Stock Exchange DefinitionA stock market's trading market is essential, making it easier for financial instrument merchants and their intended customers to conduct business. The stock markets in India must go by many regulations and laws set forth by the Commodities and Markets Board in India, or SEBI. The aforementioned authoritative body works to safeguard investors' interests and advances India's stock exchange.

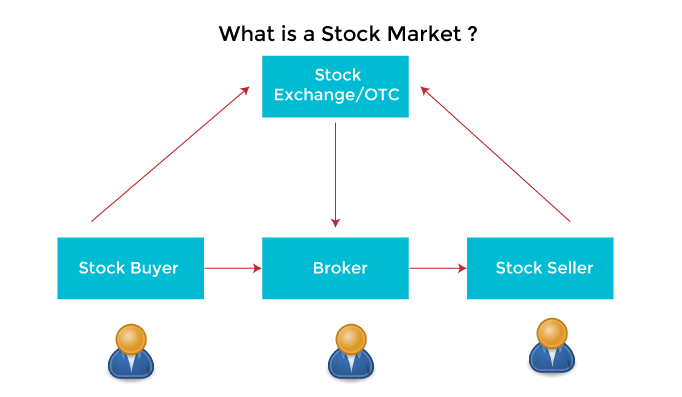

The Dutch East Indian Corporation, the first publicly listed corporation, founded the initial modern stock trading in Amsterdam. The business decided to trade in stock and give shareholders dividends to obtain funds. The Amsterdam Exchange of Stocks was subsequently founded in 1611. The Dutch East India Company properties were the only securities traded on the exchange for a long time. Similar businesses were founded in other nations by this time, and stock purchases were extremely popular among investors. Most investors were so enthralled by the excitement that they invested in any startup that became available without researching the company first. Due to the resulting economic distress, investors eventually attempted to sell all their shares quickly in 1720 out of fear. But nobody was buying, and the market fell. The South Sea Bubble was the next financial crisis in England that occurred shortly after. Investors grew acclimated to trading stocks, although the thought of a market decline worried them. What is Stock Exchange?The Indian stock exchange acts as a market for trading financial items such as stocks, bonds, and commodities. It is a place wherein sellers and buyers meet to exchange financial instruments at certain times during any company's day while following the clear rules set forth by SEBI. Yet, only businesses listed on an exchange of stocks are permitted to conduct trading there. In the "Over Counter Market," stocks not listed on an accredited stock exchange may be traded. But in a stock exchange market, these shares might be less valued. How Does Stock Exchange Work?The stock market helps firms raise money to sustain their operations by issuing shares of stock while also creating and maintaining capital for individual investors. Organizations offer investors ownership stakes to raise money on the stock market. The abbreviation of these equity investments is shares of stock. Companies can raise the funds required to operate and expand their businesses without incurring debt by listing their shares on the exchanges that drive the stock market. In exchange for the advantage of selling stock to the public, companies must provide information and give investors a say in how their businesses are run. Investors profit by exchanging their money for shares on the stock market. When businesses invest in growing and expanding their operations, the value of their stock rises over time, generating capital gains, which benefits investors. Businesses pay dividends to their shareholders as their profits rise. Although the performance of individual stocks varies significantly over time, the market for shares historically gave investors a median annual return of roughly 10%, making it among the more reliable methods to grow your money.

Functions Of Stock Exchange1. Liquidity and MarketabilityThe stock exchange's ability to support high liquidity is one of its primary attractions. The securities are convertible into cash and may be sold at any time. Due to the market's continuous nature, investors can easily sell their holdings and reinvest the proceeds as they see fit. 2. Price CalculationIn the secondary market, supply and demand laws are the only factors that can be used to calculate a security's price. This method is made possible by a stock exchange's continual appraisal of every one of the securities. The index we refer to as the Sensex allows us to keep track of such pricing for shares of various companies. 3. SafetyThe stock exchanges are rigorously governed and regulated by the government, and the Equities Commission of India serves as the governing authority in the matter of the BSE. Every transaction takes place within the bounds of the law, giving the investor security and a secure environment to trade securities. 4. Economy's ContributionAs is well known, a stock market deals in securities already issued. However, these assets are continuously purchased and then resold. This allows the money to be used instead of just sitting around and stimulates the economy. 5. Equity SpreadThe stock exchange makes sure that more people hold equities. It informs the general people about the advantages and safety of stock market investing and guarantees improved transaction quality and efficient operation. The goal is to increase the number of publicly traded investors and spread ownership of assets so that everyone wins. 6. SpeculationThe stock market is frequently described as a speculative market. Although it's true, the speculation stays within the bounds of the law. An appropriate dosage of speculation is required to maintain the stakes of availability and price setting, and the stock market gives us such a platform. Investors Who Participate in The Stock ExchangeThe allure of the stock exchange attracts people from various backgrounds, businesses, and institutions. Investors are divided into a few different categories: 1. Domestic InstitutionsThese are investors who act as a middleman or make investments in the financial asset security sector of the nation in which they are located. They are significant main and secondary market investors. 2. Businesses That Manage AssetsMost mutual fund providers invest client money in securities that meet their stated financial objectives. International large investors are hospitals, hedge funds, institutional investors, and other participants in the stock market from other countries. They deal in big sums of money and significantly impact market trends. Investors with Indian ancestry who are based abroad are known as NRIs and OCIs. 3. CompaniesWith an initial public offering (Initial Public Offering), businesses list themselves on the stock market. Following its listing on stock exchanges, market participants are free to trade the company's shares. They use the proceeds generated by the IPO to cover management expenses and grow the company. Companies may also make institutional investments in other businesses. 4. Stock MarketsThe marketplace for the purchase and sale of securities is the stock exchange, which is the real deal's location. They offer the issuance and revocation of capital, securities, etc. Stocks listed by corporations, securities, derivatives in particular unit trusts, and other financial products are just a few examples of the many diverse securities traded on the stock exchange. 5. StockbrokersRegistered businesses, known as stockbrokers, serve largely as a conduit between clients and the markets. They are one of the most significant financial middlemen, buying and selling stocks and securities for individual and institutional investors. They typically work with a trading company and pay a commission or a fee. 6. RegulatorsA third-party agency regulates the operation of markets. The main goals of SEBI, also known as the "Watch Dog of Indian Markets," are to safeguard investors and guarantee honest trade. They are responsible for creating and enforcing rules governing market participants and intermediaries. 7. Financial MiddlemenFinancial intermediaries are organizations that aid in facilitating market transactions between two parties. This group includes all banks and AMCs, for example. They form the ecosystem of the stock market's invisible support system. Through these middlemen, one can register an account, make a deposit, and even begin trading in the modern world thanks to technology integration via the web and cell phones. 8. Depository and Participant DepositoryYou receive a certificate that gives you rights as a shareholder when you trade shares. Although formerly available in paper formats, these certificates became digital in 1996. Dematerialization, or Demat, is the term used to describe this digital conversion of certificates. The certificates of share ownership are kept in the Demat Account, which functions as a safe to keep track of your assets. Two depositories in India hold the Demat accounts: CDSL (Central Depository Service Ltd) and The Depository for National Securities. What Factors Determine Stock Prices?Stock price variations are caused by various factors, not just supply and demand. In actuality, many factors may combine to cause up-and-down swings in price. Company ActivityVarious factors can influence a company's stock price, causing it to rise or fall. The Situation of The EconomyThe economy might significantly impact stock prices right now

InflationAs prices for products and services rise overall, firms' and consumers' purchasing power is diminished. Rates Of InterestInterest rates significantly impact the cost of borrowing money for businesses, and high-interest rates may increase the cost of company borrowing. As a result, company earnings might decline, lowering stock prices overall. Consumers SpendingConsumer spending may increase sales, earnings, and ultimately share prices for a wide range of publicly traded businesses at a healthy level. The Congressional Research Service's study asserts that "consumer expenditure is an important component of short-term growth in the U.S. economy." World EventsGeopolitical hazards, such as wars and bombs, can wreak havoc on the stock market in addition to causing instability in different countries. Big-time InvestorsHaigh, an expert in stock market pointed out that the activity of big institutional investors like hedge funds and mutual funds might influence changes in stock prices. As they own many shares, he added, "These investors' purchases and sales may have an important effect on stock prices." Benefits Of the Stock Exchange1. Probability of High Returns in the Short TermThis is the primary benefit of investing in the stock market. This is in contrast to other investment options like banks, F.D.s, saving accounts, etc., it has a chance to produce returns that outpace inflation soon. 2. Ownership Interest in the BusinessNo matter how few shares you purchase, you still have a proportionate amount of authority over the company when you do so. You will have voting rights due to owning shares and be eligible to collect dividends, bonuses, etc. 3. High LiquidityUnlike other investment options, shares don't have a lock-in period. Through stock exchanges, investors can quickly acquire and sell shares. 4. SEBI does a Good Job of Protecting your RightsThe Exchange Board and Securities of India oversee the stock market. To protect the interests of the shareholders, SEBI closely oversees market players like brokers, sub-brokers, advisors, and stock exchanges. 5. Tax AdvantagesLong-term capital gains, or investments held for longer than a year, are only subject to a 10% tax on earnings exceeding Rs 1 lakh. Purchases held for less than a year are considered short-term capital gains subject to tax at 15% + 3% less. You have up to 8 years of revenue to offset or carry forward any capital losses. Risks of stock exchangeStock market investments are considered dangerous because shares might vary and touch lower circuits on unpredictable markets. 1. Risk or DangerIt is the potential for an investor to lose money due to events that impact the general health of the stock market. Risks come in two varieties: Systematic Risk This type of risk tends to impact the market as a whole and cannot be completely removed by diversification. Unsystematic Risk Diverse unsystematic risk is unique to a certain industry or firm. 2. Stockholders Receive Payment LastWhen a firm is wound up, the bondholders and creditors are paid first, and the shareholders are paid last. 3. Emotional Roller CoasterVolatility causes stock values to swing back and forth regularly. Many investors purchase shares at exorbitant prices due to greed and sell them at low prices out of fear. Therefore, investing in coffee cans is the greatest way to avoid roller coaster investment. ConclusionIn conclusion, the National Stock Exchange (NSE) and the Bombay Securities Exchange (BSE) are interchangeable when referring to the Indian stock market. The banking system and the nation's economy depend on both of them. It offers a platform for investors to purchase and sell portions of those firms' stock and enables businesses to raise funds. They now operate under strict regulations, essential to India's corporate sector's expansion and advancement. Despite occasional difficulties and volatility, the Bombay Stock Exchange & NSE remain a significant engine of economic growth in the nation and a well-liked location for investors.

Next TopicThermometer Definition

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share