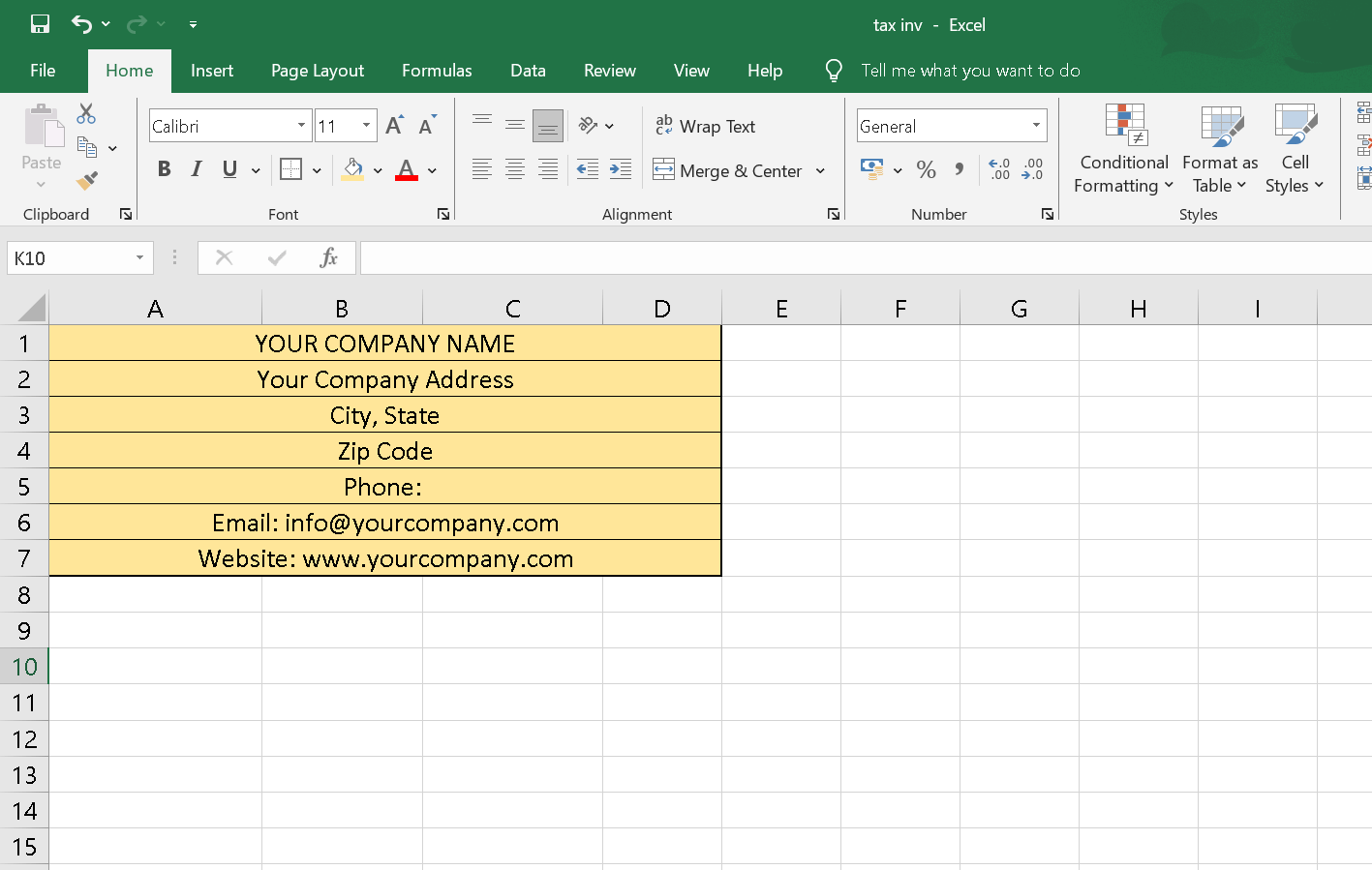

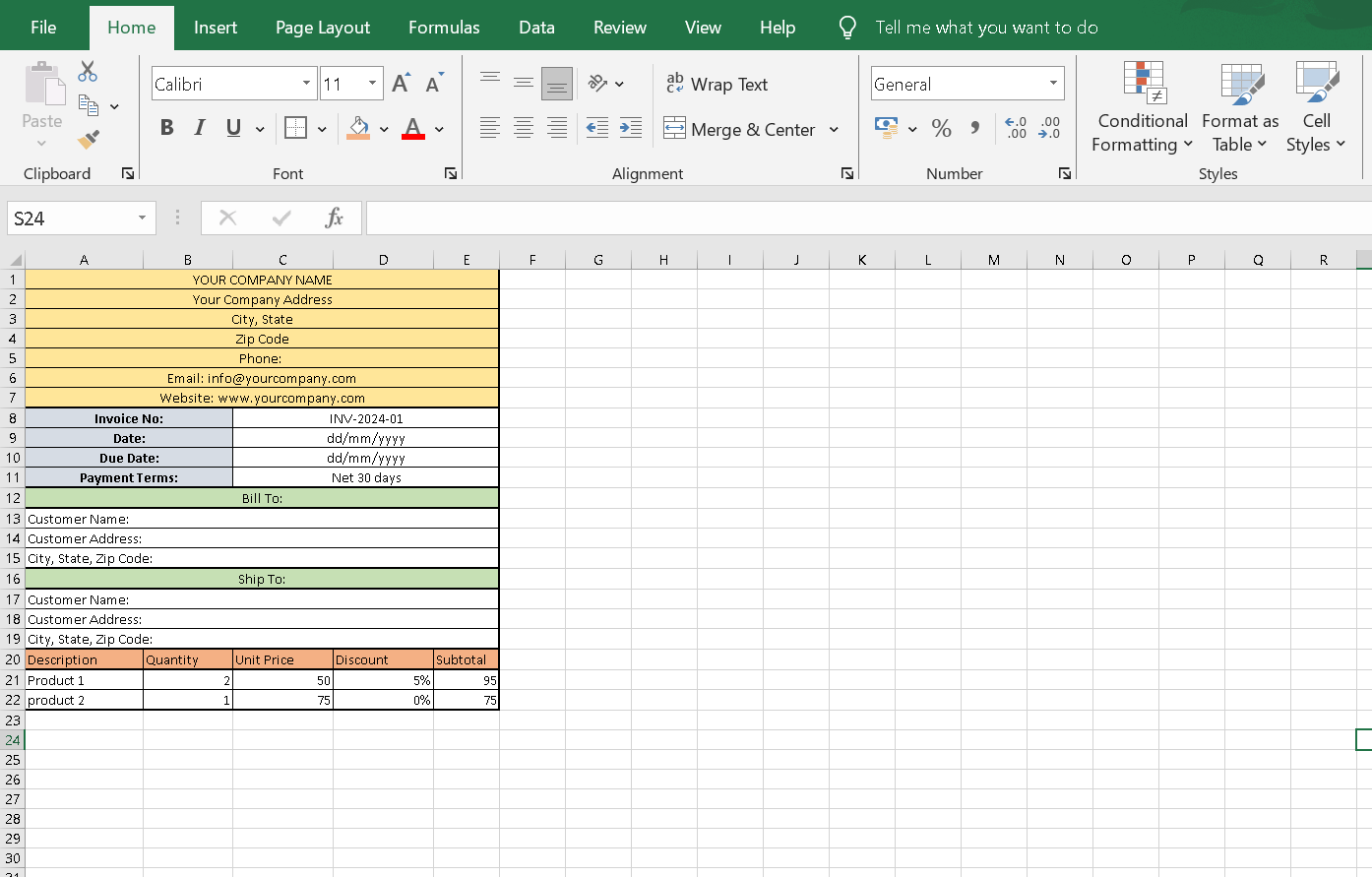

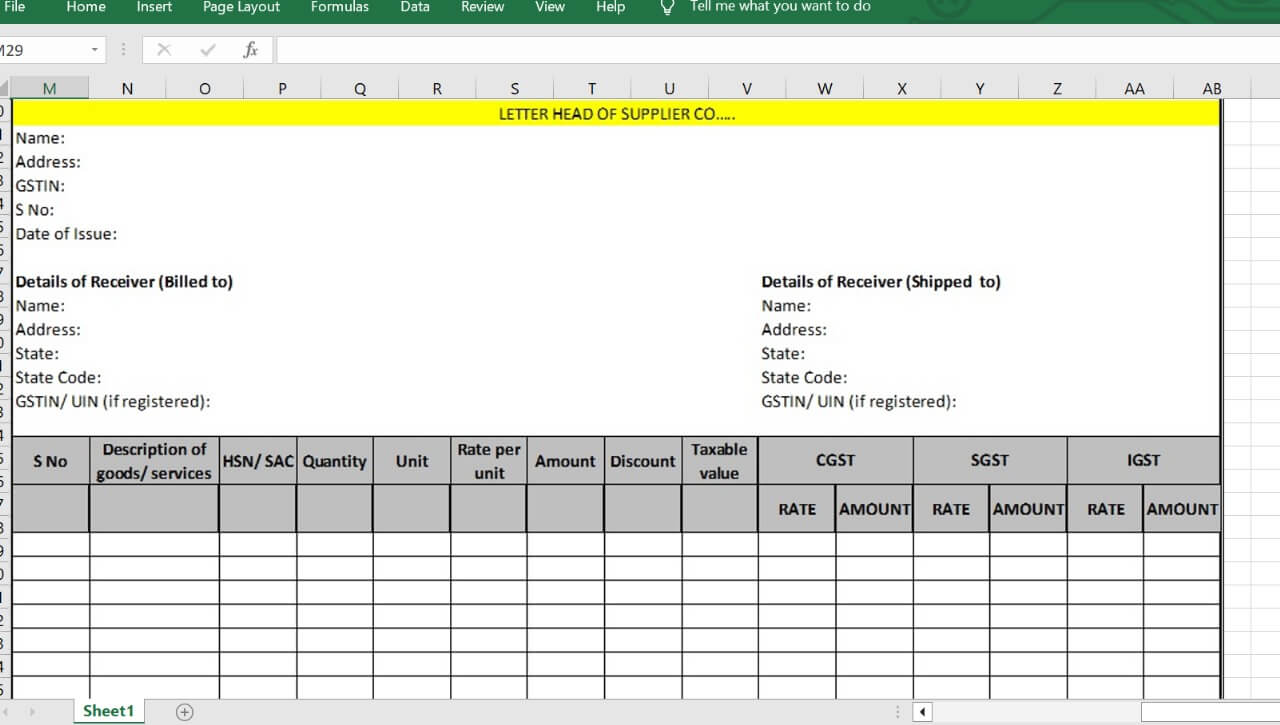

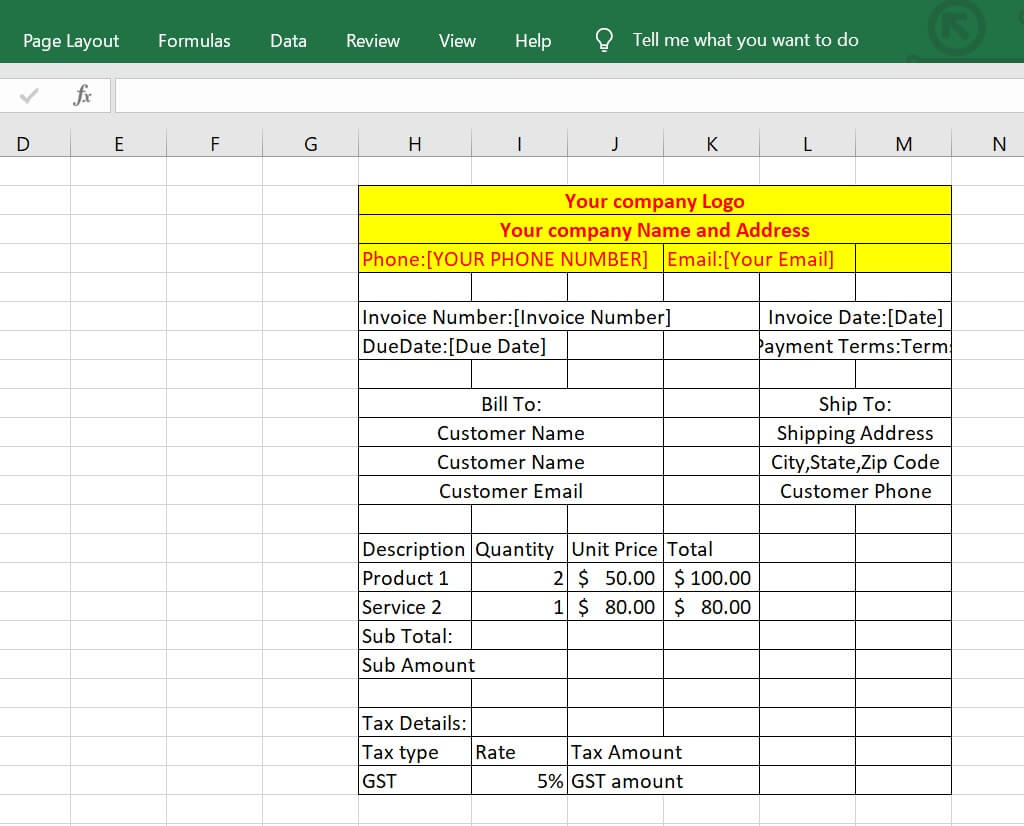

Tax Invoice format in excelIntroduction:In the dynamic landscape of modern business, maintaining accurate and transparent financial records is crucial for sustainable operations and compliance with regulatory standards. One pivotal aspect of this financial documentation is the creation of tax invoices, which play a fundamental role in the transactional processes between businesses and their clients. Leveraging tools like Microsoft Excel to design a structured tax invoice format not only enhances the professionalism of your financial transactions but also streamlines the billing process, fostering efficiency and clarity in communication. A well-crafted tax invoice in Excel serves as more than just a billing statement; it is a tangible representation of the commitment to professionalism and accuracy in financial dealings. By adopting a standardized format, businesses can ensure consistency across transactions, reduce the likelihood of errors, and establish a foundation for robust financial management. This introduction aims to shed light on the significance of an organized tax invoice format, illustrating how it contributes to the overall financial health of a business while fostering transparency and trust between parties involved. What do we understand by the term tax Invoice format in Microsoft Excel?The term "tax invoice format in Microsoft Excel" refers to a structured and organized template created using Microsoft Excel software for the purpose of generating invoices that comply with tax regulations. A tax invoice is a document provided by a seller to a buyer, detailing the transaction of goods or services and including information required for tax purposes. By utilizing Microsoft Excel, businesses can design a customizable template that facilitates the creation of consistent and professional invoices, making the billing process more efficient and accurate. In a tax invoice format in Microsoft Excel, various elements are typically included to ensure compliance and clarity. These elements may encompass the identification of the seller and buyer, a unique invoice number, the date of issuance, a breakdown of the goods or services provided (including quantities, unit prices, and totals), applicable taxes, and the final amount due. In essence, the tax invoice format in Microsoft Excel is a tool that combines the spreadsheet capabilities of Excel with the necessary components of a tax-compliant invoice, offering a user-friendly solution for businesses to create, manage, and maintain their transactional records efficiently. Steps to make tax invoice format in excel:Step 1: Open Excel Open Microsoft Excel on your computer. Step 2: Basic Company Information

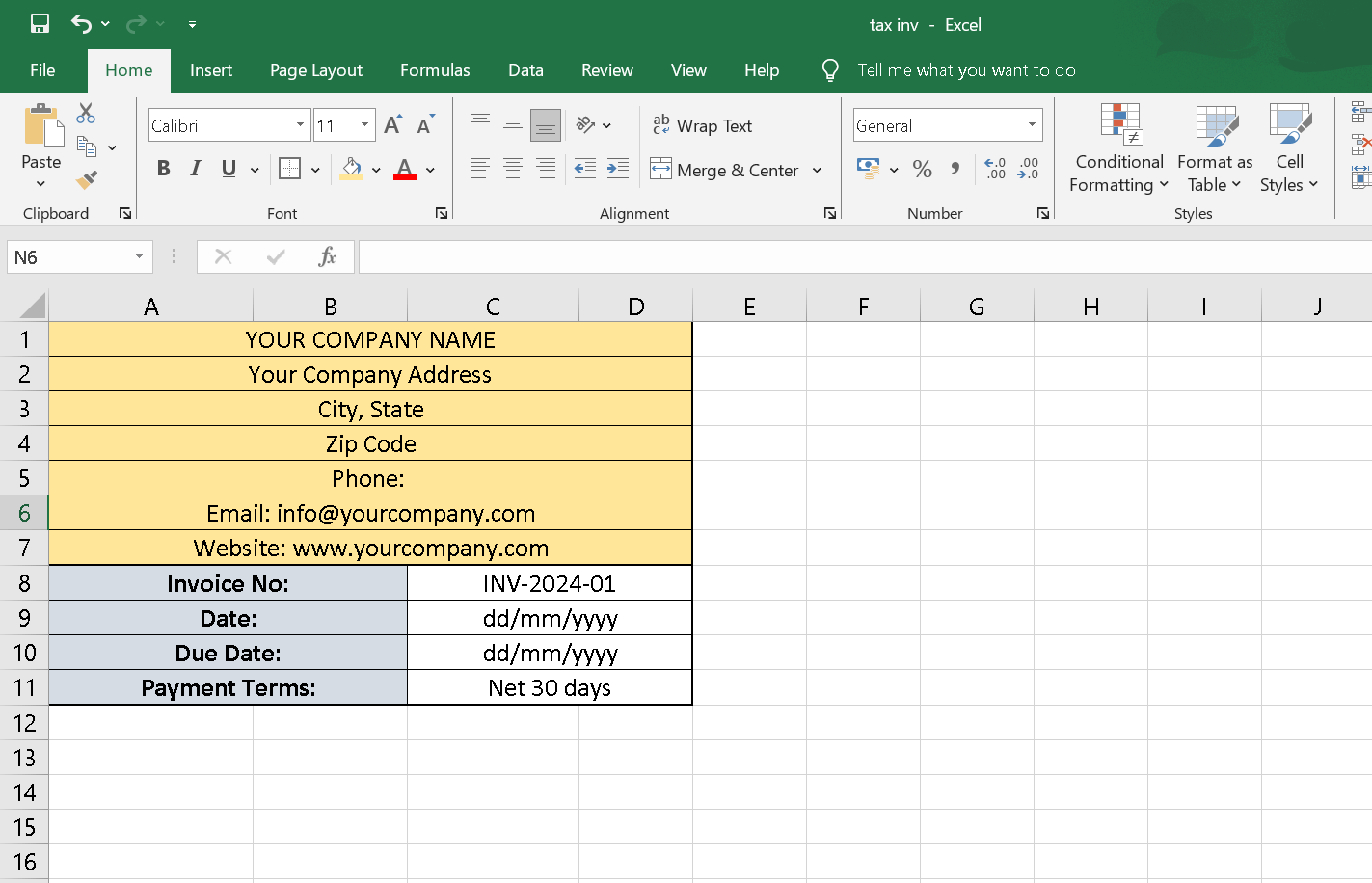

Step 3: Invoice Details

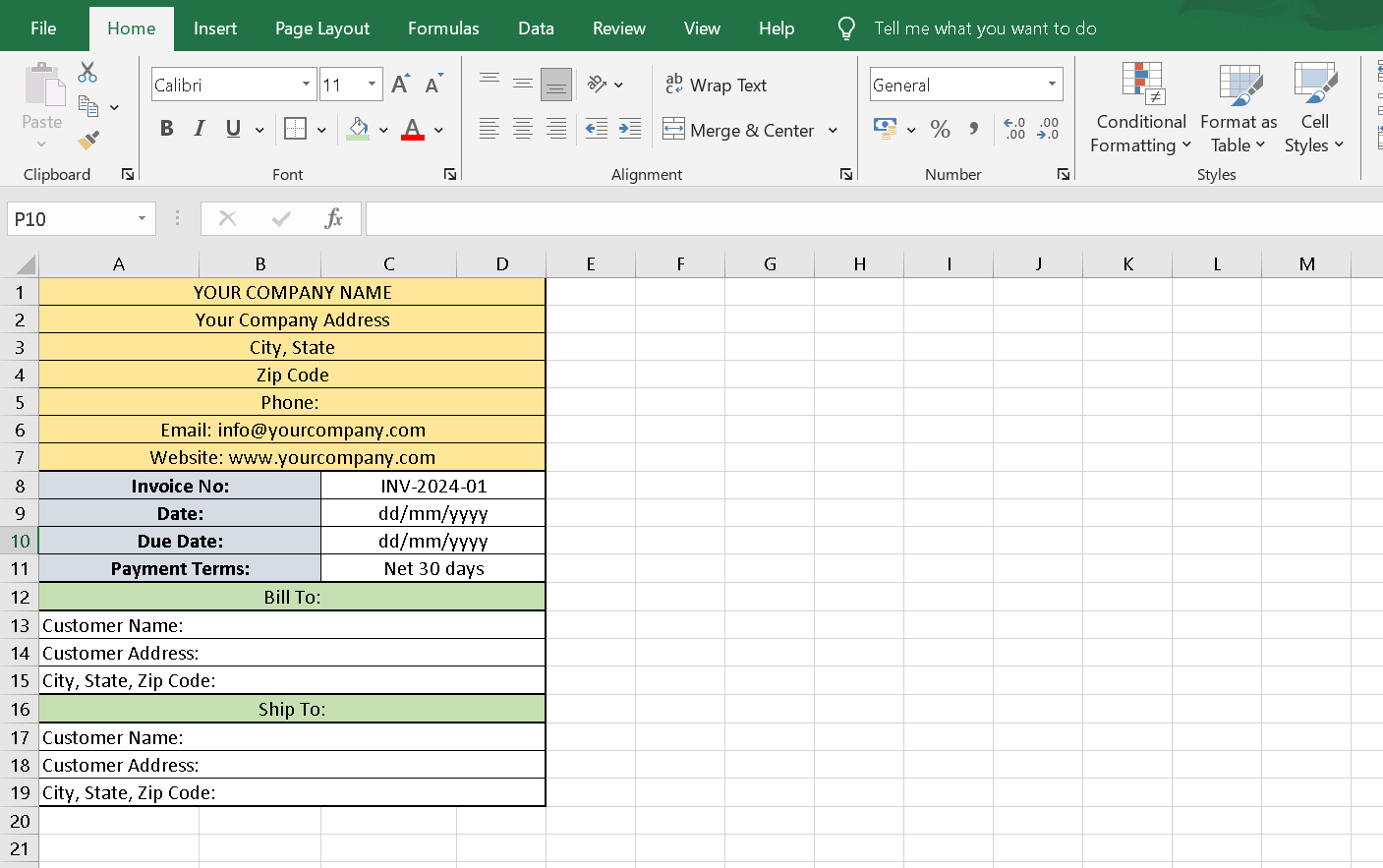

Step 4: Customer Information In cells A12 to A15, enter "Bill To:" and the corresponding customer information. In cells A16 to A19, enter "Ship To:" and the corresponding shipping information.

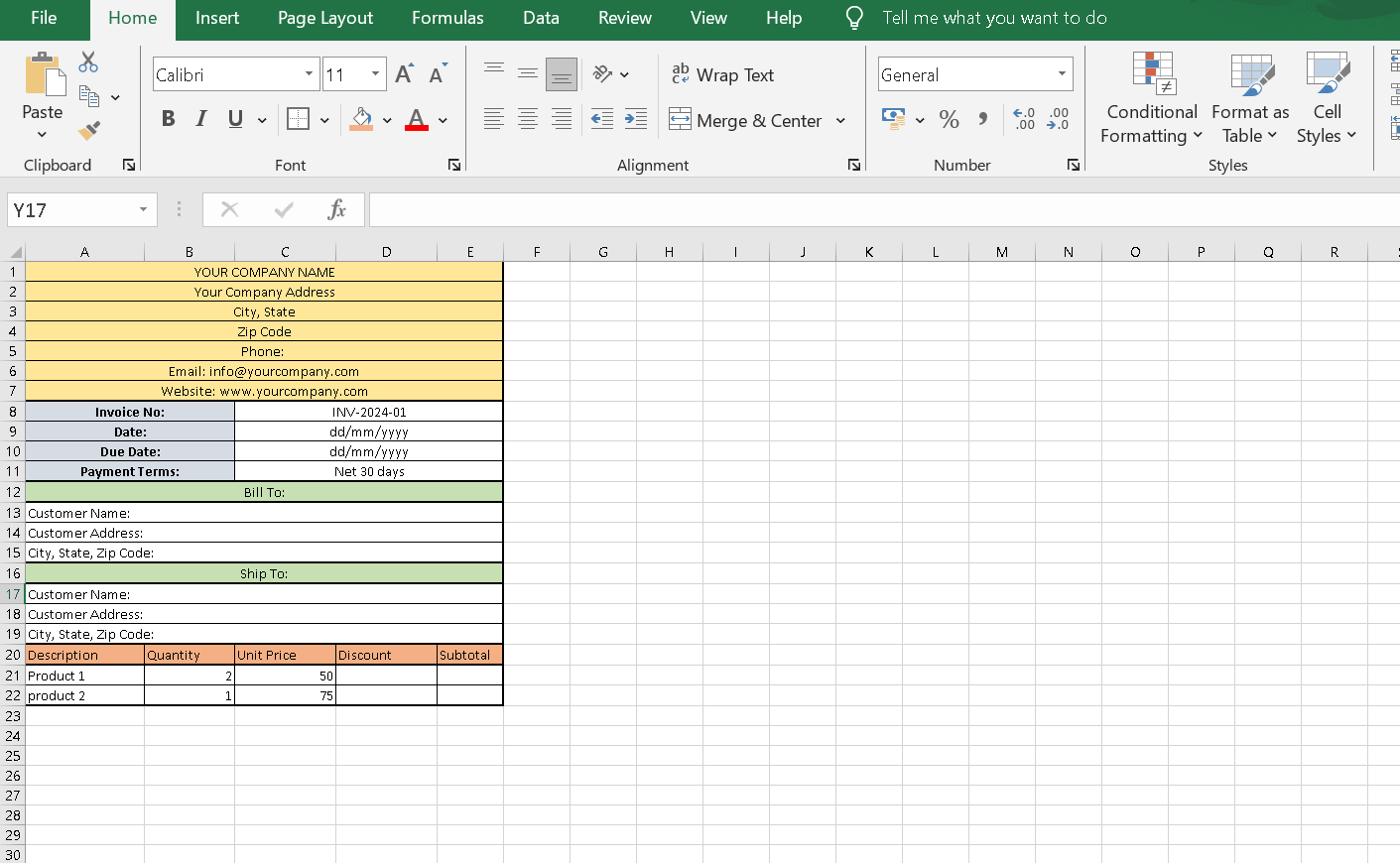

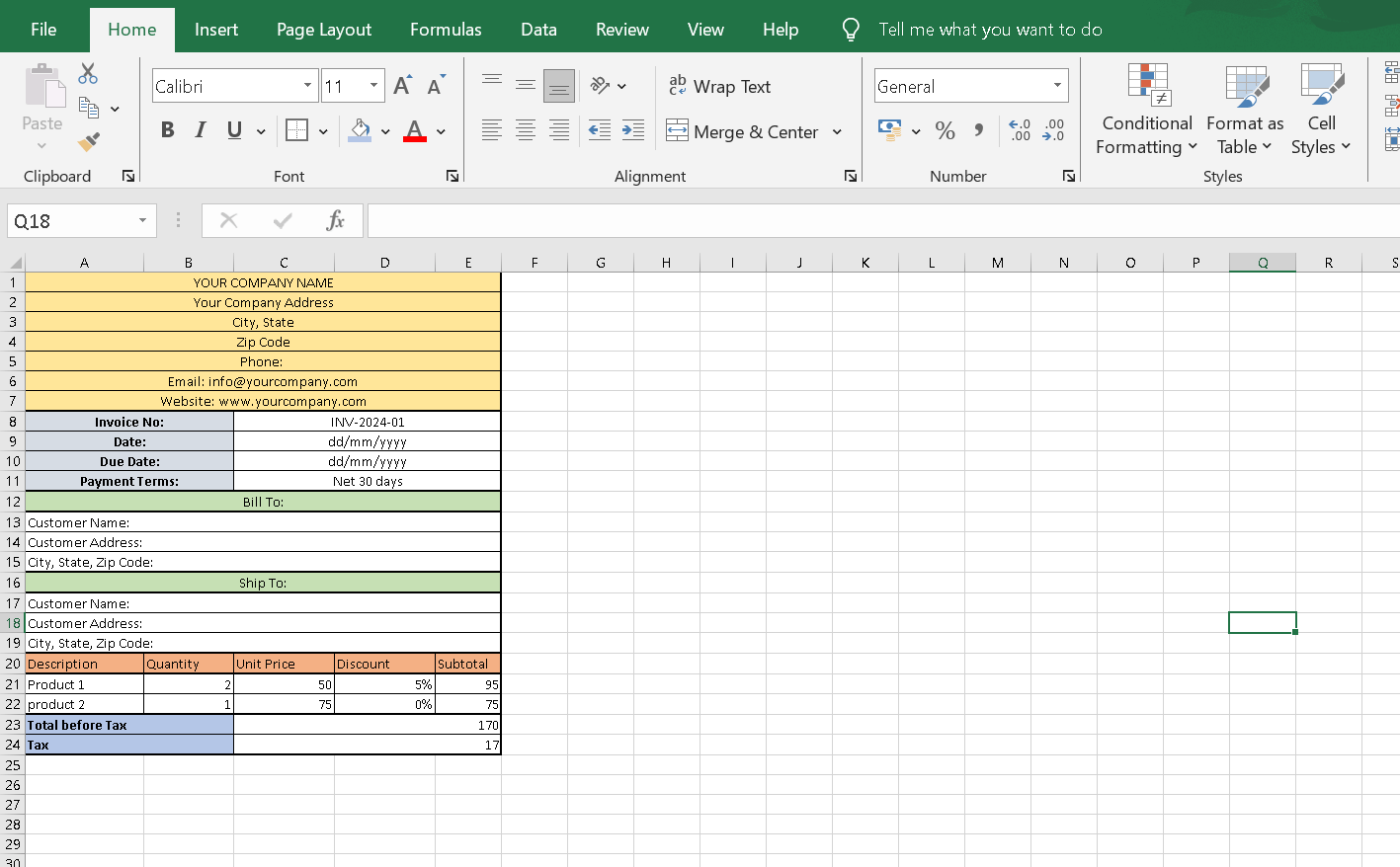

Step 5: Invoice Line Items

Step 6: Total Calculation

Step 7: Tax Calculation

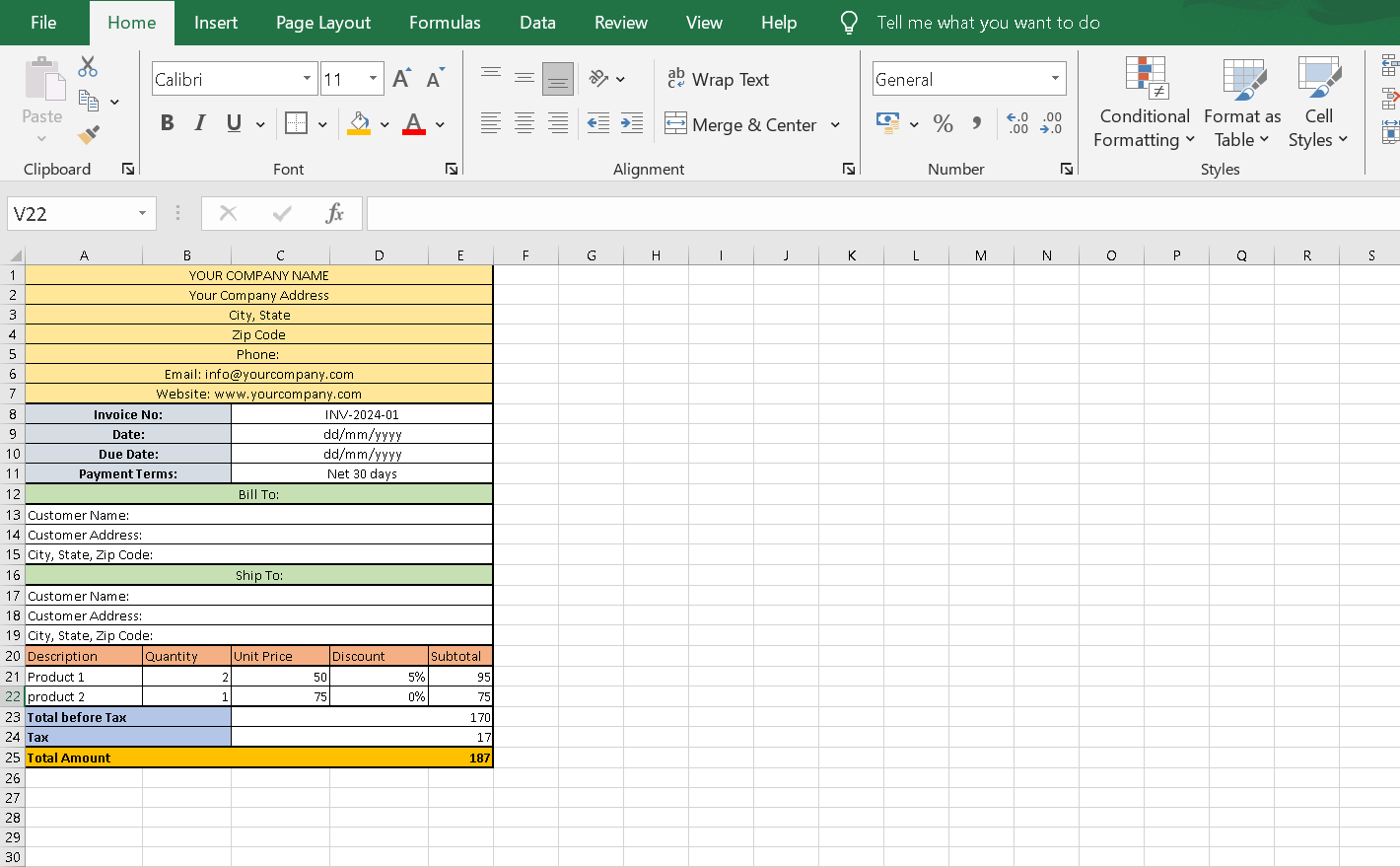

Step 8: Grand Total

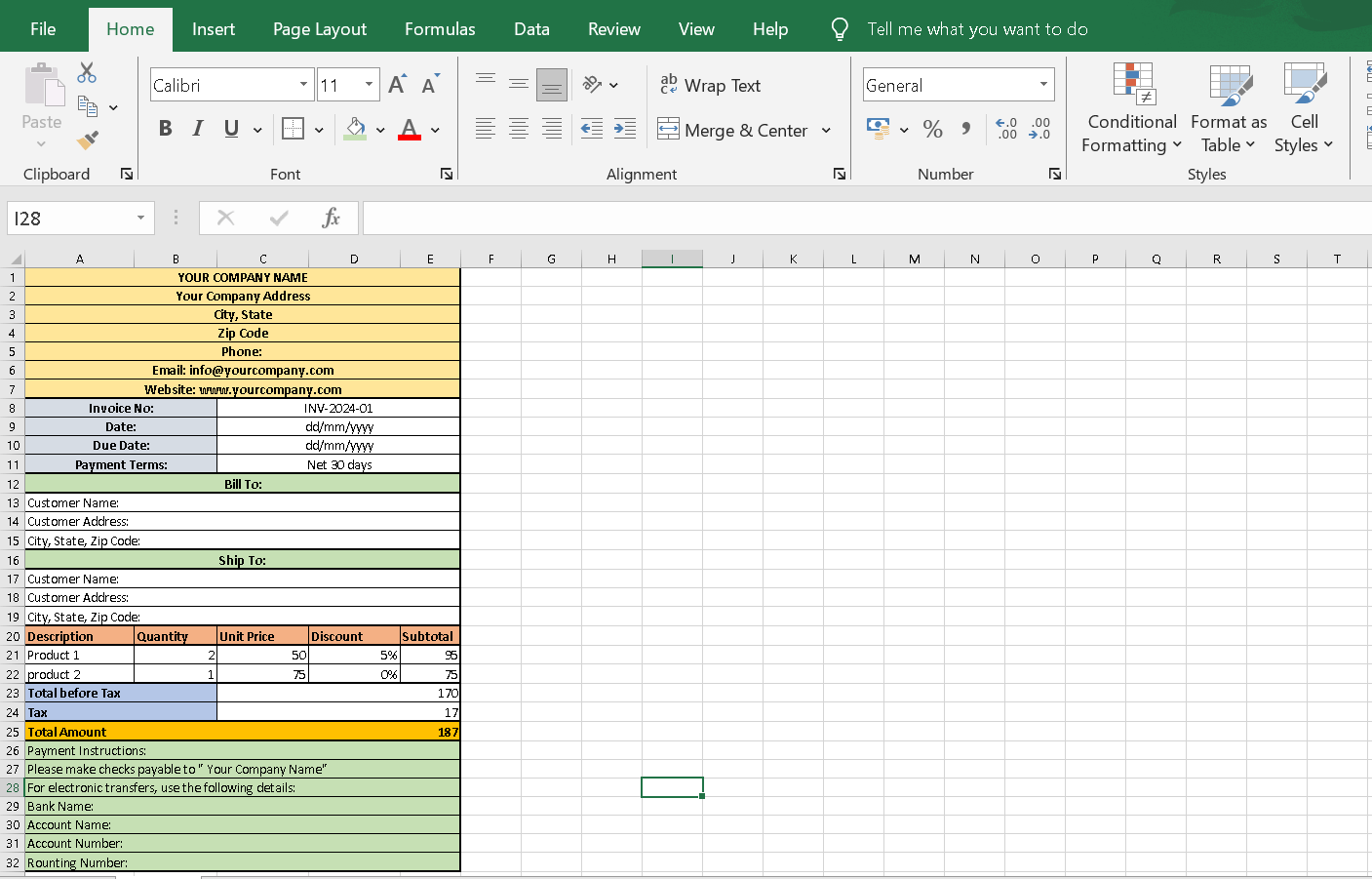

Step 9: Payment Instructions Below the grand total, provide any payment instructions or additional information.

Step 10: Formatting Apply formatting as needed, such as bold headers, borders, and number formatting. Instructions for Use:

Example:

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share