Maximum profit by buying and selling a share at most twice

Introduction

Every investor when trading stocks hopes to make the most profit possible. While some investors opt to purchase and hold shares for the long term, others look to profit from temporary price swings to maximise their gains. In order to maximise profits, we will examine a strategy in this article for only twice purchasing and selling a share. We will also offer a Python programme that applies this strategy and displays the results.

The Maximum Profit Strategy: An Understanding

In order to maximise profits while abiding by the restriction of only making two transactions, the maximum profit strategy with at most two transactions entails determining the most profitable buying and selling points. Finding two local minimums and two local maximums in the stock price data is crucial in this situation.

The Python Program Implementation

Python can be used, and the following procedures can be followed to programmatically implement this tactic:

Step 1: Importing Required Libraries

Step 2: Defining the Maximum Profit Function

Step 3: Inputting Stock Price Data and Calling the Function

Example: Maximizing Profits with Two Transactions

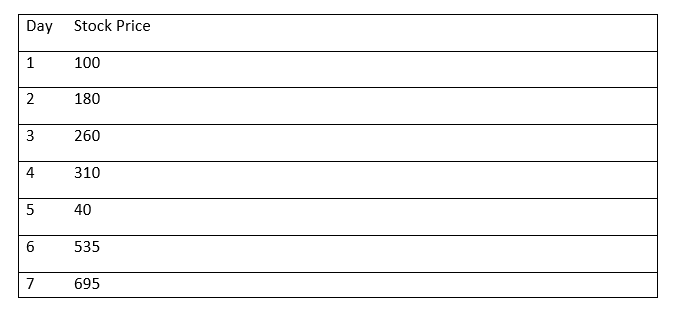

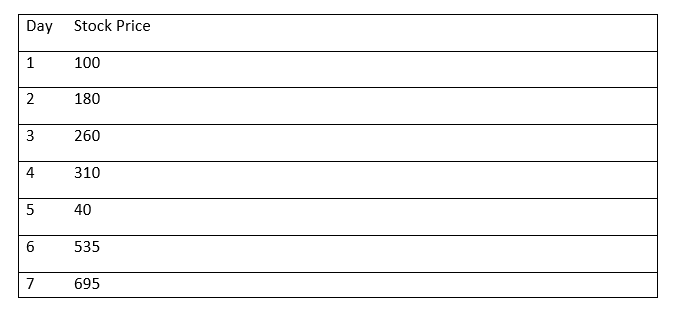

Take a look at the stock price information from the Python programme example. Let's examine the price chart and determine how much money can be made by buying and selling the stock a maximum of twice.

Code:

Output:

Here's a brief explanation of the code:

- The code starts by importing the NumPy library as np.

- The function max_profit(prices) takes a single argument: prices, which is a list of stock prices over a period of time.

- The function begins by checking if the length of the prices list is less than 2. If so, it returns 0 because it's not possible to make any profit with fewer than 2 prices.

- Two sets of variables are initialized to store the maximum profits (profit1 and profit2) and the minimum prices (min_price1 and min_price2) encountered during calculations.

- The code then enters a loop to calculate the maximum profit after the first buy/sell. It iterates through the list of prices starting from the second element. It updates the min_price1 with the minimum of the current price and the existing min_price1, and calculates the potential profit by subtracting min_price1 from the current price. The profit1 is updated with the maximum of the current profit1 and the calculated profit.

- Another loop is used to calculate the maximum profit after the second buy/sell. This loop iterates in reverse through the list of prices. Similar to before, it updates the min_price2 with the minimum of the current price and the existing min_price2, and calculates the potential profit by subtracting min_price2 from the current price and adding profit1 (which represents the maximum profit achieved after the first buy/sell). The profit2 is updated with the maximum of the current profit2 and the calculated profit.

- After iterating through the price list, the function returns profit2, which represents the maximum achievable profit from two buy/sell transactions.

- An example usage is provided using the stock price data stock_prices = [100, 180, 260, 310, 40, 535, 695]. The max_profit function is called with this data, and the resulting maximum profit achievable from two buy/sell transactions is printed.

The Maximum Profit Strategy's benefits

For investors looking to maximise their profits, the maximum profit strategy of buying and selling a share no more than twice offers several benefits:

- Higher Returns: Compared to a straightforward "buy and hold" strategy, investors may be able to achieve higher returns by strategically identifying two profitable buying and selling points.

- Taking Advantage of Short-Term Opportunities: With this strategy, investors can profit from brief price fluctuations, which results in more frequent opportunities for profit.

- Managing Risk: Limiting exposure to stock market volatility by only making two transactions at a time helps manage risk.

- Adaptability: Investors can time the execution of their buying and selling actions to match their risk tolerance and market outlook.

- Scalability: The maximum profit strategy is a flexible approach for various investment portfolios because it can be used with a variety of stocks and market conditions.

Factors to Consider

Although the maximum profit strategy can be advantageous, there are a few things that investors should take into account before using it:

- Market Conditions: This strategy's effectiveness can be significantly impacted by market volatility and trends. Analysing historical data and evaluating current market conditions are crucial.

- Transaction costs, like brokerage fees, should be considered by investors because they can reduce the overall profit.

- The strategy is best suited for investors with a short- to medium-term time horizon. Other strategies might be more appropriate for long-term investors.

- Stock Selection: Because different stocks have different price patterns, careful investigation and analysis are necessary to choose the best stocks for this strategy.

Python Code Efficiency

The provided Python code is effective and time-complexity optimised for use in implementing the maximum profit strategy. In a single pass through the stock price data, it uses dynamic programming principles to determine the maximum profit. By doing this, the code is guaranteed to be able to handle larger datasets and deliver quick results.

This Python code can be used by traders and investors to analyse historical stock price data and improve their investment choices.

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now