Calculate the Cost Of Common StockA vital component of financial research for firms is figuring out the cost of common stock, which provides information about a company's overall viability and financial health. Common stock is a vital part of a company's economic structure and signifies ownership in an organisation. For investors, buying common stock is to profit from dividends and capital growth. The return investors require to hold shares in the company is called the cost of common stock or equity. A company's weighted average cost of capital (WACC), crucial for assessing investment opportunities and making wise financial decisions, is calculated using this fundamental statistic. Several techniques are used to calculate everyday stock prices; the most popular is the Capital Asset Pricing Model (CAPM). To estimate the expected return on equity, the CAPM considers variables, including the risk-free rate, market risk premium, and stock beta. The Dividend Discount Model (DDM) is an additional method that concentrates on the present value of anticipated future dividends. Businesses can evaluate the attractiveness of their stock to investors and make strategic decisions to optimise their capital structure by precisely determining the cost of common stock. This measure affects the company's capacity to draw in outside capital and promote long-term growth in the ever-changing financial markets and internal economic initiatives. What Is Common Stock?Common stock, sometimes known as just "common shares" or "equity," is a type of equity ownership for shareholders and denotes ownership in a firm. Upon purchasing common stock, individuals or institutional investors effectively assume a partial ownership role within the corporation. The overall performance and hazards of the company are more directly related to common stockholders than preferred shares, which may have unique benefits like priority dividend payments.

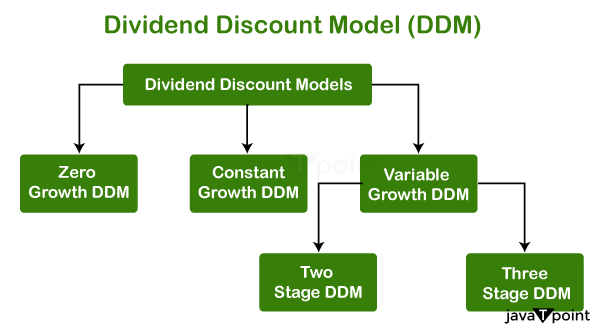

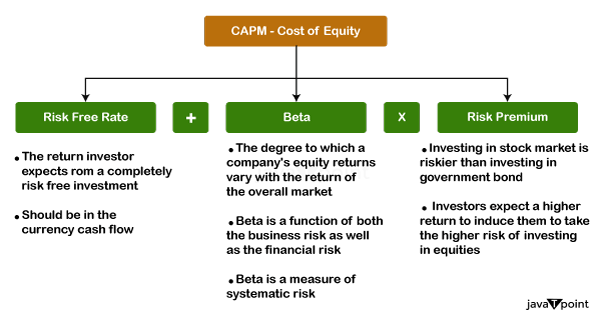

At shareholder meetings, ordinary investors can cast ballots, giving them a say in important choices that affect the course of the business. Nonetheless, the amount of shares they own frequently corresponds to their voting power. Gaining money as the price of the stock increases is one of the main ways common stockholders can get a return on their investment. Furthermore, some businesses pay dividends to their common stockholders from a portion of their profits; however, these payments are not always made and might change depending on the management choices and the company's financial performance. Even though owning common stock allows people to participate in a company's success, it also exposes them to the dangers of running a firm. Common stockholders are the last in line to get any assets left over after bondholders, creditors, and preferred stockholders have been paid off in the case of bankruptcy or liquidation. Therefore, several factors, such as the company's financial performance, market conditions, and general economic trends, affect the value of common stock. Cost Of Common StockThe rate of return a business must give its common stockholders is called the Cost of Common Stock, sometimes called the Cost of Equity. Investors demand the payment in exchange for assuming the risk of owning a specific stock. It is essential to calculate the price of common stock for several financial decisions, including figuring out a company's total cost of capital, assessing investment prospects, and establishing reasonable return expectations for shareholders. The cost of common stock can be determined in several ways, but two well-known techniques are the Dividend Discount Model (DDM) and the Capital Asset Pricing Model (CAPM): 1. The Model Of Capital Asset Pricing (CAPM):

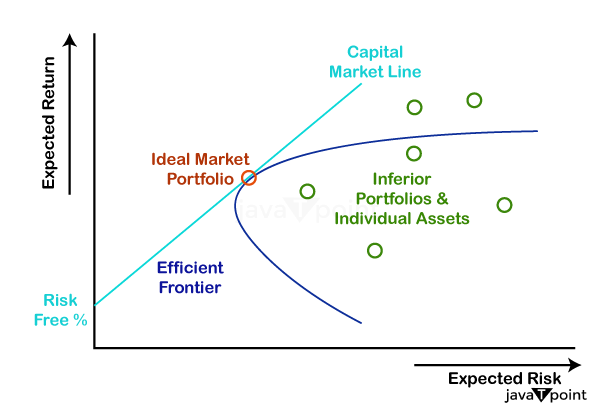

The CAPM is a popular technique that considers the market risk premium, the stock's Beta, and the risk-free rate. The risk-free rate is the return on a risk-free investment, typically represented by government bonds. The extra return investors anticipate in exchange for assuming the risk of investing in the whole market is known as the market risk premium. Beta measures the volatility of the stock in the market. Using CAPM, the cost of equity can be calculated as follows: 2. Model Of Dividend Discounting (DDM):

The current value of anticipated future payouts is the main emphasis of this method. It is predicated on the idea that a stock's value equals the total of all future dividend payments' present values. Using DDM, the cost of equity can be calculated as follows: When figuring out a company's Weighted Average Cost of Capital (WACC), or the average rate of return that the company is anticipated to offer to all of its investors, the price of common stock plays a crucial role. This statistic is employed when making financial decisions, such as evaluating the viability of new initiatives or the organisation's general economic health. Higher everyday stock prices are typically a sign of more excellent investor perception of risk, which can affect a company's capacity to raise money and the value of its shares. Calculating The Cost Of Common StockSeveral techniques are used to determine everyday stock prices; two popular methods are the Dividend Discount Model (DDM) and the Capital Asset Pricing Model (CAPM). I'll outline both approaches in detail below: 1. The Model Of Capital Asset Pricing (CAPM):

The following is the CAPM formula for the cost of equity: This is how to figure it out:

2. Dividend Discount Model (DDM):The following is the DDM formula for the cost of equity:

Remember that these calculations include assumptions about future market conditions and dividend growth and only offer an estimate of the cost of common shares. Analysts and investors frequently combine different approaches to have a more thorough grasp of the cost of equity. ExamplesLet's review some instances of how to determine the cost of common stock using the Dividend Discount Model (DDM) and the Capital Asset Pricing Model (CAPM): Example- 1CAPM

Assume a business has a beta of 1.5, a market risk premium of 5, and a risk-free rate of 2%. Cost of Equity = 0.02 + (1.5 * 0.05) Cost of Equity = 0.02 + 0.075 = 0.095 or 9.5 % Thus, the estimated cost of equity for this company is 9.5% based on the CAPM. Example - 2DDM

Let's say a corporation has a $40 stock price, pays a $2 annual dividend per share, and expects its dividends to rise at a pace of 4%. Cost of Equity = ( 2 / 40 ) + 0.04 Cost of Equity = 0.05 or 5% As a result, the DDM estimates that this company will pay 5% for equity. Remember that these are oversimplified examples; determining everyday stock prices entails more intricate factors and frequently necessitates further research and study. Furthermore, changes in financial forecasts and market conditions could affect the accuracy of these estimations. Analysts may combine different approaches and consider various scenarios to get a more thorough picture of the cost of equity for a specific company. ConclusionIn conclusion, we have covered the cost of common stock, an essential statistic in financial analysis and corporate decision-making. The cost of common stock, also known as the cost of equity, indicates the return investors must receive in exchange for their shares in the company. Common stock is a symbol of ownership in a corporation. This measure is crucial for determining a business's weighted average cost of capital (WACC), assessing potential investments, and making wise financial judgements. The Dividend Discount Model (DDM) and the Capital Asset Pricing Model (CAPM) are two popular techniques for figuring out the price of common stock. The DDM concentrates on the current value of anticipated future dividends, whereas the CAPM considers variables like the market risk premium, Beta, and risk-free rate. Based on many aspects of the organisation's financial parameters, these methodologies offer estimations of the projected return for investors. It's important to remember that these computations' assumptions and market conditions were made at a particular moment. The precision of these approximations is contingent upon several aspects, and financial analysts frequently employ a blend of techniques and consider several scenarios to derive a more all-encompassing knowledge of the cost of equity. In the end, knowing the price of common stock is essential for companies to draw in funding, evaluate potential investments, and maintain the company's financial stability and sustainable growth.

Next TopicComparison Charts In Excel

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share