Mutual Funds DefinitionMutual funds are the basic finance topic, a part of an economic discussion related to money. Mutual funds combine funds from stockholders to engage in investments like stocks, bonds, and instruments of the finance market, such as currencies and other assets. Professional or fund managers manage mutual funds, distributing the assets and attempting to produce financial gains or income for the company and the fund's investors. Their responsibility is to invest the funds in multiple instruments, which is an effort to achieve the best. The collection of a mutual fund is established and regularly updated to the date under the specified saving plans in the prospectus. Small or individual investors can access the professionally managed asset allocation of stocks, bonds, and other commodities through mutual funds. As a result, each shareholder shares proportionality in the fund's profits and losses. Mutual funds invest in various securities, and success is usually measured as the variation in the fund's entire market valuation. The investment done by the investors is known as Fixed Deposit. A mutual fund is not only a medium of investing in the share market or equity; if you want, you can invest in real estate, gold, and debt funds. In case of returns and losses, the whole working of mutual funds depends on the share market. So, for a better understanding of mutual funds, we need first to understand the share market.

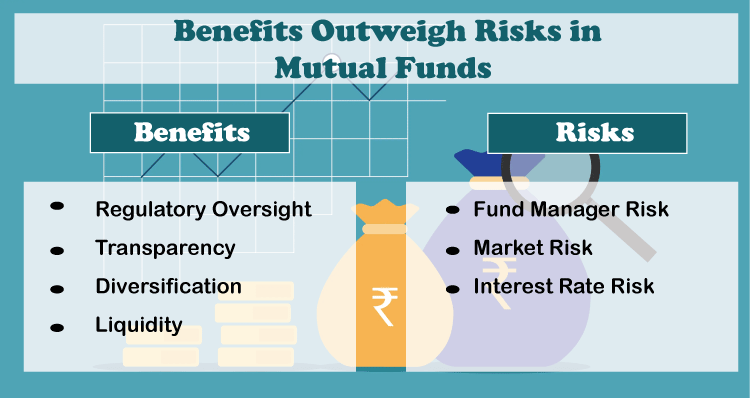

In simple language, mutual funds are a spot for sharing money for more profit. Now there are some advantages and disadvantages of mutual funds. Advantages of Mutual Funds

Disadvantages of Mutual Funds

So these were the advantages and disadvantages of mutual funds. Mutual funds have specific uses; also, it is useful for goal planning, and indirectly you can save the expected amount of money. But the investor needs to make decisions with intelligence. Again, Mutual funds are an important topic for discussion and have very money-oriented content. Let us discuss more about mutual funds. Reason for choosing Mutual FundsThere are many benefits to choosing or investing in Mutual funds, but some are the most important. 1. Professional ExpertiseFinancial market investing needs a certain level of expertise. You must conduct a market study and evaluate the best available choices. You must be knowledgeable about the overall economy, specific industries, corporate funding, and asset classes that require your full time and attention. But if you are unaware of the concept of the share market, then mutual funds are best because of their benefits. We can understand this concept with the help of an example. Think about a scenario where you buy a new vehicle. The problem is that you aren't a good driver. Now you have two options, you can either employ a full-time chauffeur or learn how to drive, practically which is so much time taking and requires your complete attention as well you need to work on your development, which is good but sometimes not suitable according to the situation. In the first case, you would need to take driving classes and pass a driving exam to get a license. But it is preferable to hire a driver if you lack the opportunity for driving lessons. 2. ReturnOne of the greatest advantages of mutual funds is the possibility for higher returns than those offered by traditional investment choices with guaranteed returns. This is so because mutual fund profits are correlated with stock market success. Consequently, the worth of your investment would be affected. 3. DiversificationMutual funds provide various kinds of investment routes with many distinct stocks. As the adage goes, don't place all your chickens in one basket. This means investing only in one place may increase the risk of loss. This is a well-known concept to keep in mind when making financial decisions. When you only engage in one commodity, you risk losing money if the market crashes. By diversifying your investments and engaging in various asset types, you can escape this issue. You must carefully choose at least ten companies from various industries for investment. It may take a lot of time and effort to complete. But you immediately achieve diversification when you engage in Mutual Funds. 4. Tax BenefitsBy participating in Equity or investment-linked services schemes. Mutual fund owners can deduct up to Rs. 1.5 lakh in taxes. The income tax act's section allows for the eligibility of this tax advantage. Three years is the hold time for the ELSS account. Deduction benefits, available on debt funds, are another tax advantage. In the case of common goods, all interest is taxable. Investors might benefit from greater post-tax profits as s result of this.

Types of Mutual FundsMutual funds can be classified based on Asset Class, Structure, and Investment Objective Based on Asset Class1. Debt Funds Also referred to as fixed-income funds engage in securities like business and government bonds. These funds are considered comparatively less risky and seek to provide investors with acceptable returns. These funds are perfect for you if you want a reliable and risk-averse salary. 2. Equity Funds Instead of debt funds, put your money into equities instead of debt funds. An essential goal of these accounts is capital growth. The profits from equity funds are based on stock market fluctuations; these funds are riskier than debt funds. As the level of risk decreases over time, they are a good option if you want to spend for long-term objectives like retirement planning or home ownership. 3. Hybrid Funds It is the combination of debt funds as well as equity funds. These kinds of funds are used to invest in a mixed format for equity and debt funds, also known as Fixed-Income Funds. Hybrid funds are classified into sub-categories based on the division between stock and debt (asset allocation). Based on Structure1. Open-Ended Funds Open-ended funds allow investors to make investments every working day. Such funds are flexible for investors because of the easy reclamation process; these accounts are purchased and sold on net asset value. The flexibility of these funds is that you can collect your units from an open-ended fund at any time during business hours. 2. Closed-Ended Funds Close funds consist of a specified expiration time. There is fix time for investing and withdrawing money. The fund can be invested only once; when the fund is launched, investors can invest in it, and only at maturity or expiration can they take their money. These are based on trading quantities and are also not flexible. Based on Investment Objectives1. Growth Funds Growth funds are considered less risky and precise for long-term investments. Their primary goal is the expansion of capital. A significant portion of the money in these funds is invested in stocks. Due to their large equity exposure, these assets can be comparatively risky, but growth funds are not recommended if you are very close to your goal and want a short-term investment. 2. Income Funds Income funds aim to give investors a steady income, as the name indicates. These debt funds primarily invest in certificates of deposit, bonds, and other government securities. They are suitable for various long-term purposes as well as for less risk-averse investors. 3. Liquid Funds Liquid funds invest money for the short term; these are used to create an emergency fund out of your surplus money. Treasury securities, deposits or CDs, term deposits, commercial papers, and short-term investments are short-term money market instruments in which liquid funds invest. 4. Tax Saving Funds Tax saving funds provide you with financial advantages. You are eligible for an annual deduction of some amount when investing in these funds. Tax saving accounts include equity-linked saving schemes. Investment Goals Related to Mutual FundsMany times question arises about which fund is best for investment and why, so the answer to these questions depends on investment goals. Honestly, there isn't just one correct response to this query. Such mutual funds can achieve particular financial objectives, which fund houses design. So you must be aware of the investment, whether it can achieve your desired goal or not. Hence, investment goal plays a vital role in making any investment, whether related to mutual funds or not. All the investment goals can be categorized into three groups-

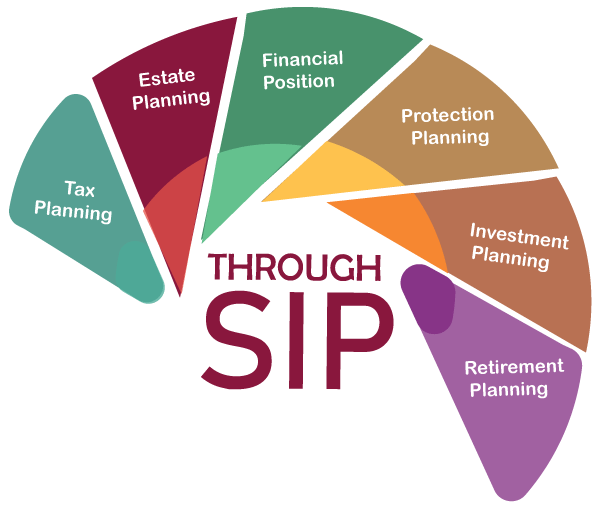

Short-term goals are required to complete small demands; for example - In a specific period, you require money, like going on a family trip annually or in two years, etc. these are planned for 1 to 3 years. Where medium-term investments are planned for 3 to 5 years, these are used as money required to fulfill educational needs, for example, pursuing any course. Long-term goals are for five years or more than five years; these are for high financial needs, for example - purchasing a house, weddings, etc. For investments made for less than one year, liquid funds are considered the best option. They are less risky than other categories of shares; even liquid funds are the best option for creating emergency funds. Investment for 1 to 3 years, dept funds are best for short-term investments. If talk hybrid funds are suitable for medium-term investments, because of stability and fewer chances of risk. And the last one is equity funds which are suitable for long-term investments. Systematic Investment Plans (SIP)This is the fact that we don't need a lot of money to get started investing in the stock market through mutual funds. Through Systematic Investment Plans, most fund companies in the nation allow investors to purchase stocks with a small amount; some start with 100 or 500. Although this may seem like a small sum, you can build a considerable sum if you regularly invest over a long period. A specific amount is invested at set intervals using the SIP technique of putting money into mutual funds. By avoiding market timing, you can gradually build your wealth. SIP is best for long-term investment, for getting more benefits, you should start investing early to enhance your returns. Investing in SIP is easy because investing some amount is easier than investing a huge amount of money simultaneously. SIP has certain benefits over a one-time investment. Some merits of SIP are simplicity of choice, convenience, and investment very simple; an individual can invest with a very small amount free from any risk. SIP consists of a unique feature called Rupee Cost Averaging, which allows you to purchase additional units when the economy or market is low and some units when the market is high. This is special feature about SIP, because of the inherent feature of SIP, you will purchase more at every market correction, where lowering your investment can increase gains.

One another important benefit of SIP is Flexibility; you have a huge amount of freedom with SIP. These funds do not have a set tenure because they are open-ended and can be withdrawn anytime. Depending on your inclination, you can either take a complete or partial loss on your investment. Moreover, flexibility is the investment quantity; it can increase or decrease. It is important to remember that building wealth relies on an extended investment horizon. Also, SIP provides high returns, even double those of other traditional deposits. SIP acts as an emergency fund because of the open-ended funding system; withdrawing is easy with SIP. Difference Between SIP and One-Time Investment

Next TopicHand Washing Definition

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share