Annuity Function in ExcelWhat is annuity function?The term annuity refers to the sectors, which includes banking, financial sectors, and other business requirement based on the future value of the particular investment. Calculating the periodic payments or series of equal amounts for a specified period is done using the annuity function. It calculates the future value of an asset or the number of regular payments to achieve future discounts. Uses of annuity function in ExcelThe several uses of the annuity function in Excel are as follows:

What is called the Present value of an annuity?The present value of the annuity is defined as the series of payments done at regular intervals where a new amount is produced in the future. The concept time value of money is explained here. For example, if a dollar purchased today is worth more than the dollar purchased in the future regarding its purchasing power. Key Points for Present Value of the Annuity

Formula to calculate the present value of the annuityExcel provides the procedure to calculate the current value of the annuity. It solves the complex calculations in the given data. The syntax of the formula is as follows, =PV (RATE, NPER, PMT, [fv], [type]). The formula is explained as follows,

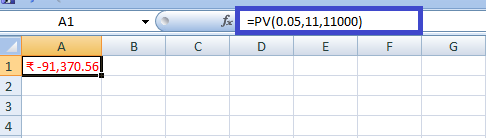

How to calculate the present value of an annuity using a formula?To steps to calculate the present value of an annuity for the given problem is as follows, Example 1: Calculate the present value of a future annuity with an interest rate of 5% for 11 years with an annual payment of $11000. To calculate the present value,

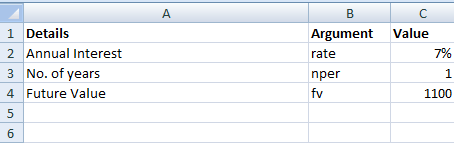

The formula returns the current value of the annuity as -91,370.56. Calculating the present value formula for a single paymentHere is an example to calculate the current value for a single price. Example: A person won a gift prize of amount 1,000. He is given the option to get either 1,000 at present or 11,00 after a year. To decide which option is best, the person needs to calculate the present value of the amount where he receives in the future (1100). To calculate the interest rate, one needs to know how much the person will get in the future to inverse the current amount. The required information to calculate the data is as follows,

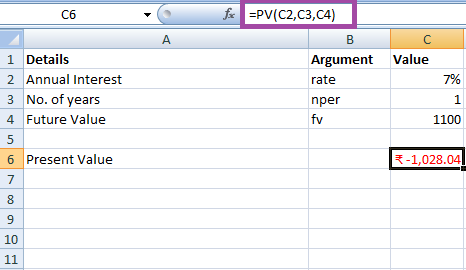

The formula to calculate the present value of the investment is, =PV (C2, C3, C4) Here C2, C3, and C4 are called cell values. The data entered in Excel is,

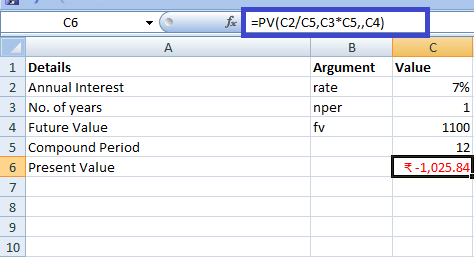

In the above example, the interest is calculated for the year. To calculate the rate of interest per month, the rate of interest is divided by 12, and the number of years is multiplied by 12. The formula is modified as, =PV (C2/12, C3*12, C4)

From the calculated compound interest, the future value is greater than the compound interest value. Necessary formulas to calculate the Present value of the annuityTo calculate the periodic interest rate (rate), the correct formulas are,

To calculate the total number of periods (per), the formulas are as follows,

Different annuity typesThe various types of annuities are as follows,

These annuity types are controlled by the fifth argument present in the formula, which is optional.

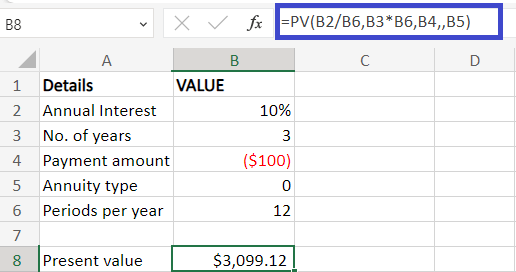

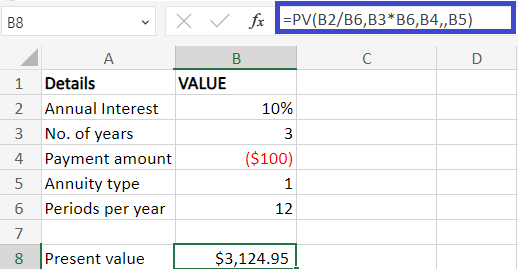

Here is an example to find the difference between the ordinary and annuity due. Enter the data in the spreadsheet as follows,

To calculate a regular annuity, enter the annuity type as 0. The formula entered is, =PV (B2/B6, B3*B6, B4,, B5)

Here in the data, the future value is not entered. The annuity due is calculated with the annuity type as 1. The formula entered is, =PV (B2/B6, B3*B6, B4,,B5)

There occurs a difference between both the ordinary and annuity due. SummaryCalculating the annuity function is essential to the financial and banking sectors. It is a versatile tool widely used in many organizations and companies. The formula to calculate the present value of the annuity is explained in this tutorial.

Next TopicA spreadsheet in Microsoft Excel

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share