Income Tax Calculator in Microsoft ExcelWhat do you mean by Income Tax?We all know that the term "income tax" primarily refers to a type of the tax which any governments impose on the income of the businesses and the individuals income as well within their jurisdiction generate. And in accordance to the law, a particular taxpayer must require to file an income tax return annually for the purpose of determining their tax obligations as well. And the respective Income taxes are also a source of revenue for the governments. Moreover, they are responsible for the purpose of funding out the public services, paying government obligations, as well as providing goods for the citizens efficiently. And in addition to the federal government, most of the states as well as the various local jurisdictions also levy income taxes on their behalf in an effective manner. KEY TAKEAWAYS

Describe the Working of the Income Tax?The respective Internal Revenue Service (IRS) is basically used for the purpose of collecting taxes and also helpful in enforcing tax law in the United States, and the IRS employs out a complex set of rules and it also defines the regulations regarding the reportable and taxable income, deductions, and credits. Furthermore, the respective agency effectively collects taxes on all forms of income, which includes the following ones:

While the personal income tax, which the Government collects, can help to fund the government programs as well as services efficiently, which include the following?

What are the various types of the Income Tax?The various types of income tax which are in action are as follows: Individual Income Tax The Individual income tax is primarily termed to be the personal income tax that is levied on an individual's wages, salaries, and other types of income. Besides all this, the Individual income tax is a tax which the state imposes on an individual because of the various exemptions, deductions, and credits. And the IRS offers a huge series of the income tax deductions as well as the tax credits taxpayers can make use of to reduce their taxable income. While a deduction can lower our taxable income and the tax rate, which is effectively used for the purpose of calculating our tax and tax credit reduces our income tax obligation. The IRS also offers a tax deduction for healthcare expenses, investments, and specific education expenses.

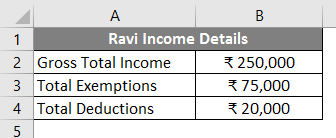

Tax credits usually help to reduce out the amount they owe, and they have been created for middle-income as well as for the lower-income households. To illustrate, if an individual owes $20,000 in taxes but qualifies for a $4,500 amount in credits, their tax obligation will be reduced to $15,500 ($20,000 - $4,500 = $15,500), respectively. Moreover, the Taxable income is our adjusted gross income (AGI) minus any itemized deductions or our standard deduction. Business Income Tax Now the all the businesses also pay income taxes on their annual earnings, and the IRS taxes income from the various corporations, partnerships, self-employed contractors, as well as the small businesses. Depends upon the business structure, the corporation and its owners, or the shareholders, report their income and then deduct their operating and also their capital expenses effectively. Furthermore, the difference between their business income and operating and capital expenses is their taxable income. What do we understand by the term Income Tax in Microsoft Excel?The particular user can efficiently calculate the "n" number of things in Microsoft Excel in just a few steps, one of which is the calculation of the Income Tax. And primarily, there are two methods of income tax deduction from the incomes and if in case a user is working in some other company, then, in that case, they will be deducting all the income-related taxes from the particular user's salary, which the user needs to declare the income tax by himself only respectively. How can one easily calculate Income Tax in Microsoft Excel?Let us now understand how one can easily calculate the Income Tax in Microsoft Excel with the help of the examples. # Example 1: Calculating out the Simple Taxable Income as well as the Income Tax of that Income Let us now suppose that Ravi's income details are given in the respective sheet 1; and his salary is about 2.5 lakhs, while the total exemptions are nearly about 75000, and the total deduction is 20000; besides these, there will be a 5 % tax on income mentioned- below 2.5 lakhs which the Government impose on it. Ravi wants to calculate out his overall taxable income, which he must pay in the form of the tax in the current financial year. We will now see how a particular user can effectively calculate his taxable income as well as the income tax. Step 1: First of all, we will be opening out Microsoft Excel, and then we will go to Sheet 1, in which Ravi's income details are available.

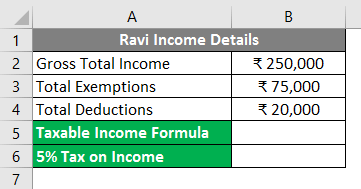

Step 2: And when a user wants to calculate taxable income as well as the tax on the income >>, we are required to create two rows to calculate the taxable income and the tax on the given income.

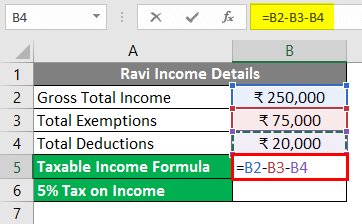

Step 3: After that, firstly, a user needs to calculate the taxable income >> and need to click on cell B6, subtracting the exemptions as well as deduction amount from the given total income >> as well as writing down the formula in cell B6 =" B2-B3-B4". Press the Enter key.

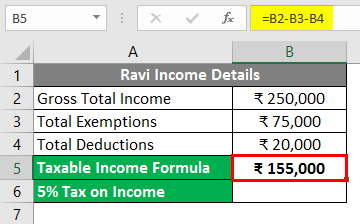

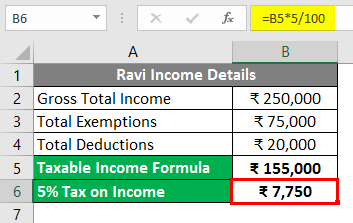

Step 4: And now, in this step, the respective Taxable income will come, that is, none other than 1.55 lakh respectively.

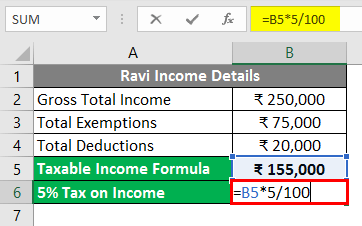

Step 5: After that, we are required to calculate out the tax which must be paid on the taxable income >> and the Tax is 5% below the 2.5 lakhs income >> after that we will be calculating 5% of the taxable income as well as writing down the formula in the cell B7 >> "=B5*5/100".

Step 6: Finally, we must click on the Enter key from our keyboard respectively.

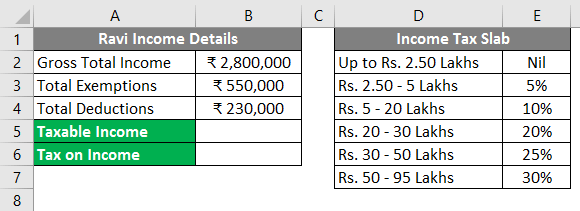

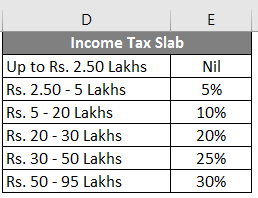

Summary of Example 1: In this a user wants to calculate his taxable income as well as the tax which must be paid by him in the current financial year, it is also primarily calculated in the above discussed example. Ravi's taxable income is 1.55 Lakh, and he needs to pay put 7750 Rupee as income tax. # Example 2: Calculating out the Taxable Income as well as the Income Tax with Different Tax Slab Now in this, a user's income details are given in the sheet 2, and his salary is just around 28 Lakhs, and the total exemptions are 5.5 Lakhs, while the total deduction is nearly about 2.3 Lakhs; the Government gives tax slab. Now the user wants to calculate his taxable income as well as the tax which he needs to pay by him in the current financial year as well. Now after that we will be seeing how a particular user can easily calculate his taxable income and the income tax which needs to be paid to the Government. Step 1: First, we need to go to the particular Sheet 2, on which the user's income details and the tax slab are mentioned.

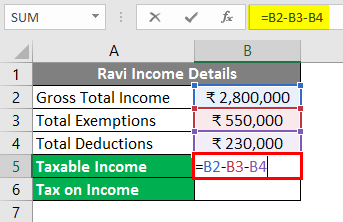

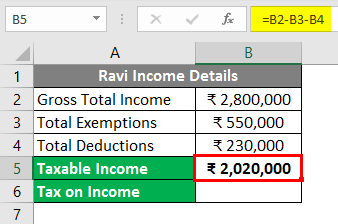

Step 2: And now in order to calculate the taxable income and the tax on the given income >> so for this, two rows will be created to calculate the taxable income and the tax on the income column A. Step 3: And in this step, first of all, a particular user needs to calculate the taxable income >> and click on cell B6, and then subtract the exemptions and deduction amount from the total income >> writing down all the formulas in the cell B6 =" B2-B3-B4". >> After that, we must also click on the enter button from our keyboard.

Step 4: Now, the Taxable income will come, that is, none other than 20.20 Lakhs.

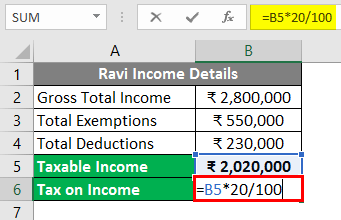

Step 5: After that, we are required to calculate the tax that needs to be paid on the taxable income >>, and it is coming in the 4th slab, which is around Rs. 20 - 30 Lakhs= 20% >> Now we will be calculating 20% of the taxable income respectively.

Step 6: In this step, we must write the formula in cell B7 >> "=B5*20/100".

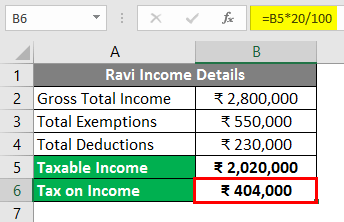

Step 7: Finally, we will click on the Enter key from the keyboard.

Summary of Example 2: The user's taxable income is nearly 20.20 Lakhs, from which he needs to pay about 4.04 Lakhs Rupee as income tax. What essential things need to be remembered about calculating Income-tax in Microsoft Excel?The various essential things that need to be remembered about the calculation of the Income-tax in Microsoft Excel:

Next TopicInvoice Format in Microsoft Excel

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share