Stock average calculator ExcelWhat is the typical price per share?

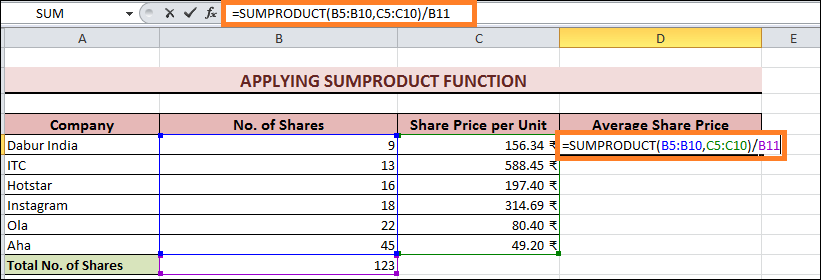

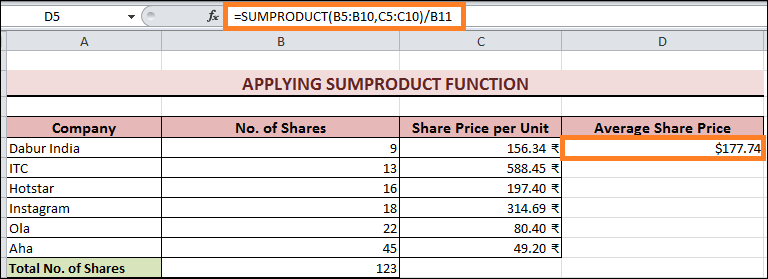

The weighted average from different shares is the average share price. The weighted average cannot be calculated by default in Excel. Thus, we will demonstrate in this tutorial how to compute the weighted average for the shares or compute the average share price using Excel. The Weighted Average: What Is It?One elegant method for calculating the average of things with varying prices and quantities is using the weighted average. For instance, you paid $2.5 for four apples and $3 for six oranges while purchasing them. The weighted average for these two charges will then be your average cost. Two Simple Methods for Computing the Average Share Price Using ExcelIn this tutorial, we'll go over two efficient methods for figuring out the average share price using Excel. To begin with, we will complete the work using the SUMPRODUCT function. The weighted average formula will then be manually inserted to determine the average share price. 1. Employing the SUMPRODUCT FunctionThe values in the specified ranges or arrays are multiplied by the SUMPRODUCT function, which then adds the resultant values and returns them. This technique will use the function to determine the average share prices. Steps:

= SUMPRODUCT(B5:B10,C5:C10)/B11

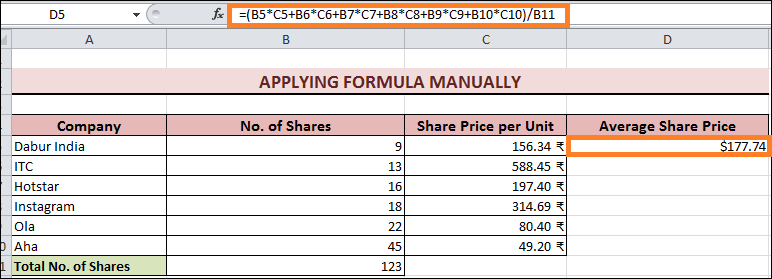

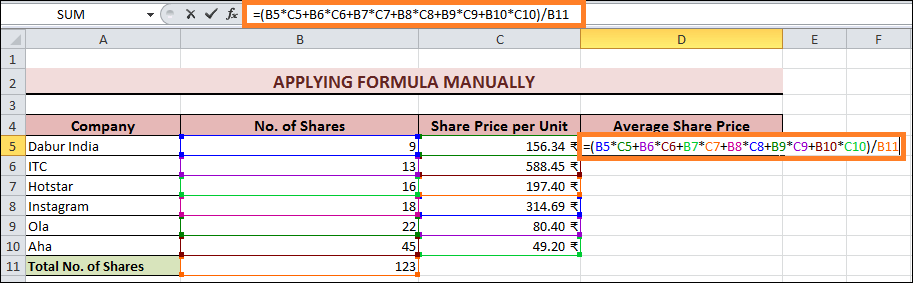

2. Using the Formula ManuallyThe weighted average algorithm will be manually applied to determine the average price of shares. In this case, the weighting element will be the number of shares. Steps:

=(B5*C5+B6*C6+B7*C7+B8*C8+B9*C9+B10*C10)/B11

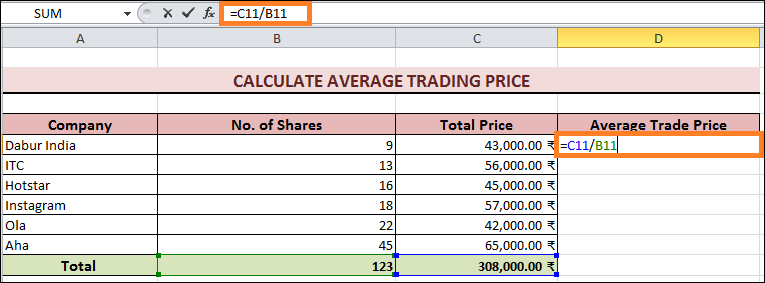

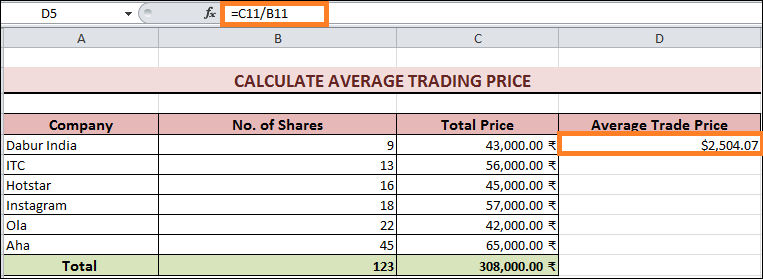

How to Determine the Average Price of TradingThe mean trade price represents the verb Third-person singular simple present indicative form of representing Report Word the mean of all the prices of trades carried out over a given time frame. One can get the average trade price by summing the prices of all transactions made during a given time frame and dividing the result by the total number of trades. The Average Trade Price is computed as follows: Average Trade Price = ∑(Prices)/Number of Trades

The average trade price on a few trades will be determined using this procedure. Steps:

=C11/B11

Variables that may affect the average price of stocksThe averaging for a stock price is dependent upon four elements. 1. The foundations of a stock Only firms with strong fundamentals, a favourable market sector, and prices significantly below peak are suitable candidates for averaging. Otherwise, if you wind up purchasing or selling a fundamentally bad stock, it could become even more stressful and turn into a liability with growing losses. 2. Volatility The share average may seem appealing when a fundamentally good stock exhibits significant price movements and becomes volatile. 3. The movement towards futurism Any company that shows a growing trend into the future, such as equities of IT and digitization companies, is a good candidate for price averaging. In the stock market, an appropriate average may be key to determining a reasonable stock price that would yield higher returns. For this reason, average pricing may be the most sensible approach to making long-term purchasing and selling decisions. 4. To rectify errors in stock selection To favourably minimize the price for your entire holding in both the purchase and sell sides is the fundamental rationale and necessity for averaging. This suggests that a stock bought at its peak and quickly declined in value may benefit from future averaging. ConclusionIn this tutorial, we've covered two methods for using Excel to determine the average share price in this tutorial. Using these techniques, users can obtain the average share prices for various shares and, because the average is weighted, determine which share has the highest weight.

Next TopicTravelling Bill Format in Excel

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share