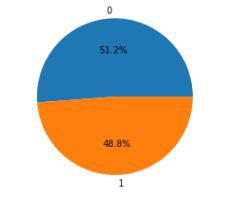

Above we have added a few additional columns which will help in the training of our model. We have added the objective component which is a sign regardless of whether to purchase we will prepare our model to just foresee this. In any case, prior to continuing we should check regardless of whether the objective is adjusted utilizing a pie graph. Output:

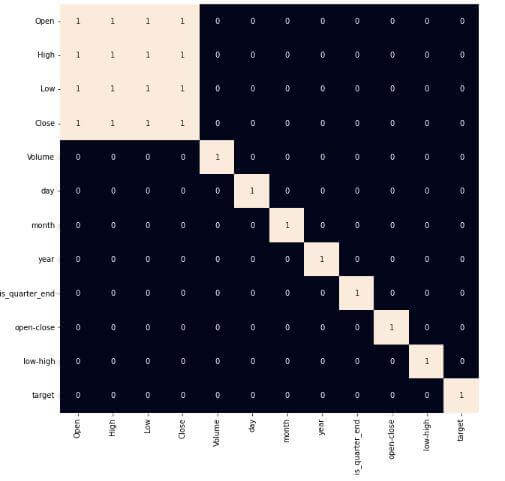

At the point when we add features to our dataset we need to guarantee that there are no exceptionally related features as they don't help in that learning process with handling of the calculation. Output:

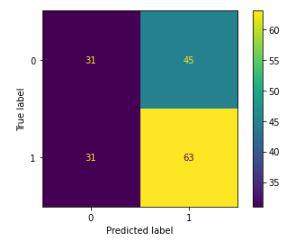

From the above heatmap, we can express that there is a high relationship between OHLC that is really obvious, and the additional features are not profoundly connected with one another or recently gave highlights which implies that we are all set and build our model. Data Splitting and Normalization:Output: (1435, 3) (190, 3) After choosing the elements to prepare the model on we should standardize the data in light of the fact that standardized information prompts steady and quick preparation of the model. After that entire information has been parted into two sections with a 90/10 ratio in this way, that we can assess the presentation of our model on concealed data. Model Development and Evaluation:This is the ideal opportunity to prepare some cutting edge AI models(Logistic Relapse, Backing Vector Machine, XGB Classifier), and afterward founded on their exhibition on the preparation and approval information we will pick which ML model is filling the need within hand better. For the assessment metric, we will utilize the ROC-AUC bend however why this is on the grounds that as opposed to anticipating the hard likelihood that is 0 or 1 we would like it to anticipate delicate probabilities that are ceaseless qualities between 0 to 1. Furthermore, with delicate probabilities, the ROC-AUC bend is for the most part used to gauge the precision of the expectations. Code: Output: Logistic Regression(): The Training Accuracy of the model is: 0.5148967 The Validation Accuracy of the model is: 0.5468975 SVC(kernel = ?poly?, probability = True): The Training Accuracy of the model is: 0.47108955 The Validation Accuracy of the model is: 0.4458765 XGB classifier(): The Training Accuracy of the model is: 0.7856421 The Validation Accuracy of the model is: 0.58462215 Among the three models, we have prepared XGB Classifier has the best presentation but it is pruned to overfitting as the contrast between the preparation and the approval precision is excessively high. Output:

Confusion matrix Conclusion:We can see that the accuracy accomplished by the state-of-the-art ML model is no more excellent than basically speculating with a likelihood of half. Potential purposes behind this might be the absence of information or utilizing an exceptionally basic model to perform such a complex task as Stock Market prediction. |

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share