Demand DefinitionWe frequently hear the term "Demand" for goods or services daily. In business, the demand for a product determines its value and company's profit or loss. Hence, in this study we will understand what exactly is in demand. And why is it so important in business? Demand is a fundamental economic concept that applies to customers and businesses providing goods and services. Understanding demand is crucial for businesses when deciding on inventory, pricing, and aiming for a specific profit. Consumers who understand demand can decide which or when the products should be purchased. What is Demand?Demand is the number of commodities that buyers are willing to buy at different prices throughout a certain time. In general, demand refers to a consumer's willingness to buy and purchase products and services. Preferences and decisions can be described in terms of cost, advantages, profit, and other variables as demand fundamentals. The number of products customers select will modestly be impacted by the cost of the commodity, cost of certain other commodities, the customer's earnings also their tastes and preference. The quantity a person is willing to buy, can handle and afford at given prices of goods as well as the customer's tastes and choices which is well know as commodity demand. Force of Demand in the Economy

Understanding DemandTwo elements influence economic demand. To begin, it is dependent on consumer willingness to buy a product in which customer preferences and tastes distinguish it. Second, consumers capacity to purchase a product or service at a certain price influences demand. This means that the consumer should have enough money to obtain the product. Demand and supply act together to drive the economy and will influence the prices. Companies will spend money to increase the demand for their products and services. At any given pricing, how many of their products can they sell?

Supply and demand are interconnected. Suppliers attempt to maximize profits, while consumers seek for the lowest possible price for goods and services. Inaccurate forecasting can lead to lost in sales from potential buyers if demand is underestimated. It also losses from excess inventory if demand is overstated. If suppliers overcharge for a product, then demand will reduce, and suppliers may need to sell more products to earn a profit. As suppliers charge less the demand rises but falling prices may not cover supplier's expenditures or gain any profits. The factors that impact demand are:

Demand EquationThe number of goods or services buyers can purchase at any market price determines market demand. It can be stated mathematically as follows Q = a-bP The demand formula considers factors such as demand, price, and quantity.

Facts About Demand

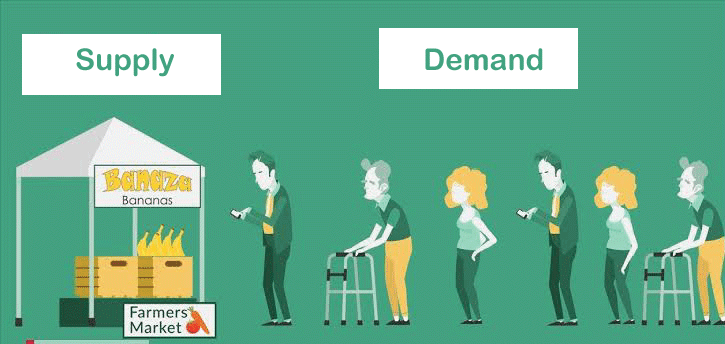

Elasticity of DemandThe elasticity of demand, also termed as demand elasticity, measures how demand relates to price or income changes. Because the cost of a product or service is the most widely used economic component to quantify, it is also known as the demand elasticity of price. An elastic good is the one in which a change in price causes a large movement in demand, the more replacements available for an item, the more elastic the good can cause. The demand is elastic if the quotient is higher than or equal to one. If the value is less than one, the demand is said to be inelastic. PEd Luxury and consumer budgeting products, such as cereal brands and candy bars are prominent examples of highly elastic goods. Food can be easily substituted, and lower-cost products can easily replace brand names. A change in the price of a luxury car can induce a change in the amount demanded, and the magnitude of the price change determines whether demand for the good changes and if so, by how much. Other factors such as income level and available substitutes influence the demand elasticity of services and goods. People could save their money rather than replace their smartphones or purcpurchaseigner purses during a period of job loss, resulting in a dramatic shift in the consumption of luxury items.

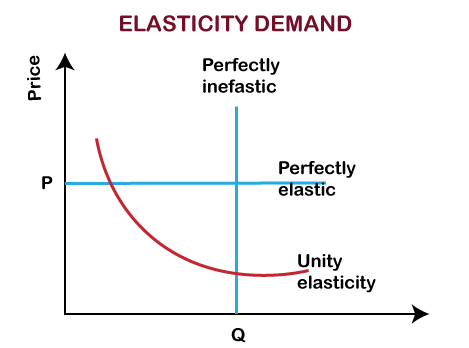

The availability of substitutes for a good or service tends to make a product more sensitive to changes in price if the cost is less. If the price of Android phones rises by 1and demand for iPhones may shift away from Android. Demand elasticity describes how flexible a product demands to price changes. For example, a minor change in price causes a large change in demand along with demand elasticity. If the price of their normal goods has raised a little, shoppers may choose appealing substitute products. This could suggest strong demand elasticity, which is important for firms to understand. Inelasticity of DemandInelasticity of demand arises when the demand for a particular product or service remains static despite price fluctuations or other factors. Inelastic products are typically required when suitable substitutes are unavailable. The most prevalent inelastic demand commodities include utilities, prescription medications, and tobacco. Companies selling such products maintain greater price and flexibility since demand remains steady despite price variations. Necessities, pharmaceuticals, and tobacco products are among the most prevalent things with inelastic demand. Necessities and medical procedures are generally not elastic, whereas luxury products are. Demand ForecastingThe process of evaluating and estimating future consumer demand over a given time is known as demand forecasting. To create the most accurate forecasts which will typically use previous sales data together with seasonal variances and other characteristics. Demand forecasting aids pricing in business planning, goal setting, budgeting, and profit margin estimation. You may develop an informed plan based on your understanding of future sales. Other activities that could be initiated include production scheduling and future capacity planning. You can ensure that your supply fulfills the demand by using demand forecasting. It also enables businesses to improve inventory, increase turnover rates, and save warehousing costs. Forecasting demand provides insight into the future financial flow. It develops a more precise budget for suppliers and other operational expenses. It also allows you to invest further in business expansion. The Law of DemandWhen prices rise the demand falls according to the rule of demand. As prices fall, demand will rise. The inverse connection between price and demand is easily expressed by the law of demand. That is entirely about money. None of the other demand factors mentioned shown are involved. If they are claimed, the operation of the law may be affected. Demand may vary for reasons apart from price.

The rule of demand is among the most fundamental concepts in economics. It integrates with the law of supply to describe how market economies manage resources and set prices for goods and services that we see in everyday transactions. The quantity purchased varies inversely with price, according to the rule of demand. In other words, as the price rises, correspondingly rises the quantity demanded. This is due to diminishing marginal utility. That is, customers spend the first unit of an economic good they buy to meet their most demanded products, then use each additional unit to meet progressively lower-valued ends. Facts about the Law of Demand

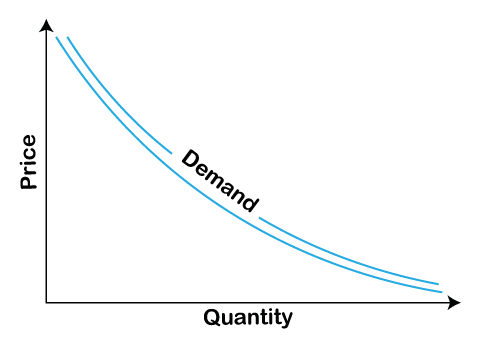

The Demand CurveA demand curve is a graph that describes the change in demand because of a price fluctuation. It shows the law of demand graphically. Because it displays the cost at which customers begin to buy less or more. The demand curve can be a beneficial tool for businesses. It will determine the prices at which a business can maintain consumer demand while making a respectable profit. On a demand curve graph, the vertical axis signifies the price, whereas the horizontal axis signifies the quantity demanded. The statistics for the demand curve chart can be obtained from a demanding schedule, or a table generated by a business that specifies the quantity of a product that customers will purchase at various price points.

When plotted, the demand curve slopes downward from left to right. Consumers desire less of a service or product when prices rise. A supply curve slopes upward. When prices grow where suppliers supply additional goods or services. Many factors can affect the shape and position of the demand curve. Increasing salaries tend to raise demand for ordinary economic products since people are more eager to spend money on specific products. The convenience of close alternative things that compete with economic commodities tends to have lesser demand because they can satisfy customer wants and needs with similar types of goods. The availability of closely complementary commodities, on the other hand, tends to increase demand for an economic product because having two things together, such as peanut butter and jelly, could be more useful to consumers than using them separately. What Impacts Demand?Cost, preference, income, and other factors impact demand. These factors also influence consumer purchasing decisions. The following are the primary demand determinants:

If all other conditions remain constant, the price influences the number of goods or services purchased by consumers, according to the demand rule. This suggests that people will buy fewer products if the price is higher. When prices fall, however, consumers will buy more.

The income determines consumer purchasing power. Reduced demand is caused by a fall in income. Yet, more income sometimes translates into more purchasing of a specific commodity. Furthermore, as the Law of Diminishing Marginal Utility implies, satisfaction falls when a consumer uses more of a single commodity or service.

There are two kinds of related expenses to be considered. Consider the cost of a supplementary good or service purchased in conjunction with a specific item, such as pancakes with maple syrup or bread sticks and dip. Demand increases when the cost of related goods falls. The second factor is the cost of alternatives purchased in place of a product. For instance, swapping Coke for Pepsi or opting for a store-brand item over a name-brand item. In this circumstance, an increase in the cost of substitutes increases demand for the good or service.

Changes in consumer preferences will have an impact on demand. For example, if consumer preference favors a particular product, the quantity demanded rises. Similarly, the demanded amount falls if their taste contradicts a product or service.

People's subjective evaluations of the worth of a specific commodity or service can impact their purchasing decisions. Typically, expectations refer to a buyer's assumption that the price of a product may rise or fall in the future. For example, if buyers expect a product to grow more expensive, current demand tends to increase. Types of Demand

This is the quantity demanded several products or services that are utilized and demanded simultaneously. It is best classified as a supplementary commodity. Yet, the demand for one product is unrelated to the need for another, like pen and ink refills, cars, and gasoline.

A price change on a product with numerous uses can result in a considerable shift in demand across all usages. For example, if milk costs rise, demand for cheese, butter, and cream may fall. Similarly, an increase in demand for any of these products can result in a supply shortfall for the others. Prices may rise as a result.

Given constant other parameters, short-term demand reflects customers' quick reaction to price fluctuations. Conversely, long-run demand shows how price, supply, and other factors can affect demand.

This type of demand is the number of goods or services that a buyer is willing to purchase at a specific price and time. It can also be interpreted as the value that a consumer is capable of spending on a product or service.

This is the consumer demand for a specific quantity of a product or service based on their income level [high or low]. In general, when customers earn more money, so does demand. Furthermore, one's choices and expectations vary as one's income level changes. As seen by income demand, consumers frequently base their buying choices on what they can afford.

When consumers have a variety of goods or services to choose from, there is competitive demand. Consumers may prefer name-brand products over store-brand products, for example. However, when name-brand products are out of stock, demand for store-brand products rises.

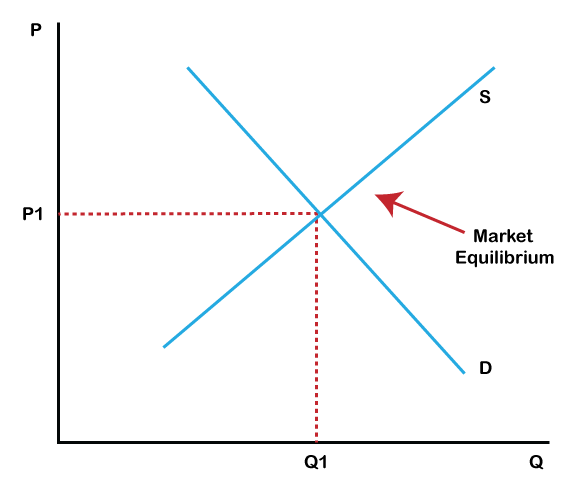

Direct demand, also known as autonomous demand, relates to finished goods such as cell phones, clothing, and food. Likewise, derived demand refers to products that are derived from the use of other commodities. When the demand for one product rises, so does the demand to produce an intermediate good. Demand for cheese, for example, can raise demand for milk. In another case, the steel demand is determined by the need for its applications, such as the production of cans and automobile parts. Market EquilibriumThe market clearing or market equilibrium price is defined by the intersection of the supply and demand curves. As demand rises, the demand curve moves to the right.

When the two curves intersect at a higher price consumers are willing to spend more for things. Because supply and demand factors continually change, equilibrium prices for most products and services usually vary. Prices tend to move towards market equilibrium in fair competitive markets. Market Demand vs. Aggregate DemandEach market in an economy is subject to a distinct set of circumstances that vary in degree and type. We also focus on aggregate demand through an economy in macroeconomics. The real demand for all commodities and services by all customers in an economy among all markets for individual goods is known as aggregate demand. Because aggregate demand comprises all products in an economy, it is unaffected by competition or product substitution. It also does not consider the effects of changing consumer preferences between products. These variables can affect demand in specific product markets. Macroeconomic Policy and DemandThe Federal Reserve and certain other fiscal and monetary authorities devote a significant part of their macroeconomic policymaking efforts to managing the aggregate demand. The Fed can lower demand by raising interest rates and costs by limiting the supply of money and credit growth. If the Fed wishes to increase demand, it can lower the interest rates and increase the money supply by giving businesses and consumers more money to spend. Even the Fed is unable to build demand in some circumstances. Even though interest rates are low, even with low interest rates, people may be unable to spend or incur lower-cost interests. The ConclusionA perfect competition economy is one in which many businesses compete for the attention and income of consumers. The connection between price and the quantity demanded and delivered by customers and producers are represented by demand and supply. The quantity required decreases as the price rises, but the quantity supplied rises. Understanding this will encourage countries to concentrate and trade products with one another rather than producing everything they need.

Next TopicDevelopment Definition

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share