Financial Functions in ExcelMicrosoft Excel is the most valuable tool for investment bankers and financial analysts. Over 70% of their work was creating Excel models and generating calculations, graphs, assumptions, and valuations. Investment bankers are probably experts at Excel formulas and shortcuts. Even though Excel has more than fifty financial functions, the top fifteen financial functions are those that are most commonly utilised in real-world scenarios. Future Value (FV): Excel Financial FunctionUse the formula as follows to determine the future value of a certain investment with a fixed interest rate and recurring payments:

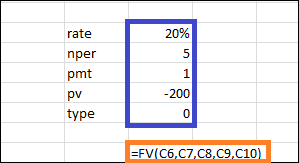

Example:In 2015, A invested $200 US. The money has been sent on an annual basis. The annual percentage rate of interest is 20%. What would the FV be in 2018? The equation will be entered into Excel as follows:

FVSCHEDULE: Excel Financial FunctionThis financial function is handy for determining future value using a variable interest rate. View the feature list below:

Example:At the end of 2015, for instance, X invested $200 in the US. One can anticipate an annual fluctuation in interest rates. 5%, 6%, and 4% interest rates would apply in 2016, 2017, and 2018. The FV in 2018 would be what? The following will be done in Excel: Present Value (PV): Excel Financial FunctionIt is simpler for you to determine PV if you understand how to compute FV. How to do it is as follows: The Excel Financial Functions are represented as

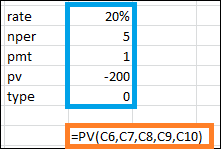

Example:The potential return on an investment made in US $200 in 2018. The amount has been paid each year. The annual interest rate is 20%. What is the current PV going to be? We will enter the equation in Excel as follows:

=US $77.38 Net Present Value (NPV): Excel Financial FunctionThe total for all cash flows, both positive as well as negative, over some time, is called net present value. Using Excel, here is how we will show it:

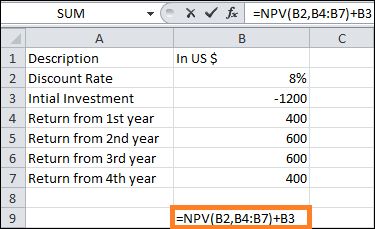

Those that are positive would be viewed as inflows, and those that are negative would be viewed as payments. Example:

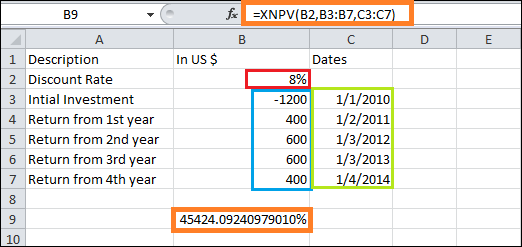

=45508.4948% XNPV: Excel Financial FunctionWith a little modification, this financial function resembles the NPV. The income and payout, in this case, are not recurring. For every payment and income, fairly precise dates are mentioned. We shall compute it as follows: The formula represents Excel financial functions

Example:

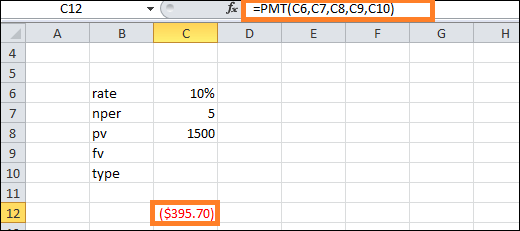

PMT: Excel Financial FunctionAs used in Excel, the term PMT refers to the periodic payment needed to settle an account with a fixed interest rate over a specific duration. Now, let us examine the process of computing it using Excel.

Example:In five years, the US $1500 must be paid in full. The annual payment is required, with an interest rate of 10% p.a. Learn what the PMT is. We'll compute it using the following formula in Excel.

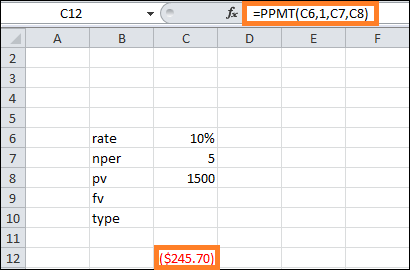

PPMT: Excel Financial FunctionThis is a different PMT variant. The PPMT computes principal repayment using a fixed interest rate and constant monthly instalments, which is the only distinction. This is the PPMT calculation formula: Excel's Financial Functions using PPMT

Example:

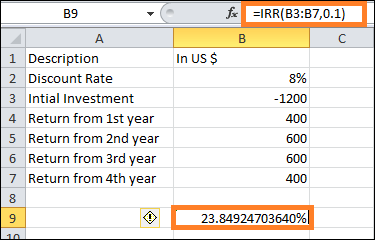

Internal Rate of Return (IRR): Excel Financial FunctionThe company employs IRR to determine the profitability of any fresh project or investment. The firm is profitable if its internal rate of return (IRR) exceeds the hurdle rate, which is the difference between the acceptable rate and the average cost of capital. Let's see how to calculate IRR in Excel.

Example:

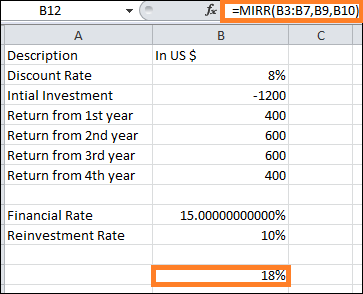

Internal Rate of Return Modified (MIRR): Excel Financial FunctionThe Internal Rate of Return lags behind the Modified Internal Rate of Return by one step. MIRR is a business metric to indicate an investment's profitability. When calculating MIRR, NPV is assumed to be zero. This is how to use Excel to calculate MIRR:

Example:

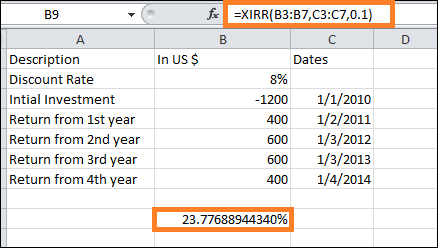

XIRR: Excel Financial FunctionHere, the IRR must be determined, and the cash flow dates must be precise. There isn't any other distinction between XIRR and IRR. Check out this Excel financial function calculation for XIRR.

Example:

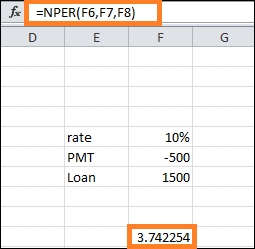

NPER: Excel's Financial FunctionIt is merely the amount of time needed to repay the debt. Let's examine how to compute NPER using Excel.

Example:

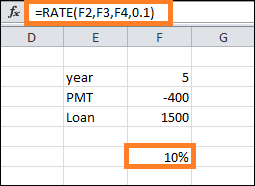

RATE: Excel Financial FunctionUtilising Excel's RATE function, one may ascertain the interest rate necessary to fully settle the debt over a specified timeframe. Here is an example of using Microsoft Excel to calculate the RATE financial function.

Example:

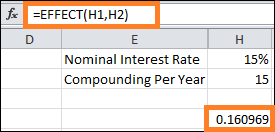

EFFECT: Excel Financial FunctionWe may comprehend the effective yearly interest rate by using the EFFECT function. It is simple to determine the effective rate if we know the nominal interest rate and the total number of annual compounded events. Let's look at how to use Excel to generate the EFFECT financial function:

Example:

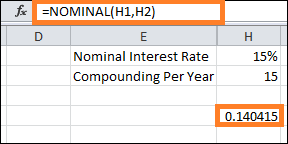

NOMINAL: Excel Financial FunctionThe NOMINAL rate of the year can be determined once we know the effective yearly rate and the total number of periods of compounding in a year. Let's examine the steps involved in doing it in Excel.

Example:

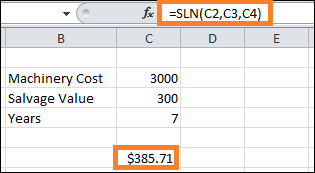

SLN: Excel Financial FunctionWe can compute depreciation using a straight-line method by using the SLN function. Here is how we will examine the SLN financial function in Excel:

Example:

Next TopicHOW TO ADD RUPEE SYMBOL IN EXCEL

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share