Debt consolidation calculator excelThe Debt Consolidation Calculator: Understanding Its Purpose?"Debt consolidation occurs when a borrower merges several existing high-interest loans with low-interest loans to create a consolidated loan. Additionally, the borrower may use monthly savings towards loan repayment." This will lower the borrower's debt and allow them to save interest. Thanks to the debt consolidation calculator, any such computations will be simple in this case. It is a tool that determines if loan consolidation is viable based on many comparison levels. The comparison will be made based on several parameters, such as monthly Payment, total interest, or payout duration. Understanding the Debt Consolidation CalculatorThe debt consolidation calculator facilitates the restructuring of debt by combining many loans into one with a reduced interest rate resulting in smaller monthly payments. A reasonable sum for each could be obtained if the debt consolidation calculator performs accurately. This will make managing loans and their monthly repayments simpler and less complicated. It streamlines and expedites the procedure. The borrower must input all loan details into the calculator, including real estate, cars, credit cards, etc. The combined loan amount is then adjusted to reflect the borrower's preferred interest rate and monthly payment schedule. The borrower can, therefore, use this tool to modify the terms and circumstances until they reach a payment that fits their financial objective and budget. However, there are benefits and drawbacks to using a debt consolidation calculator. Therefore, it is essential to have a thorough understanding of the process and its implications when selecting a suitable calculator to ensure the best outcome. It's crucial to remember that not all loans can be consolidated, so borrowers shouldn't anticipate being able to do so with each kind of loan that has been taken out. Consolidating debt, including credit card debt, affects credit score; which is another important detail about that calculator. A decline in creditworthiness is assumed due to the lower loan interest and instalment, which impacts the score. This could impact the score by several points, but it's just momentary. People with poor credit scores should, therefore, avoid it while it keeps the debt management procedure simple. How Do You Compute?The process involves the following steps: Step 1: To start, figure out how much the different loans' outstanding sums are currently worth. PV = L*[1-(1+i)^-n/r] Step 2: Using the formula below, determine the latest instalment amount according to the current outstanding balances using a reduced interest rate. Installment for a New Loan = [∑PV*R*(1+R)^N]/[(1+R)^N-1 Step 3: Determine how long it will take to pay off the loan. nPVA = In[(1-PV(R)/L')^-1]/In (1+R) Whereas,

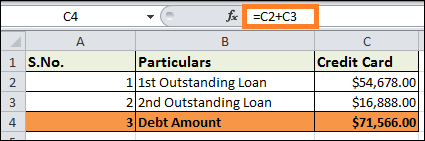

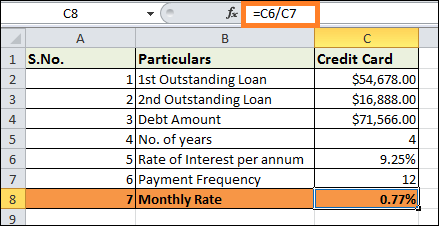

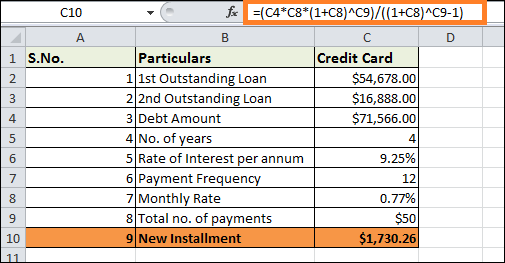

In the financial industry, this free debt consolidation calculator technique is commonly utilized to consolidate loans to reduce loan burden. It enables the borrower to get clarity on several issues. Primarily, it helps determine affordability and assess whether the borrower can manage the additional instalment. Secondly, it provides a means of making a budget and allocating funds to loan repayment, instilling discipline throughout the process. Lastly, utilizing the online debt consolidation calculator allows the borrower to set aside money for unexpected expenses, which is essential from the financial planning perspective. ExamplesWith the aid of some pertinent instances, which are provided below, let's examine the idea of the free debt consolidation loan calculator: Example 1:Let's say that Mr A owes $16,888 and $54,678 in outstanding debts, respectively. Mr. A chose to combine them into a four-year loan with a 9.25% interest rate because the interest rate is quite high. Using the provided information, you must figure out the new instalment amount for the combined debt. Solution

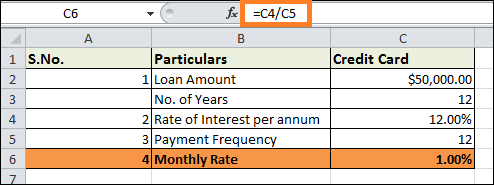

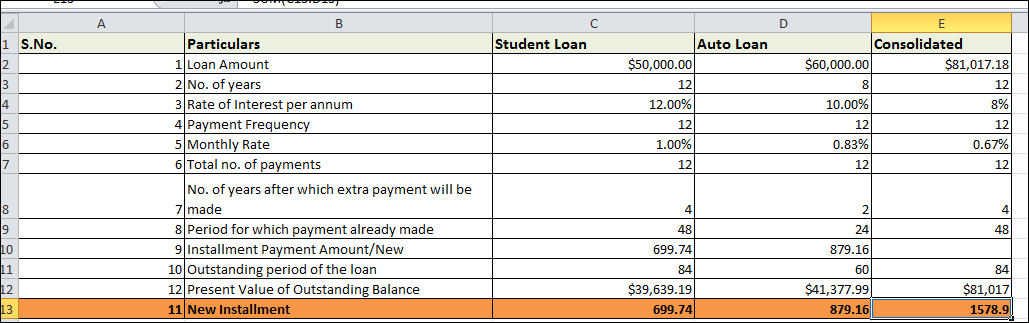

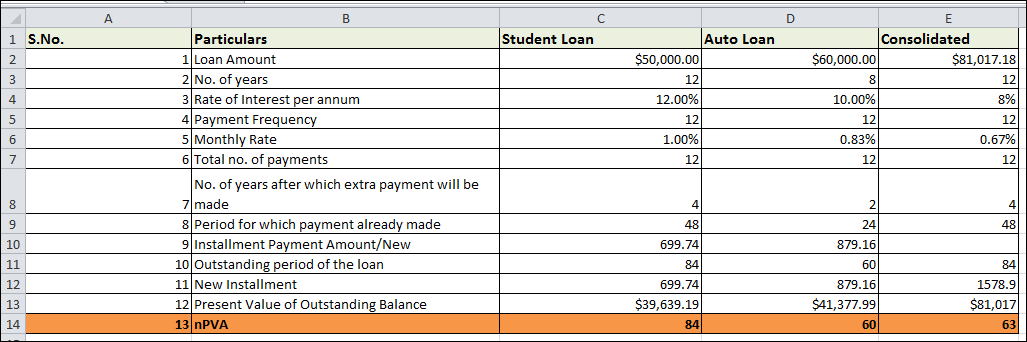

= [$71,566 x 0.77% x (1+0.77%)^48] / [(1+0.77%)^48-1] =$1,730.26 Therefore, Mr. A must pay $1,559.37 monthly for four years to consolidate the loan. Example 2:The following details relate to the two loans that Sunita Williams took out: The Bank has offered Sunita the opportunity to combine all her debt into one with the longest remaining term. She is making payments of $619.88 and $913.07 each month. 10% interest is the rate that is being given. The new consolidated loan instalment amount and the maximum repayment period must be determined using the information provided. Solution: The present value of the current outstanding debt balance must be determined. This can be done using the formula below. Loans for students1% is the applicable monthly interest rate.

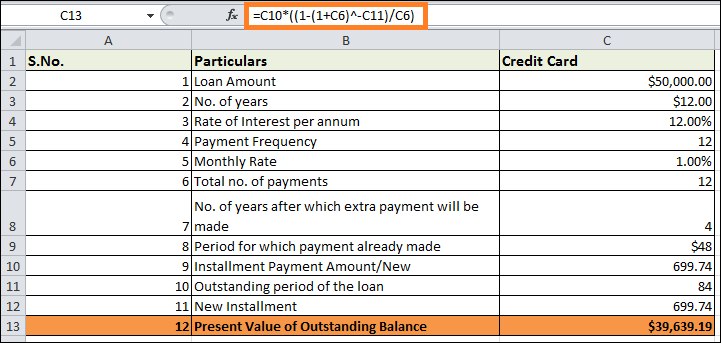

PV = L*[1-(1+i)^-n/r]

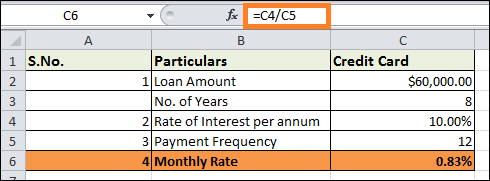

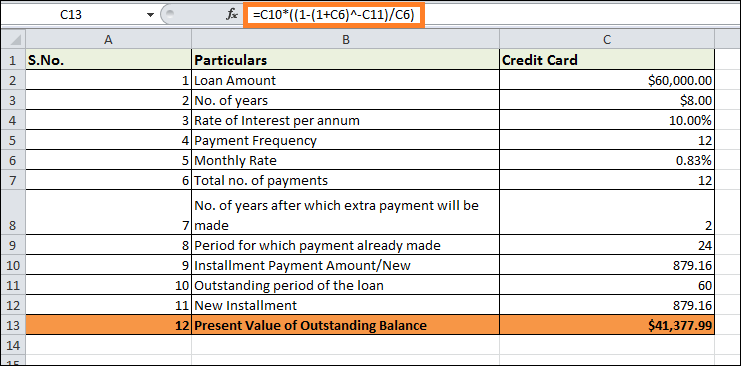

$699.74*[1-(1+1%)-84/1%] is the current value =$39,639.19 Auto Loan The interest rate that applies every month is 10/12, or 0.83%.

PV = L*[1-(1+i)^-n/r]

$879.16 x [1 - (1+0.83%)-60 / 0.83%] is the present value of the auto loan. = $41,377.99

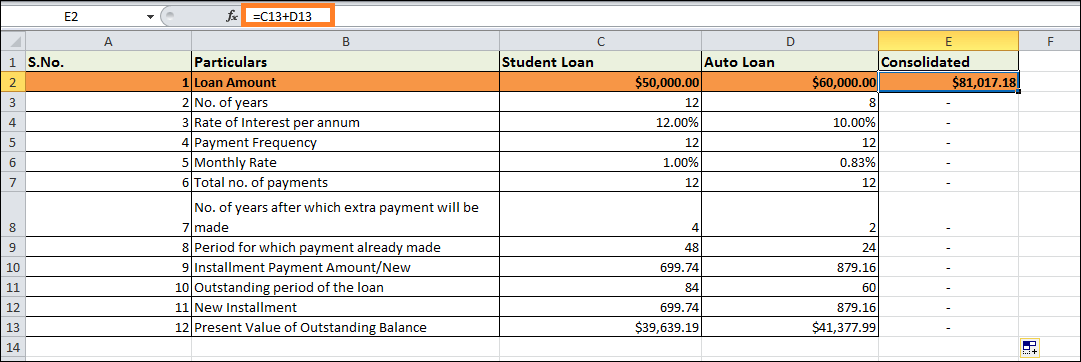

The total amount owed on the loan is =$39,639.19 + $41,377.99 =$81,017.18

New Loan Installment: [∑PV x R x (1+R)^N]/[(1+R)^N-1

= [81,017 x 0.67% x (1+0.67%)^84] / [(1+0.67%)^84-1]. = $1,578.9 Duration of a consolidated debt repayment

nPVA = In[(1-PV(i)/L')-1]^-1]/In(i+1)

Because of this, the examples above provide a clear and thorough explanation of the idea and the processes and knowledge needed to utilise the calculator. BenefitsHere are a few noteworthy benefits of using the online debt consolidation loan calculator.

DrawbacksThe following are a few drawbacks of the idea.

Notable and significant pointsWhen consolidating debt, keep the following in mind.

The lesson here is that, regardless of whether the loan would be secured/unsecured, the borrower has two options: either consolidate the debt and pay it off sooner by paying less interest or use liquidity constraints to force the borrower to pay off the debt sooner. These combined loans are transferred rather than erased.

Next TopicDGET FUNCTION IN EXCEL

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share