GST invoice format in excel

Introducing a Goods and Services Tax (GST) invoice format in Excel underscores the importance of a systematic and organized approach to financial documentation. In the realm of modern business, maintaining accurate records of transactions is crucial for regulatory compliance and transparent financial management. The GST invoice, a cornerstone of this process, serves not only as a proof of sale but also as a comprehensive breakdown of the goods or services provided, along with associated tax details. Crafting an effective GST invoice in Excel requires a meticulous design that captures essential information, ensuring seamless communication between businesses and their clients while adhering to the intricate tax structures imposed by GST regulations.

In the dynamic landscape of commerce, the Excel spreadsheet emerges as a powerful tool for creating, customizing, and managing GST invoices. Its versatile features allow businesses to effortlessly structure key elements, from the header containing business information to the detailed breakdown of products or services, associated taxes, and payment details. As the backbone of transparent financial transactions, this GST invoice format in Excel not only facilitates compliance with tax regulations but also enhances the professionalism of business interactions, fostering trust and clarity in the exchange of goods and services.

What do we understand by the term GST invoice format in excel?

The term "GST invoice format in Excel" refers to a structured and organized template created in Microsoft Excel to generate invoices that comply with the Goods and Services Tax (GST) regulations. In many countries, including India, GST has replaced the previous tax system, and businesses are required to issue invoices that accurately reflect the GST details for their transactions.

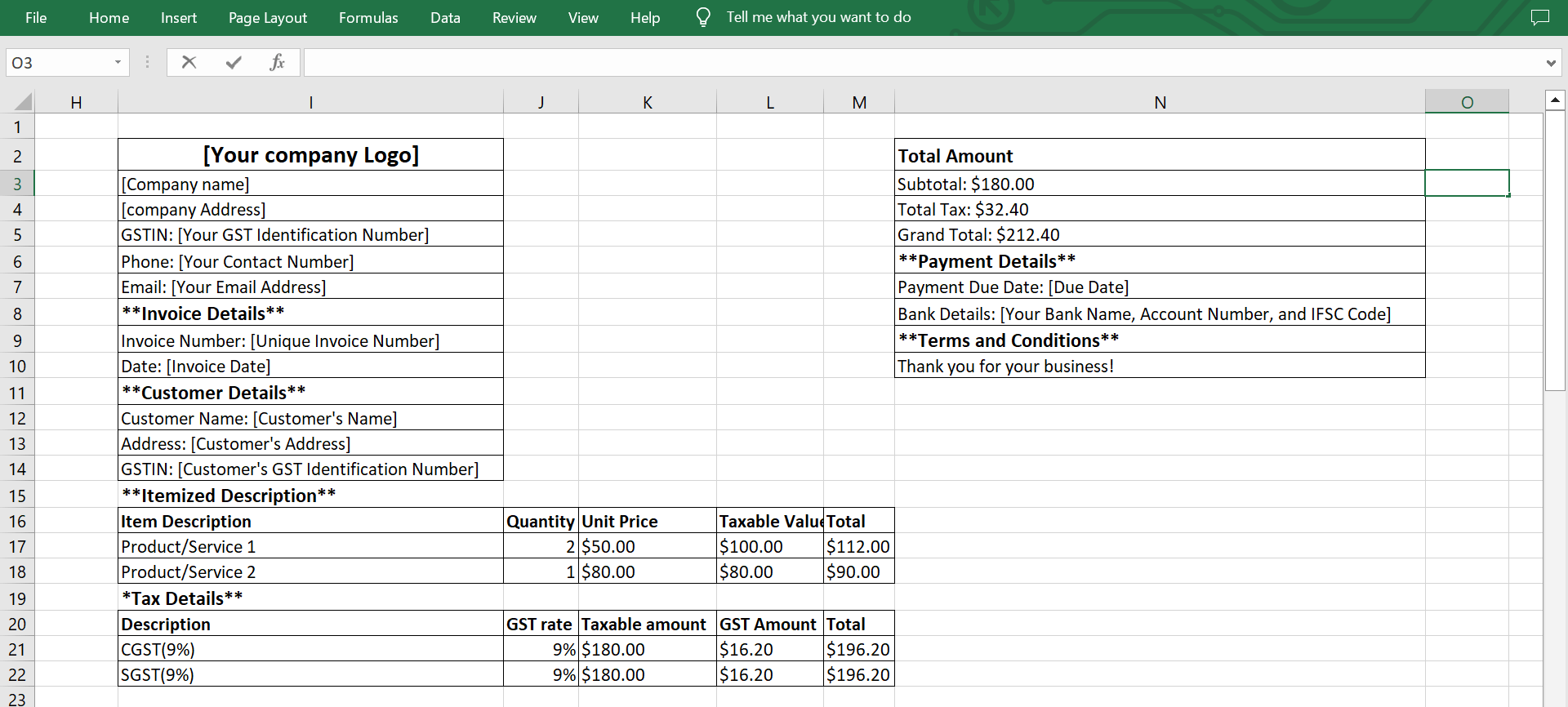

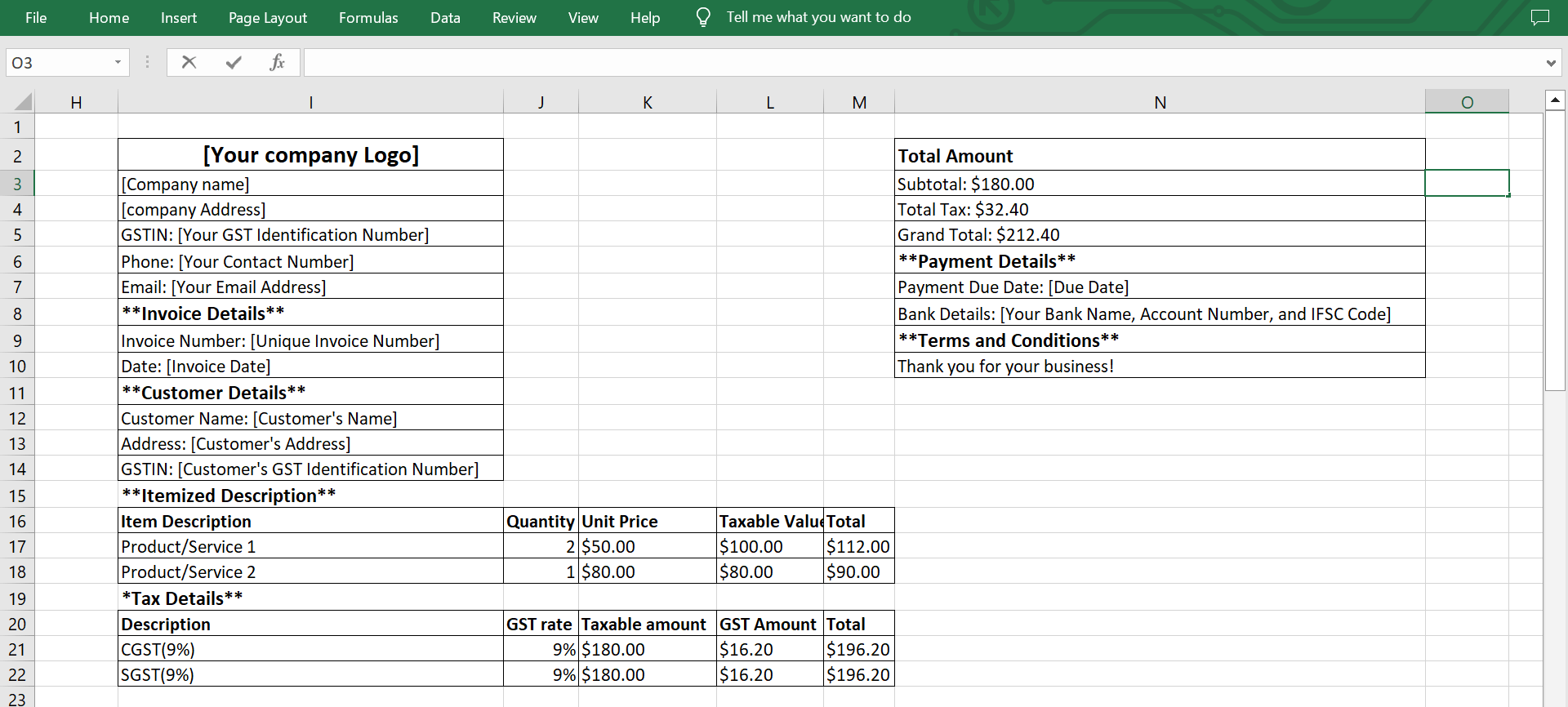

Creating a GST invoice format in Excel involves designing a spreadsheet that includes specific sections for essential information such as the business details, customer information, invoice number, date, itemized descriptions of goods or services, their quantities, unit prices, applicable GST rates, and corresponding tax amounts. The format ensures a systematic presentation of transaction details, making it easier for businesses to calculate and communicate the tax implications of their sales.

Using Excel for GST invoicing provides a flexible platform where businesses can customize the layout according to their specific needs while adhering to the regulatory requirements. This approach facilitates efficient record-keeping, transparency, and compliance with GST laws, streamlining the invoicing process for both businesses and their clients.

Sample Format:

How to create GST invoice in excel?

The following are the procedures you must take in order to establish a GST invoice format in Excel:

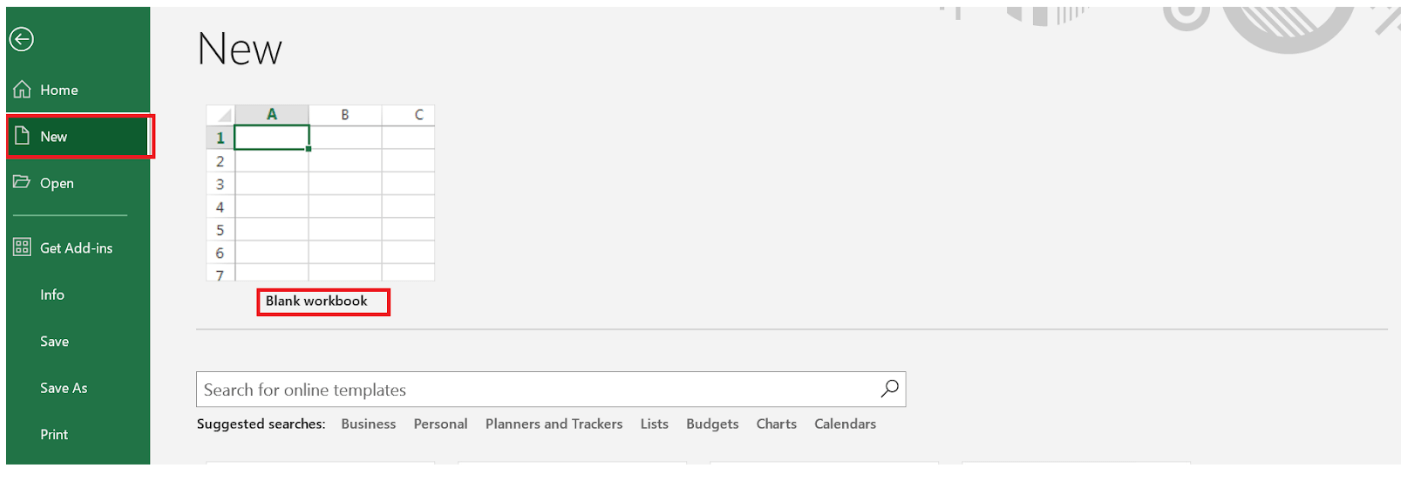

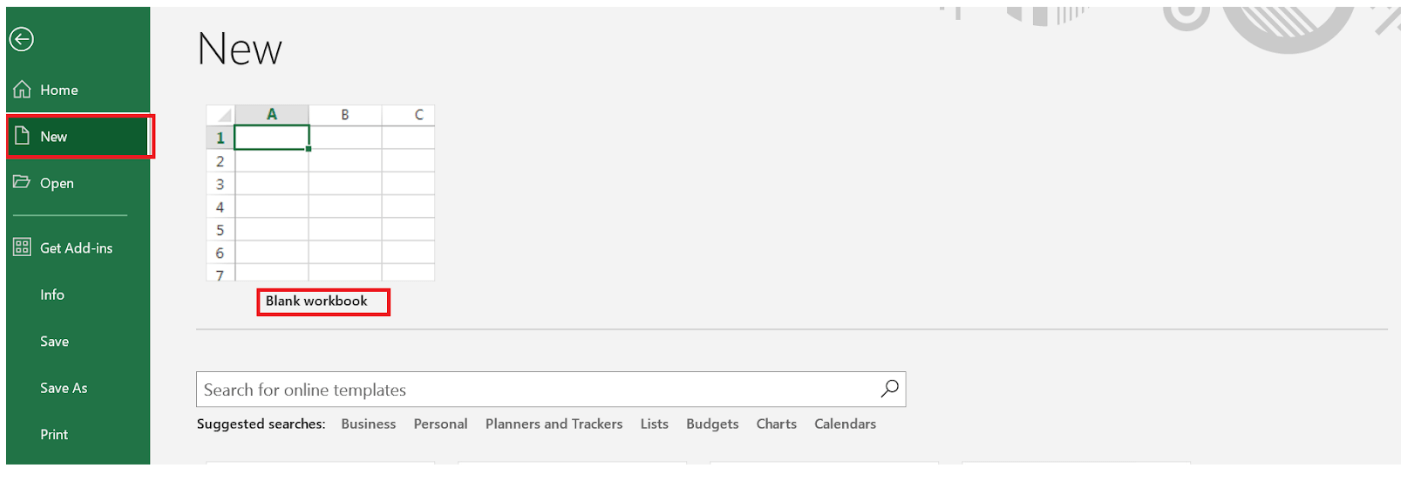

Step 1: Launch Microsoft Excel and choose File from the menu. After selecting "new," press "blank workbook."

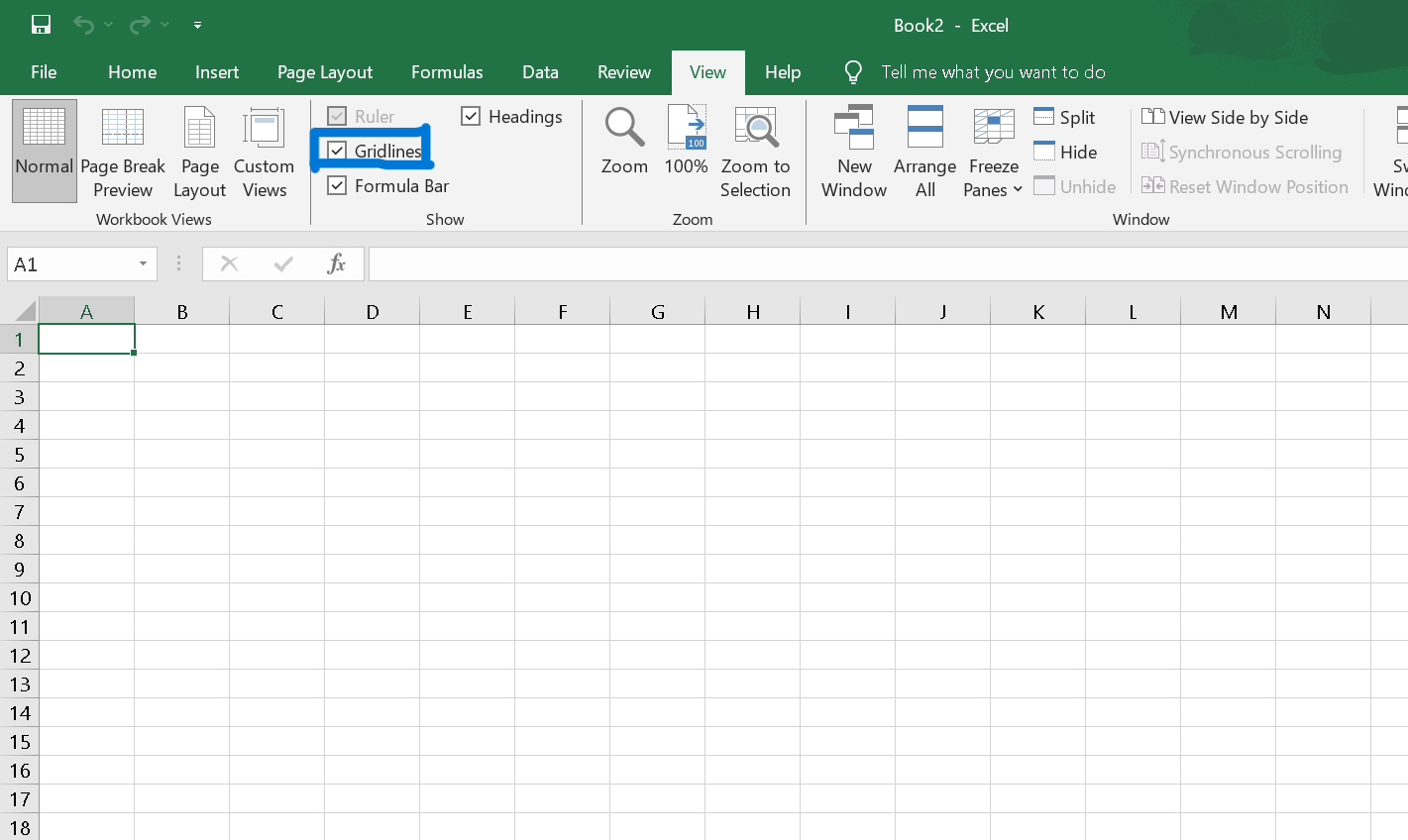

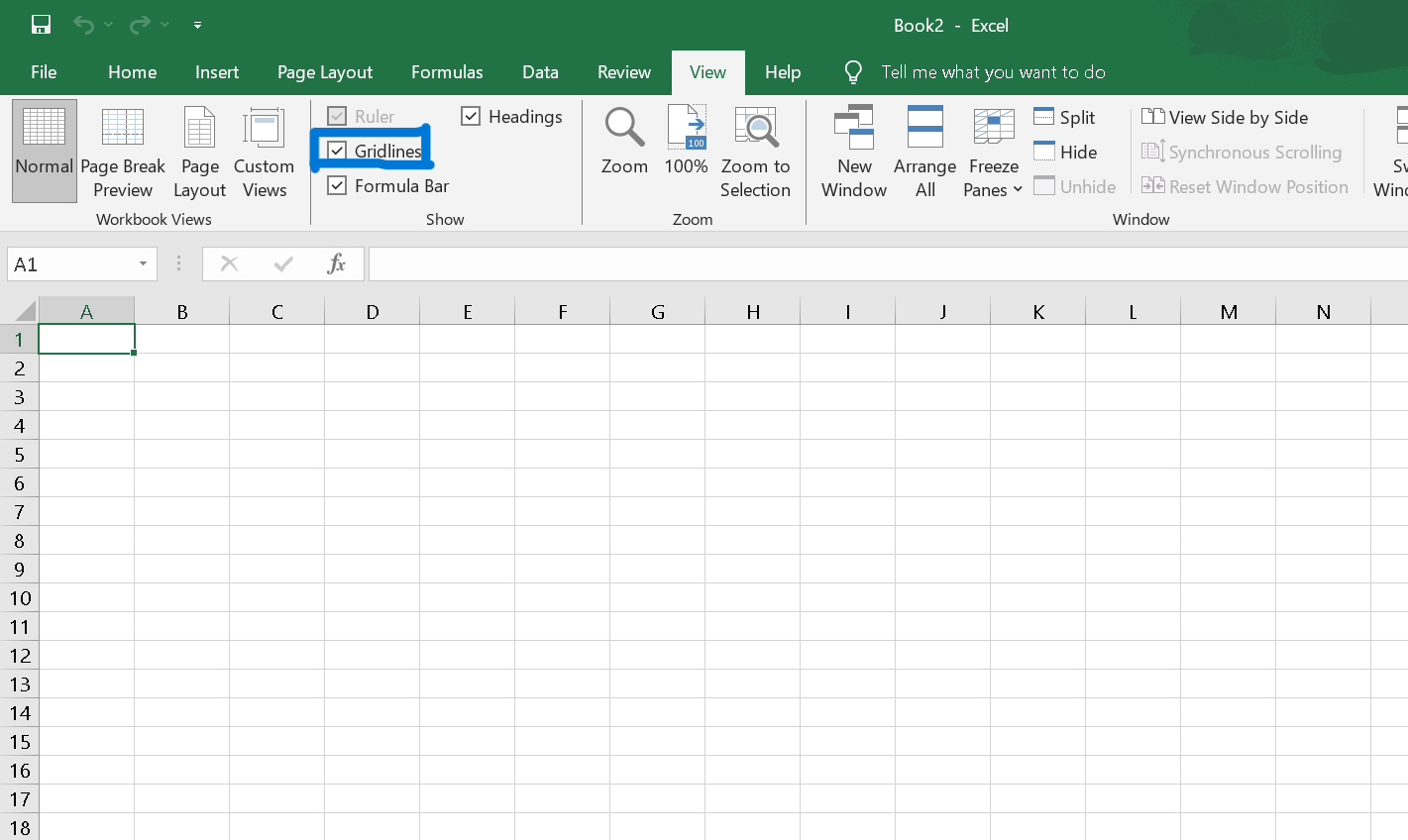

Step 2: The gridlines must be taken out next. Select "view" and make sure the "gridlines" column is not checked.

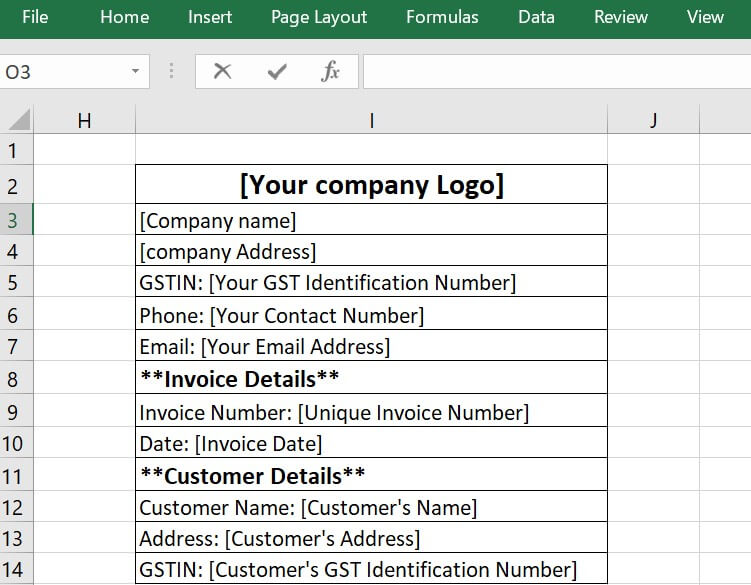

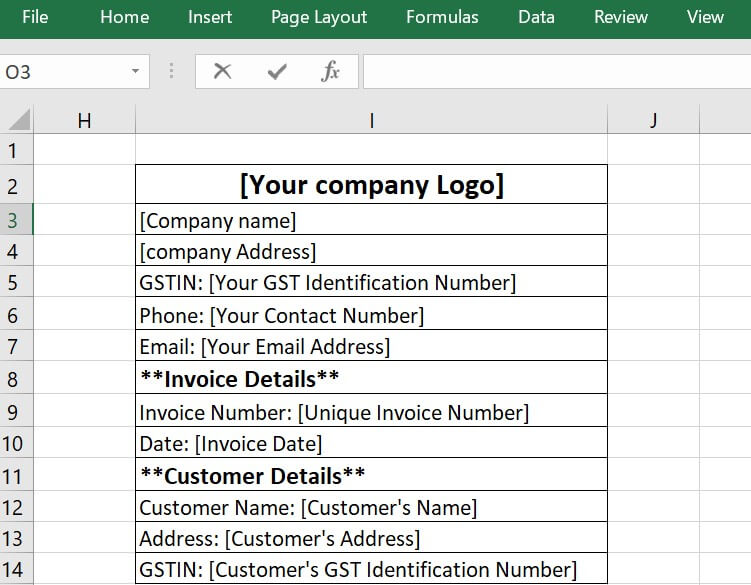

Step 3: After finishing the previous step, add your company's logo and any relevant data, including your address, business name, GSTIN, and phone number.

Step4: Enter the client's information. This is a one-time process since Excel will keep this data for use in future transactions.

Step 5: Enter the details of the sale of the products or services. Add information about the pricing, the amount total, and the quantity.

Step 6: Complete the procedure by providing your bank information, your selected method of payment, and the deadline, thereby completing the main goal of the GST invoice.

How can one make use of an GST invoice format in excel?

Using a GST invoice format in Excel provides businesses with an efficient and organized way to document their transactions while ensuring compliance with Goods and Services Tax (GST) regulations. Here's a step-by-step guide on how to make use of a GST invoice format in Excel:

- Download or Create a GST Invoice Template:

You can either create your own Excel template or find a pre-designed GST invoice template online. Ensure that the template includes all the necessary fields, such as business details, customer information, itemized description, tax details, and payment information.

- Customize the Template with Your Business Information:

Insert your company logo, name, address, GSTIN, and contact details in the header section of the invoice. This personalization helps establish your brand identity.

- Fill in Invoice Details:

Each time you make a sale, open the template and fill in the unique invoice number and date. This information helps in tracking transactions and managing your financial records.

- Enter Customer Details:

Input the customer's name, address, and GSTIN if applicable. This information is crucial for GST compliance and helps in maintaining a database of your clients.

- Itemized Description:

List the products or services provided in the itemized section. Include details such as item description, quantity, unit price, taxable value, and total amount for each line item.

- Tax Details:

Specify the applicable GST rates for each product or service, and let Excel automatically calculate the tax amounts. Ensure that you differentiate between CGST, SGST, and IGST as per the nature of the transaction.

- Calculate Totals:

Use Excel functions to calculate the subtotal, total tax amount, and grand total based on the itemized details. This ensures accurate financial calculations.

- Include Payment Terms and Bank Details:

Specify the payment due date and provide your bank details. This information helps streamline the payment process and ensures clarity for your customers.

- Terms and Conditions:

If there are specific terms and conditions associated with the transaction, include them in the designated section. This helps in setting expectations and avoiding misunderstandings.

- Save and Share:

Save each completed invoice with a unique file name or number for easy reference. Share the invoice with your customer through email or print a hard copy for physical records.

- Regularly Update and Review:

Periodically review and update the template to accommodate changes in your business requirements or any modifications in GST regulations. This ensures that your invoicing process remains accurate and compliant.

What are the Invoice payment collection methods available?

Various payment collection methods are available for businesses to receive payments from their customers. The choice of method depends on factors such as the nature of the business, customer preferences, and the convenience of both parties. Here are some common invoice payment collection methods:

- Cash Payments:

Customers can make payments in cash either in-person or through designated collection points. This method is straightforward but is often more applicable to retail transactions.

- Cheque Payments:

Customers may issue a cheque as payment, which the business can deposit into its bank account. Cheques are still used in some business-to-business transactions, but their use has declined in favor of more modern methods.

- Bank Transfers:

Bank transfers, also known as wire transfers or electronic funds transfers (EFT), involve customers transferring funds directly from their bank account to the business's bank account. This method is commonly used for larger transactions and international payments.

- Credit and Debit Cards:

Businesses can accept payments through credit and debit cards. Card payments are convenient for both parties and are widely used for online and in-person transactions.

- Mobile Payments:

Mobile payment methods, such as digital wallets and mobile banking apps, enable customers to make payments using their smartphones. Popular options include services like PayPal, Venmo, Google Pay, and Apple Pay.

- Online Payment Gateways:

Businesses can integrate online payment gateways into their websites to allow customers to make payments securely. Examples of payment gateways include Stripe, PayPal, Square, and Braintree.

- Recurring Billing:

For subscription-based services, businesses often set up recurring billing, where customers authorize automatic payments at regular intervals. This is common for services like software subscriptions and membership fees.

- ACH Payments:

Automated Clearing House (ACH) payments are electronic transfers that allow customers to make payments directly from their bank accounts. ACH is commonly used in the United States for bank-to-bank transfers.

- Invoice Financing:

In some cases, businesses may choose to use invoice financing services. This involves selling outstanding invoices to a third party (factor) at a discount in exchange for immediate cash.

- Point of Sale (POS) Systems:

For in-person transactions, businesses use POS systems that accept various payment methods, including cards, mobile payments, and even contactless payments.

- Cryptocurrency Payments:

Some businesses accept payments in cryptocurrencies such as Bitcoin or Ethereum. This is less common but may be an option for tech-savvy customers.

Applications:

- Square:

Square offers a comprehensive suite of tools for businesses, including a point-of-sale system and online payment processing. It allows businesses to accept card payments, send invoices, and manage transactions.

- PayPal:

PayPal is a widely used online payment platform that enables businesses to send invoices and receive payments securely. It supports various payment methods, including credit cards and PayPal balances.

- Stripe:

Stripe is a popular online payment gateway that allows businesses to accept payments directly on their websites. It supports card payments, digital wallets, and ACH transfers.

- QuickBooks:

QuickBooks is accounting software that provides invoicing and payment processing features. It allows businesses to create professional invoices and accept payments through various methods.

- FreshBooks:

FreshBooks is an invoicing and accounting platform that facilitates easy creation of invoices, tracking expenses, and accepting online payments. It's particularly suitable for small businesses and freelancers.

- Zoho Invoice:

Zoho Invoice is an online invoicing software that allows businesses to create and send professional invoices. It includes features for online payment processing, making it convenient for businesses and clients.

- Wave:

Wave is a free accounting and invoicing platform that enables small businesses to create invoices and receive payments online. It includes features for invoicing, accounting, and receipt scanning.

- Venmo:

Venmo, owned by PayPal, is a mobile payment app that allows individuals and businesses to send and receive payments easily. It's commonly used for peer-to-peer transactions.

- Braintree:

Braintree, owned by PayPal, is a full-stack payment platform that provides tools for online and mobile payment processing. It supports various payment methods and is suitable for e-commerce businesses.

- Authorize.Net:

Authorize.Net is a payment gateway that enables businesses to accept payments online. It supports credit cards, e-checks, and digital wallets, making it versatile for various industries.

- Xero:

Xero is cloud-based accounting software that includes features for invoicing and online payment acceptance. It's suitable for small to medium-sized businesses.

- Square Invoices:

Square Invoices is a standalone invoicing tool that allows businesses to create and send invoices, accept card payments, and track payments. It integrates seamlessly with other Square products.

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now