Carried Interest Calculation in ExcelIn finance, carried interest, or carry, refers to a percentage of an investment's returns provided for the investment manager specifically for use in alternative investments. The manager gets this evaluation fee in return for improving performance. We can quickly determine the carried interest by using Microsoft Excel. Today's post will teach us four efficient methods for computing carried interest in Excel, along with relevant examples. Fundamentals of Carried InterestA portion of the income received by general partners in hedge funds, private equity, and venture capital is allocated to carried interest. As a result of their involvement in the fund rather than their original investment, general partners have access to the carried interest. As a performance fee, carry interest ties the general partner's earnings to the fund's performance. The minimum return required by the fund to qualify for carried interest is known as the hurdle rate. Generally, carried interest is subject to a lower tax rate than ordinary income since it is seen as a capital gain that will accrue over time. Carried Interest in Private EquityCarry interest is the term used to refer to a private equity fund/fund manager's share of the profit received upon selling an investment. It represents the largest share of the fund manager's total revenue. A distribution waterfall was a way to allocate capital gains or investment income to investors. Payouts are restricted. General partners are arranged in a hierarchy known as the distribution cascade, which is often associated with private equity firms. The general distribution formula used in private equity investments is, Carry Distribution = (X-Y*(1+H))*I

Here,

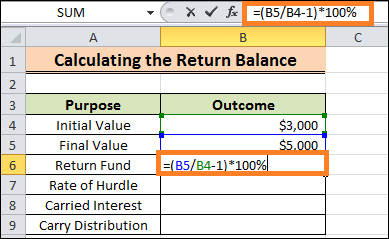

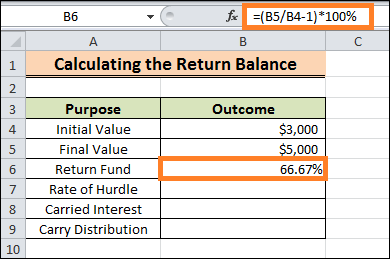

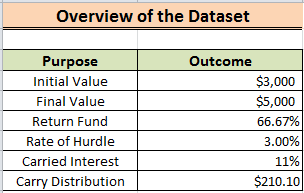

Excel Formulas for Computing Carried Interest: Step-by-Step GuideConsider the following scenario: we have access to a dataset that details the carried interest calculation for the ABC organisation. We will determine a carried interest using our dataset. This mathematical method makes it simple to compute a carried interest in Excel. The dataset for today's challenge is summarised here.

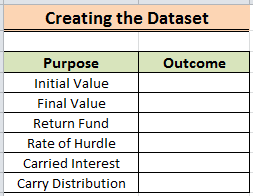

Step 1: Make a dataset using the appropriate parameters We're going to go into the carried interest section now. Starting balance, ending balance, percentage of funds transferred after multiple passes, and so forth are a few examples.

Step 2: Determine the Fund Return as a Percentage We will use the mathematical formula within this part to determine the fund/balance transfer. The fund or balance return is a proxy for the investment fund's performance. For example, the original sum invested by ABC Group was $3000. After multiple passes, the final total was $5000. We will use our dataset to compute the fund or balance transfer. Let's learn by doing as instructed here!

= (B5/B4-1)*100%

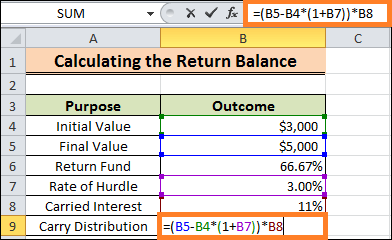

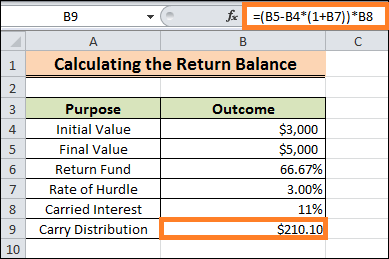

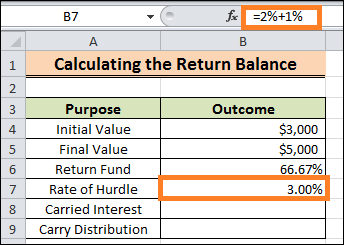

Step 3: Assess the Hurdle Rate A project's or investment's "hurdle rate" is the lowest Rate at which a return is required. Hurdle rates assist companies in choosing whether to move forward with a specific project. Higher hurdle rates typically correspond to more risky efforts, while lower rates are linked to less risky ones. The hurdle rate formula is as follows: Hurdle Rate = Cost of Capital + Risk Premium

For example, if the price of capital for the ABC group equals 2% while the risk of premiums is 1%, the Rate of hurdles becomes 3%.

Step 4: Establish Carry Distribution and Carried Interest Carry-forward interest is the portion of the total fund return that the investment fund bills as a performance fee. At 11%, the ABC group has carried interest. We shall, therefore, use our dataset to compute the carry distribution. To learn, let's adhere to the guidelines below!

= (B5-B4*(1+B7))*-B8

Next TopicConvert Negative to Positive

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share