Cash flow statement format in excelIntroductionA financial report that summarises a company's cash inflows and outflows over a given time period is called a cash flow statement. Together with the income statement and balance sheet, it is an essential part of financial statements. The three primary components of the cash flow statement are the operating, investing, and financing operations.

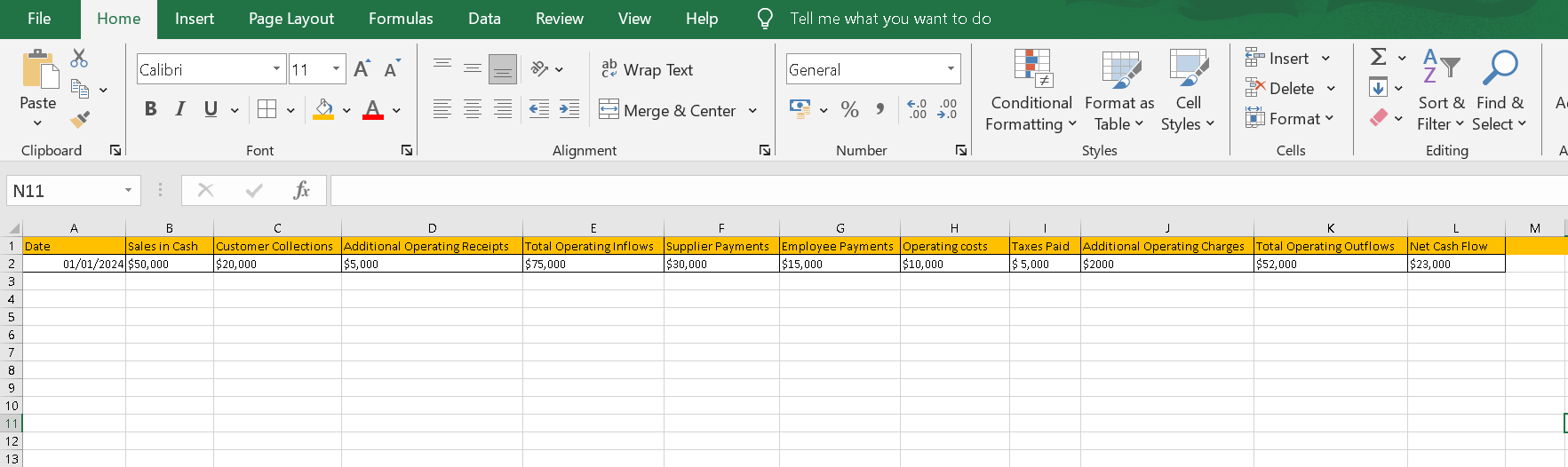

The cash flow statement is crucial for investors, analysts, and stakeholders to analyse a company's liquidity, financial health, and its capacity to satisfy short-term and long-term obligations. It provides a thorough understanding of a company's cash situation and its capacity to create and manage cash, which enhances other financial statements. Operating activities:Cash inflowThe cash generated by a company's main business operations is represented by the cash inflow from operational activities on the cash flow statement. It offers information on how successfully the business's fundamental operations-aside from cash flows from borrowing and investing-are producing cash. Transactions involving the selling of products or services and the corresponding operating expenses of the company are often included in operating activities. Example:To demonstrate how cash inflow from operational activities is computed, let's dissect a straightforward example:

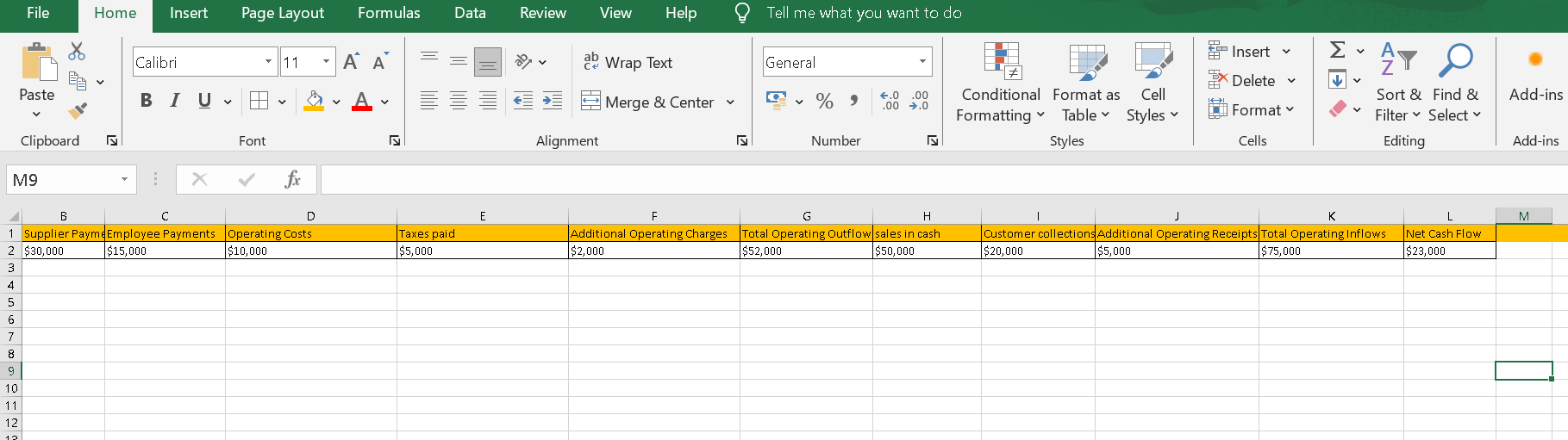

Cash OutflowCash payments made by an organisation as a part of its regular business operations are shown as cash outflow from operational activities in the cash flow statement. It includes the monetary outlays required to maintain the business's daily operations. Determining the effectiveness and long-term viability of an organization's operational performance requires an understanding of cash outflows from operating operations. Example:To demonstrate how cash outflow from operational operations is computed, let's take the following straightforward example: $30,000 in supplier payments Employee Payments: $15,000. Operating Costs: Ten Thousand $5,000 in taxes paid Additional Operating Charges: $2,000. Sales in Cash: $50,000 Customer Collections: $20,000. $5,000 in additional operating receipts

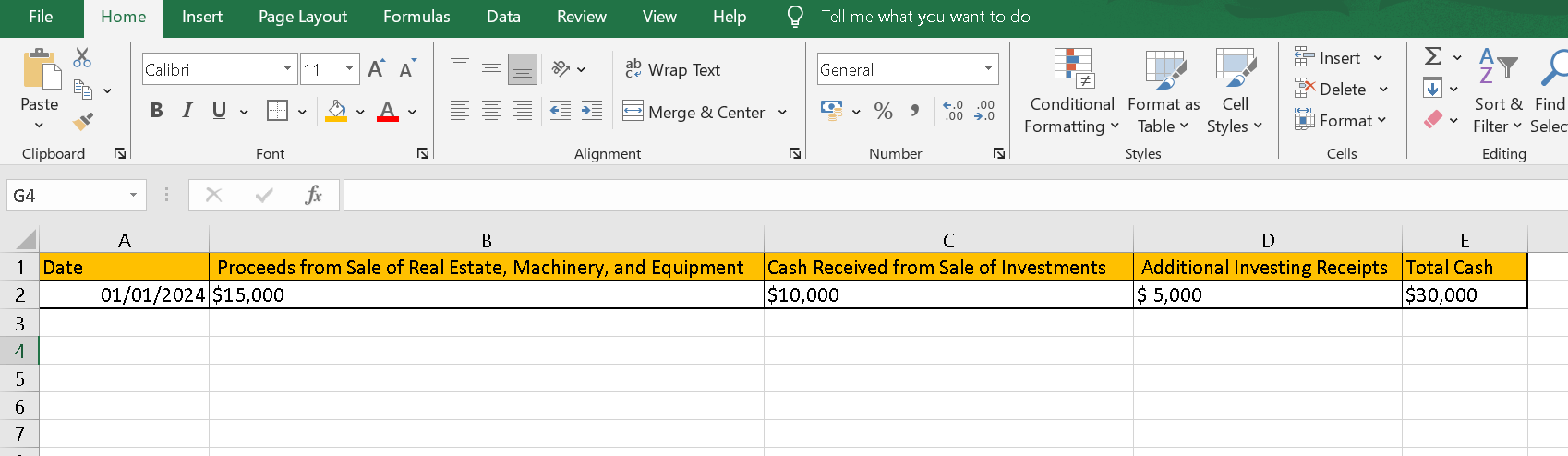

Investing activities:Cash inflow:The cash created by a firm via its investment operations during a given period is shown as cash inflow from investing activities in the cash flow statement. Long-term assets and investments, which are normally not a part of a business's daily operations but are crucial to its expansion, strategic goals, and financial stability, are acquired and disposed of as part of investing activities. Example:To demonstrate how cash inflow from investment activities is computed, let's take a straightforward example: $15,000. Proceeds from the Sale of Real Estate, Machinery, and Equipment $10,000 was received from the sale of investments. $5,000 in additional investing receipts $30,000 is the total cash inflows from investing activities (15,000 + 10,000 + 5,000). The firm received $30,000 in cash from different investment operations throughout the reporting period, as indicated by the example's total cash inflow from investing activities.

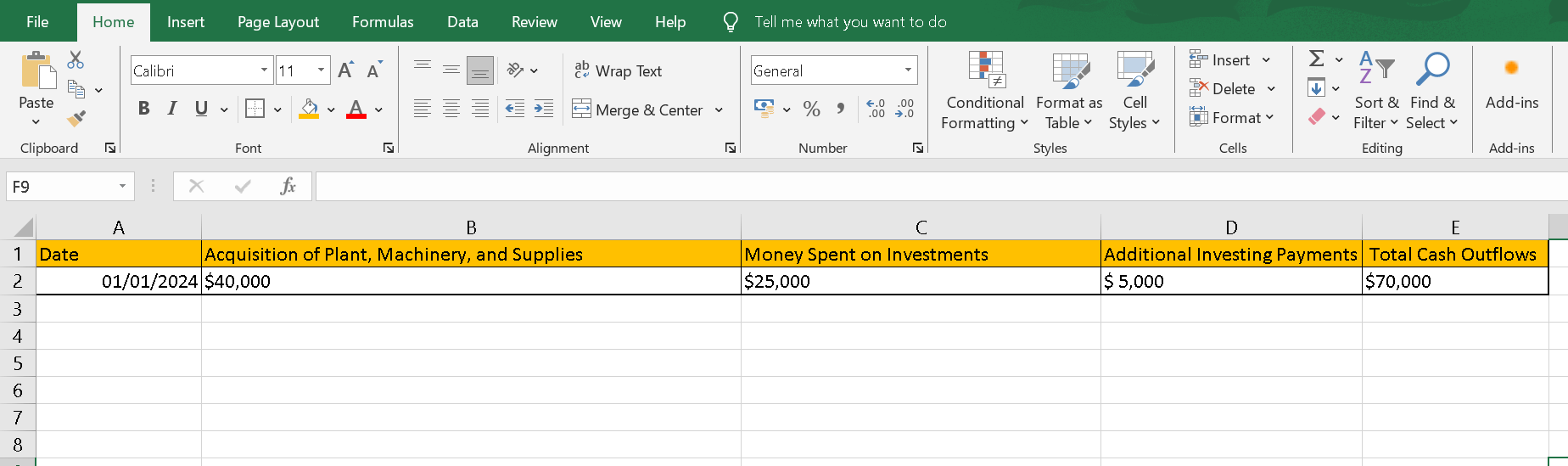

Cash outflow:A company's cash outflow for investing operations, or cash payments for long-term asset investments and other investment-related activities, is shown in the cash flow statement. These activities involve the purchase or sale of assets that have the potential to yield returns or increase in value over time, but they are not directly related to the day-to-day operations of the business. Example:To demonstrate how cash outflow from investment activity is computed, let's take the following straightforward example: Acquisition of Plant, Machinery, and Supplies (Capex): $40,000. $25,000 was spent on investments. $5,000 in additional investing payments The entire amount of money out of investing activities is $70,000 (40,000 + 25,000 + 5,000). In this case, the company's whole cash outflow from investing operations is $70,000, which suggests that it was used to buy long-term investments and assets.

Sample format:Step 1: Set Up the Excel SpreadsheetOpen Microsoft Excel and create a new blank workbook.

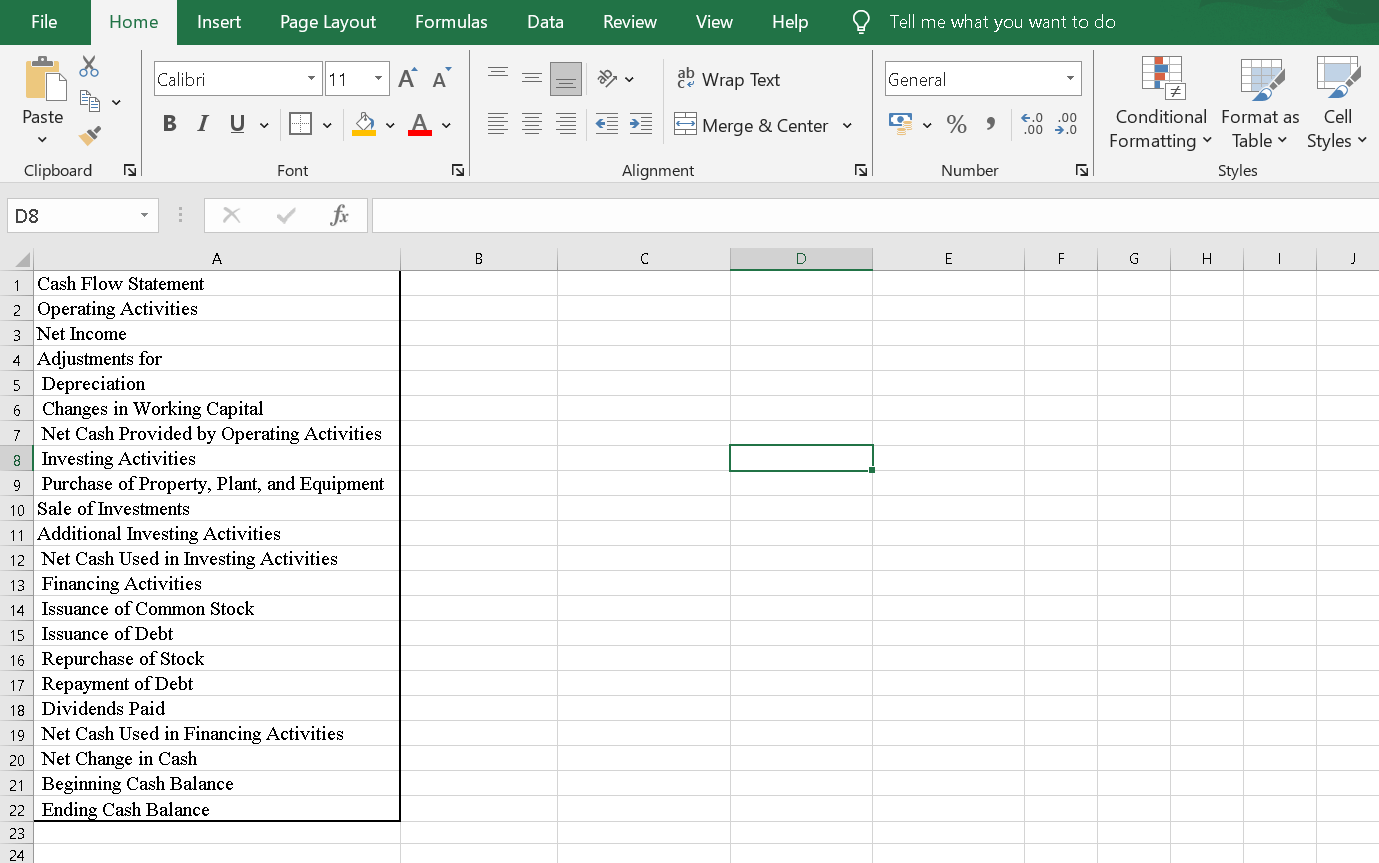

Label the columns in the first row for each section: A1: Cash Flow Statement A2: Operating Activities A3: Net Income A4: Adjustments for: A5: Depreciation A6: Changes in Working Capital A7: Net Cash Provided by Operating Activities A8: Investing Activities A9: Purchase of Property, Plant, and Equipment A10: Sale of Investments A11: Additional Investing Activities A12: Net Cash Used in Investing Activities A13: Financing Activities A14: Issuance of Common Stock A15: Issuance of Debt A16: Repurchase of Stock A17: Repayment of Debt A18: Dividends Paid A19: Net Cash Used in Financing Activities A20: Net Change in Cash A21: Beginning Cash Balance A22: Ending Cash Balance

Step 2: Input DataEnter financial data in the respective cells under each section:

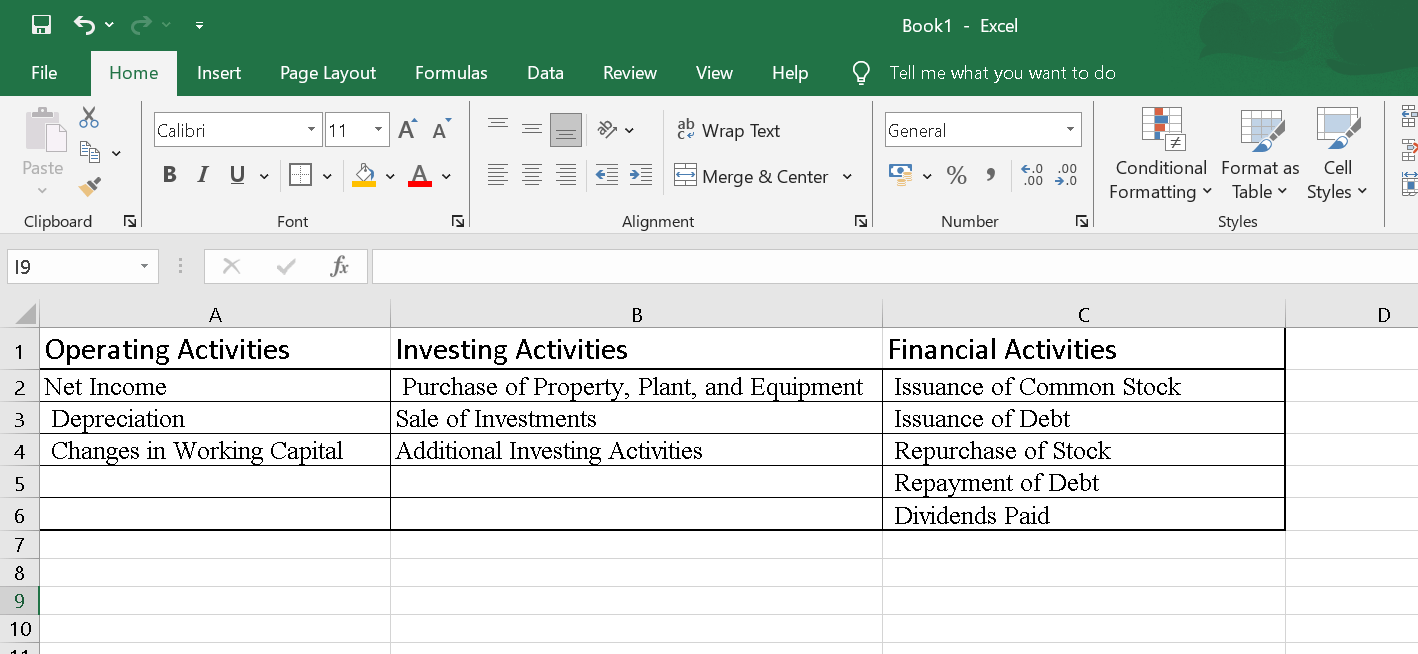

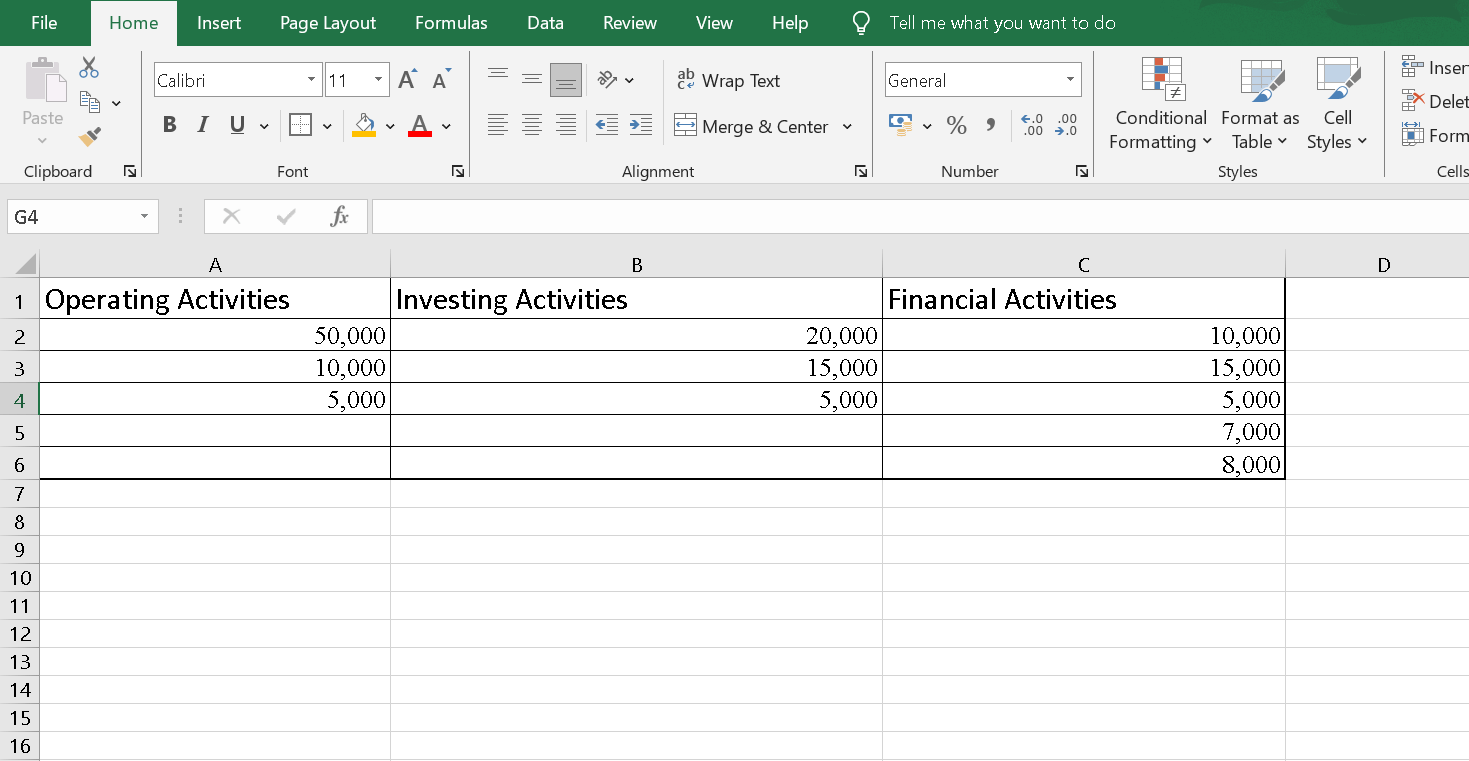

Example of the format:Step 1: Set Up the Excel SpreadsheetOpen Microsoft Excel and create a new blank workbook. Label the columns in the first row for each section as mentioned in the previous response.

Step 2: Input DataEnter the following example data in the respective cells: Net Income: $50,000 Depreciation: $10,000 Changes in Working Capital: $5,000 Purchase of Property, Plant, and Equipment: $20,000 Sale of Investments: $15,000 Additional Investing Activities: $5,000 Issuance of Common Stock: $10,000 Issuance of Debt: $15,000 Repurchase of Stock: $5,000 Repayment of Debt: $7,000 Dividends Paid: $8,000 Beginning Cash Balance: $30,000

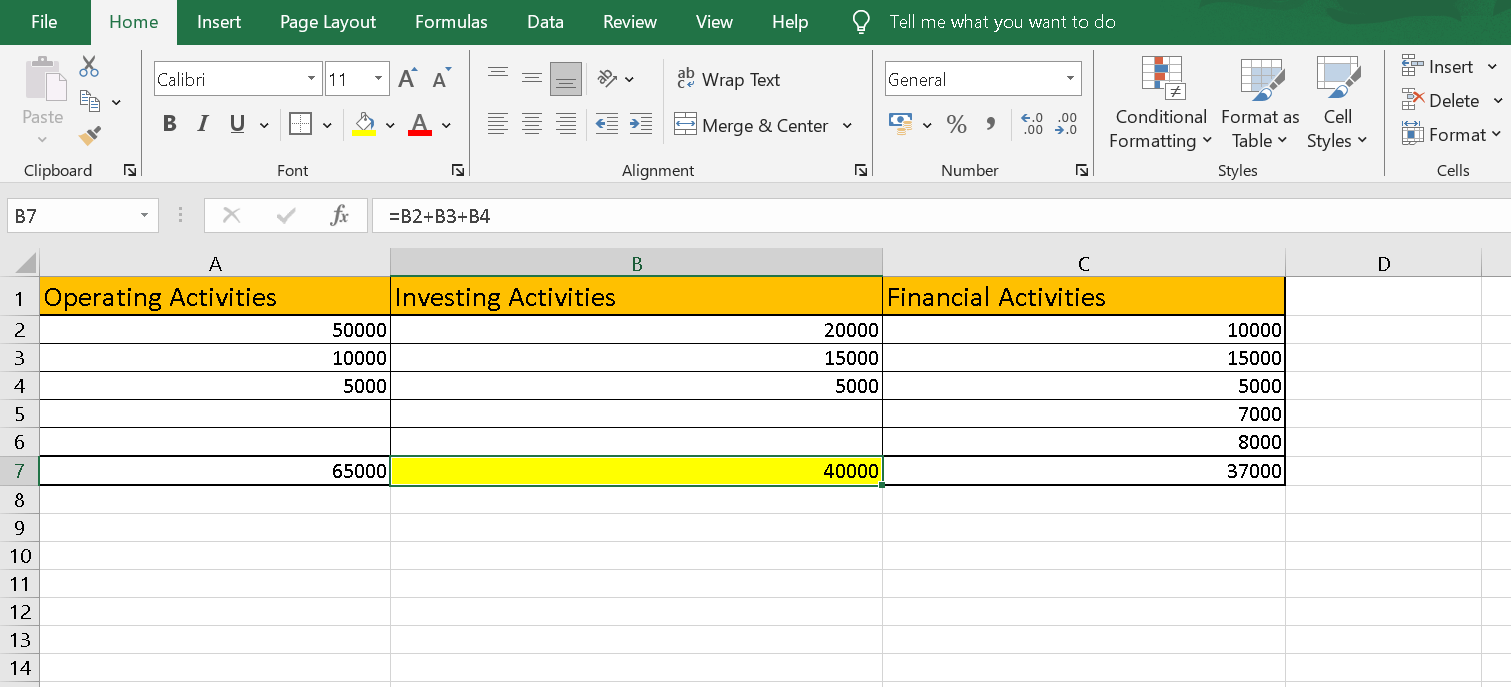

Step 3: FormulasIn cell B7, use the formula =B2+B3+B4 to calculate Net Cash Provided by Operating Activities. In cell C7, use the formula =C2+C3+C4 to calculate Net Cash Used in Investing Activities. In cell D7, use the formula =D2+D3+D4+D5+D6 to calculate Net Cash Used in Financing Activities.

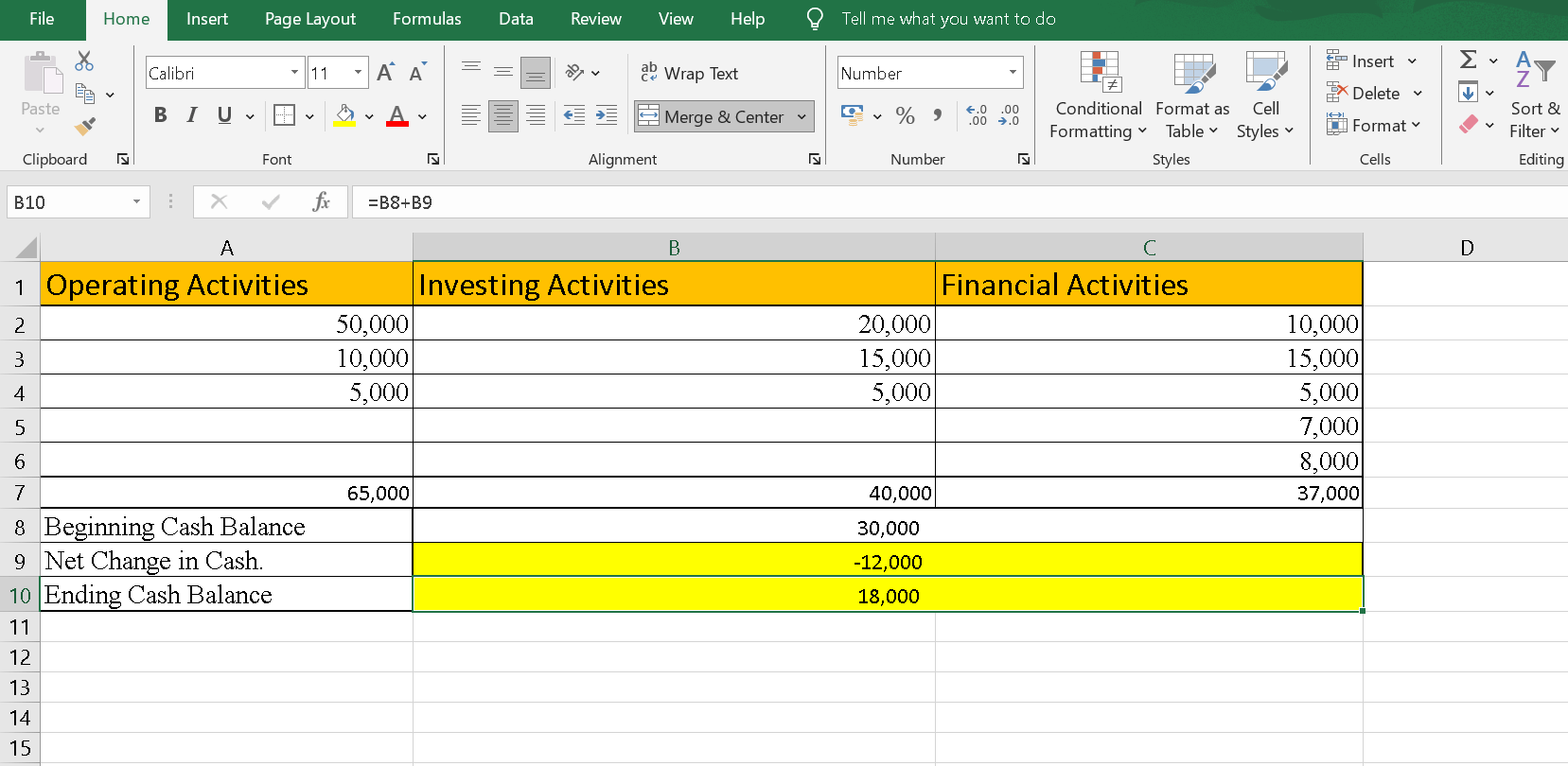

In cell B9, use the formula =B7-C7-D7 to calculate Net Change in Cash. In cell B10, use the formula =B8+B9 to calculate the Ending Cash Balance.

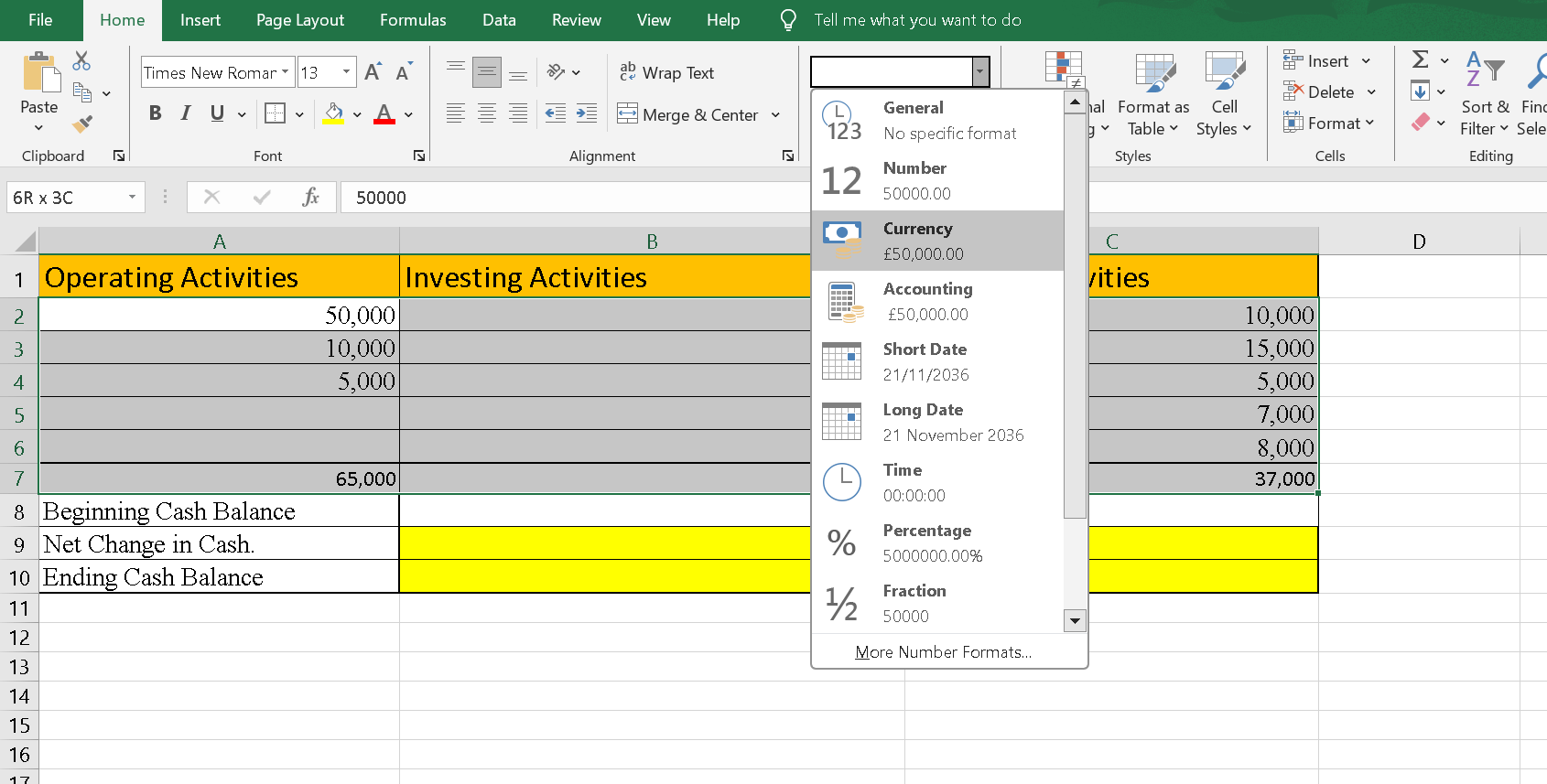

Step 4: Format the SpreadsheetFormat the cells: Select the cells with financial data and format them as currency. Use bold or different colors for headers and important figures to improve readability.

Step 5: Review and AdjustReview the cash flow statement to ensure accuracy. Adjust formulas or data as needed based on your specific business context.

Next TopicDTR CALCULATOR EXCEL

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share