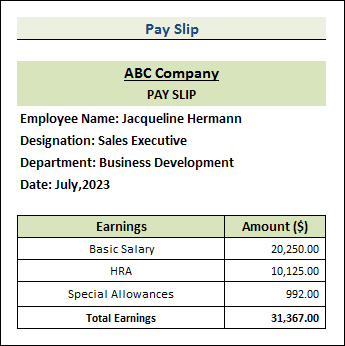

HRA Calculation in ExcelBefore using Excel to compute it for a basic wage, we need to understand what HRA implies. It alludes to the House Rent Allowance in its entirety. In essence, we receive a portion of our gross pay in addition to our base pay and other benefits. It only applies to us when we rent an apartment. To take advantage of the HRA exemption during yearly tax payments is the ultimate purpose of calculating HRA on basic salary. Calculate HRA on Basic Salary in Excel Using These 3 Easy StepsThree quick and simple ways are available in Excel to compute HRA on basic income. Once we have the three outcomes, the least amount of HRA will be determined as the ultimate output. We build up a dataset of an employee's pay slip to start the computation. The Earnings sectors are shown in Cells B12:C14, their respective amounts and the overall salary for July.

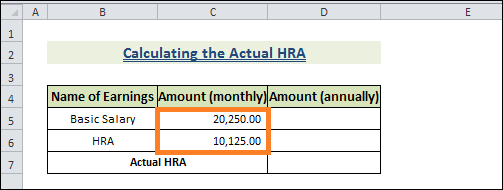

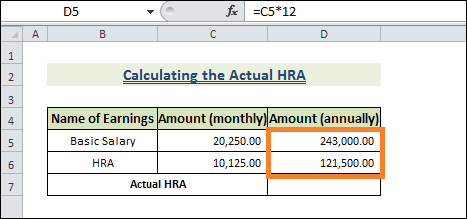

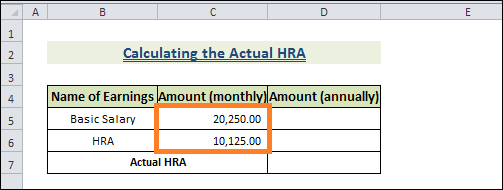

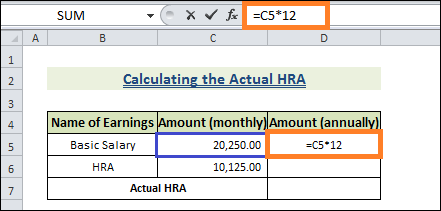

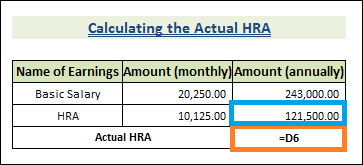

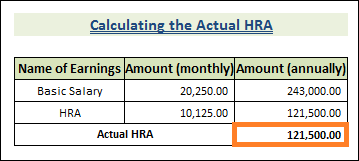

We will now use the following three ways in Excel to compute HRA on basic salary: Method 1: Using Excel, Calculate the Actual HRA based on a Basic SalaryThe amount the employer pays the employee each month, in addition to the base wage, is the actual HRA. This is how we determined the actual HRA based on base pay for one year or 12 months using Excel:

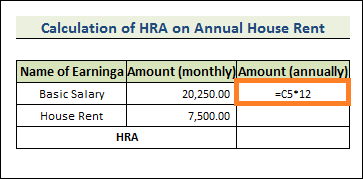

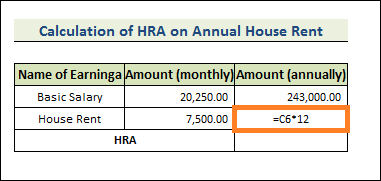

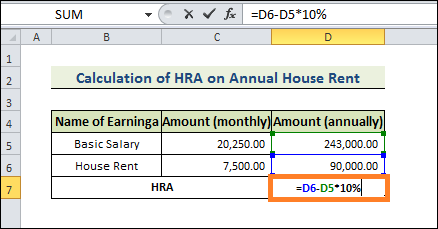

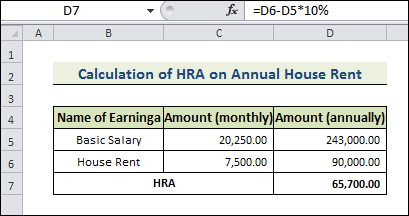

Method 2: Determine HRA using Basic Salary and Annual House RentWe will compute HRA using Excel in the second technique, which is based on annual housing rent and base pay. The formula that follows is as follows: These easy methods will help us examine the computation now:

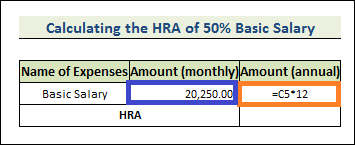

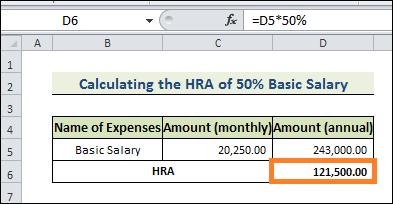

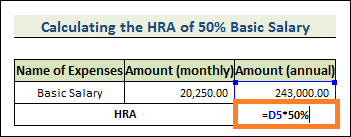

Method 3: Utilise Excel to obtain HRA at 50% of the basic payUsing 50% of the base pay as a starting point is the final way for calculating HRA. Now, let's follow the steps below:

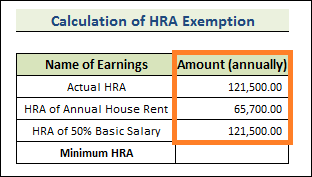

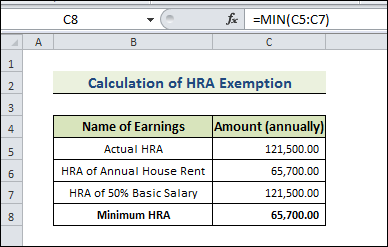

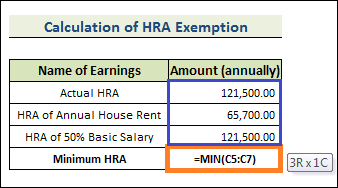

How to Determine Excel's HRA ExemptionAfter determining the three HRA amounts required to be exempt from paying taxes, we will now compute the minimum HRA amount required. The above data make it clear what the minimal amount is. If not, we can proceed with the following procedure:

Points to Keep in MindWe need to consider the following while calculating HRA on a basic salary:

Next TopicImprove your Excel

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share